Generating a yield on crypto is increasingly tricky. The Terra ecosystem implosion — where up to $50 billion was wiped out — led to a decline in decentralized finance (DeFi) protocols offering interest.

At the other end of the table, centralized finance, or CeFi, where all processes are rooted through a central body, has endured a comparatively peaceful bear market, yet interest rates are trending down.

On the first of the month, investors who have an account with a CeFi provider such as Ledn, Celsius, BlockFi or Nexo generally receive emails detailing the interest rate for the following month.

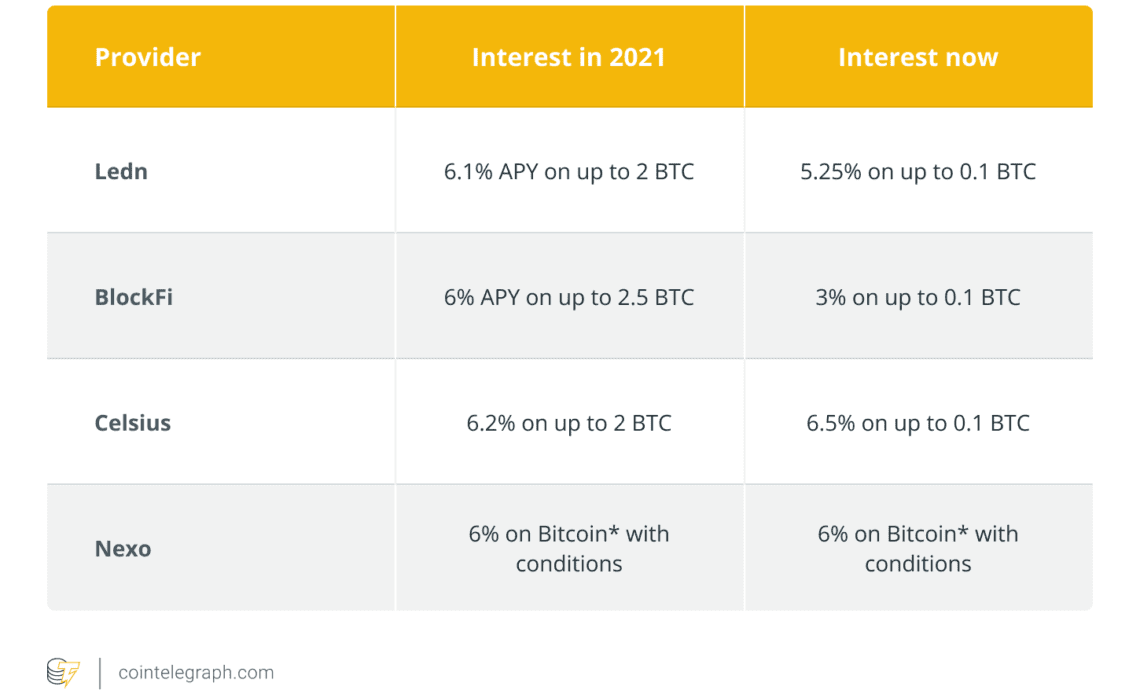

A blow for those looking for passive income, the interest paid from CeFi providers has ground down since the 2021 bull market. Giving up custody of a crypto asset for a miserly interest payment has encouraged some crypto enthusiasts to take control of their private keys, even drawing comparisons to legacy banking.

In the table below, three of the largest custodians of Bitcoin (BTC) and crypto assets have fallen, taking into account both the interest rate and the amount of interest paid on each asset.

Cointelegraph spoke to three of the largest lenders of Bitcoin and other crypto assets to understand whether interest rates from CeFi providers may eventually hit rock bottom, aka 0.01% interest — like at banks — and why these lenders and interest providers exist.

Interest rates will continue to be attractive

Representatives from Ledn, Nexo and BlockFi agreed that while interest in crypto is lower, it outcompetes legacy lending. Mauricio Di Bartolomeo, co-founder of Canada-based Ledn, told Cointelegraph, ”We are still five to 10 years away from Bitcoin rates coming anywhere close to those of fiat bank accounts.”

“Most legacy bank savings accounts are paying out mere basis points (between 0.01% and 0.05%). Interest rates for our Bitcoin…

Click Here to Read the Full Original Article at Cointelegraph.com News…