Today, Fetch.AI (FET) is once again emerging as a stand-out performer. The price of FET has surged by an impressive 21% in the past 24 hours, rising to $1.63. Currently, this substantial uptick is positioning Fetch.AI as the top performer among the top 100 cryptocurrencies by market capitalization.

Fetch.AI is benefiting from the AI hype in the tech sphere. As AI continues to make headlines, projects that are seen as contributing to this future, like Fetch.AI, naturally attract attention and investment, riding the wave of AI hype to gain visibility and financial support in the crypto sphere.

The project aims to leverage AI to enable smarter, more efficient blockchain networks and applications, appealing to both investors and developers interested in cutting-edge technology. Furthermore, the broader market trends show a growing appetite for investments in technologies that promise to shape the future.

Fetch.AI Price Analysis: FET/USD

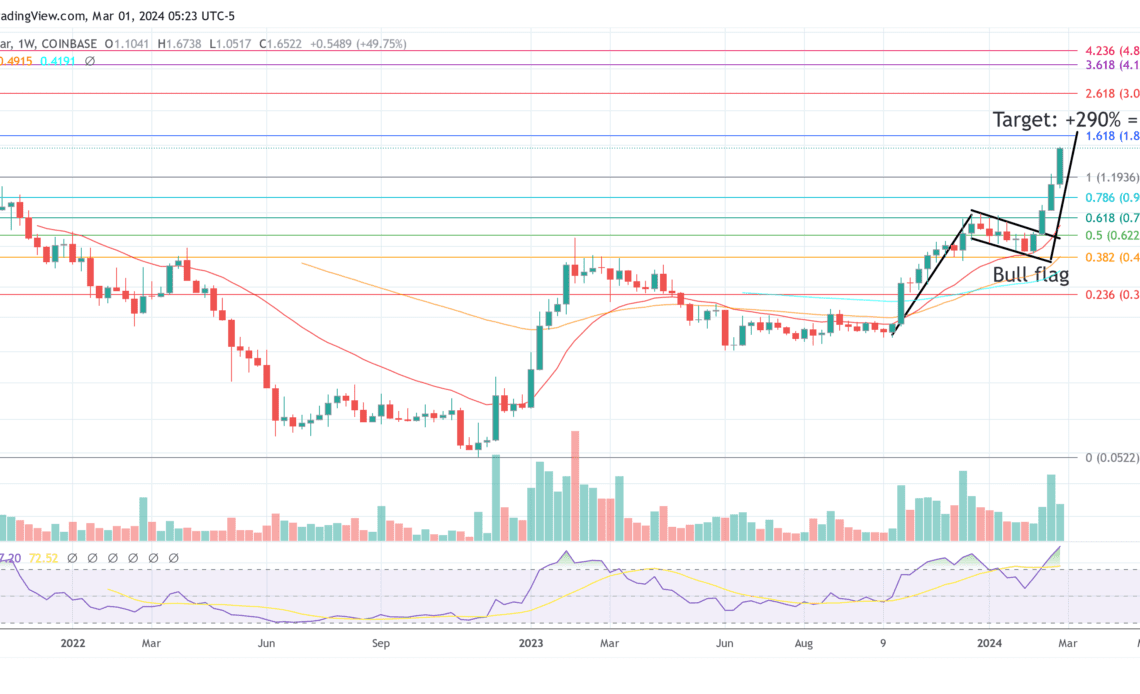

When examining the weekly FET/USD chart, it is evident that the momentum for the AI coin is strong. Earlier this week, FET broke its previous all-time high of $1.19. Notably, this puts Fetch.AI in an elite group of very few cryptocurrencies that have already surpassed their previous all-time high.

The chart shows a well-formed ‘Bull Flag’ pattern, a bullish continuation pattern, which has developed over the past weeks. This pattern is characterized by an initial strong upward movement in price, followed by a downward sloping consolidation phase, and then typically results in a breakout to the upside.

The flag pole formed from mid-October till mid-December 2023. During the consolidation phase, the FET price fell towards the 20-week EMA (red line), but was always able to hold it on a weekly basis. The breakout from the flag occurred on February 12.

Based on the bull flag poll, the projected target is a 290% increase from the flag’s bottom, which would place FET at around $2.00. Notably, this closely aligns with the 1.618 Fibonacci extension level at approximately $1.90.

Another bullish argument are the volume bars, denoting trading volume. This has shown a substantial increase coinciding with the price surge, suggesting strong buyer interest.

Moreover, the Relative Strength Index (RSI), a momentum oscillator that measures the speed and change of price movements, is currently at 72.5. While this puts the…

Click Here to Read the Full Original Article at NewsBTC…