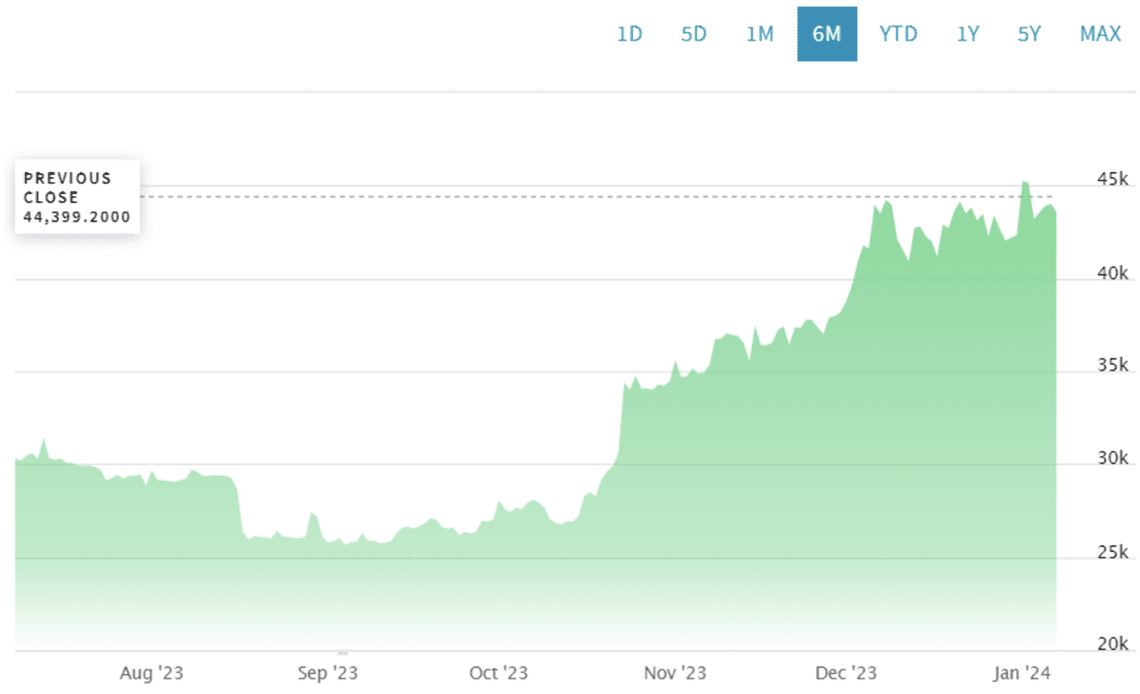

This week, the SEC is expected to give their decision on a proposed spot bitcoin ETF and, according to some analysts, approval is just about guaranteed. Crypto traders have believed that for some time, resulting in big gains in BTC/USD in the last couple of months of last year taking bitcoin (BTC) up to around $45k. That has had one interesting effect: The people who said, once again, that BTC was going to zero earlier last year when it had dropped to around $20k have disappeared for some reason, just as they have every time it has jumped.

You would think after being so wrong so many times, these bears would have learned that BTC is here to stay, but it seems not. Ironically, now that the permabears are in hiding, this might actually be a good time to be at least somewhat bearish.

It is not that a spot ETF won’t have a positive impact on demand for bitcoin. It obviously will, given that the fund will have to own the asset to back it, but the massive gains in BTC/USD that we have seen look overdone, and a “buy the rumor, sell the fact” pattern shortly after the approval is announced this week is starting to look very likely. It is funny how a reversal in direction in any market for any reason can be an “Emperor has no clothes!” moment for traders and investors, so if a post-announcement drop does come, it could easily prompt a rethink about the beliefs underpinning the run up.

…

Click Here to Read the Full Original Article at Cryptocurrencies Feed…