Bitcoin’s on-chain activity has been declining, with transaction counts, UTXO numbers, and fees all dropping significantly in the past three months. At first glance, this might seem like a negative signal, suggesting reduced demand or waning network usage. However, a deeper look at the data tells a different story.

The number of UTXOs steadily increased through most of 2024, peaking around December before beginning a sharp decline that continued into early 2025.

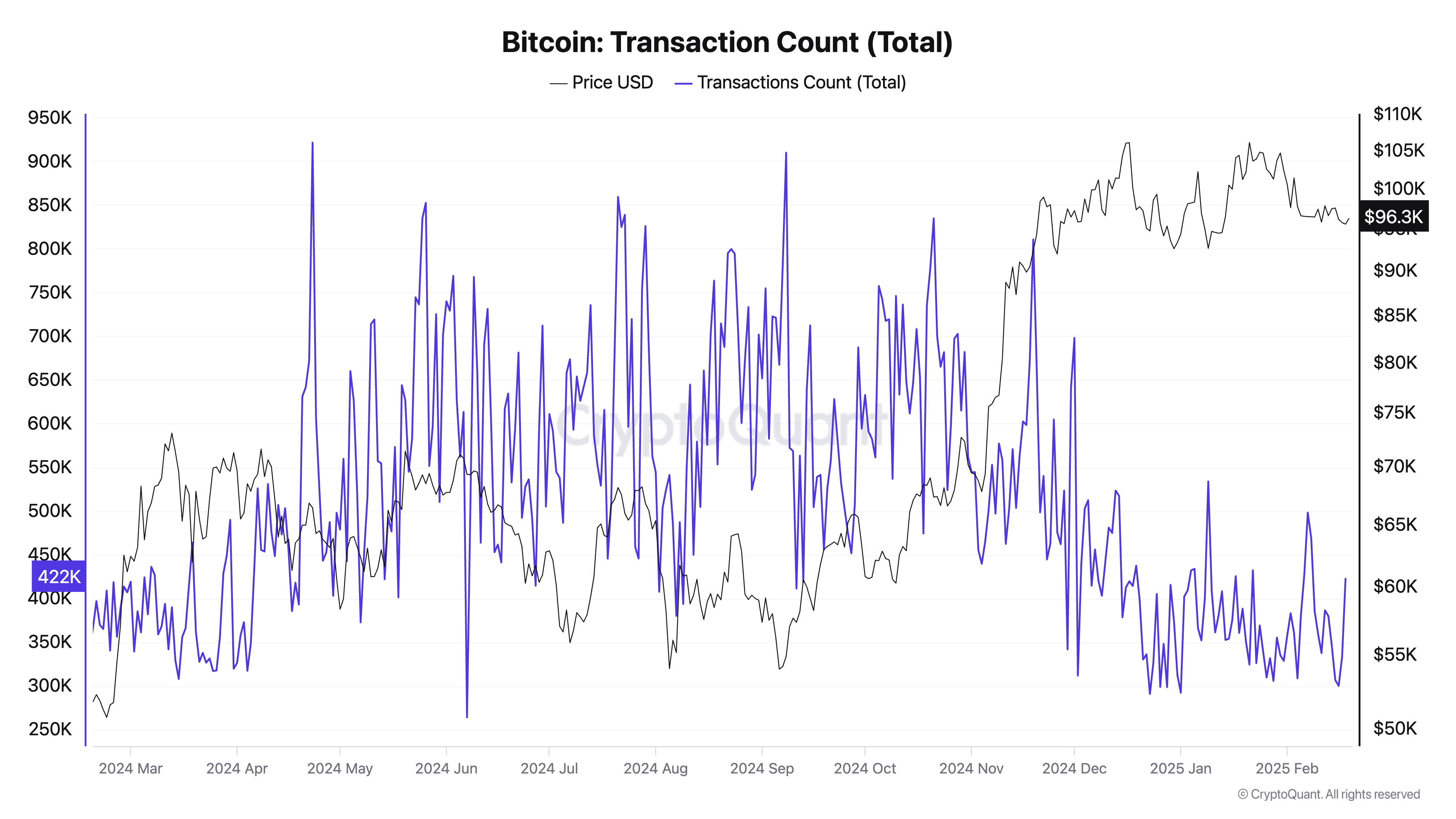

This decline follows a reduction in the total transaction count, which, while volatile throughout the past year, has been trending downward since December 2024.

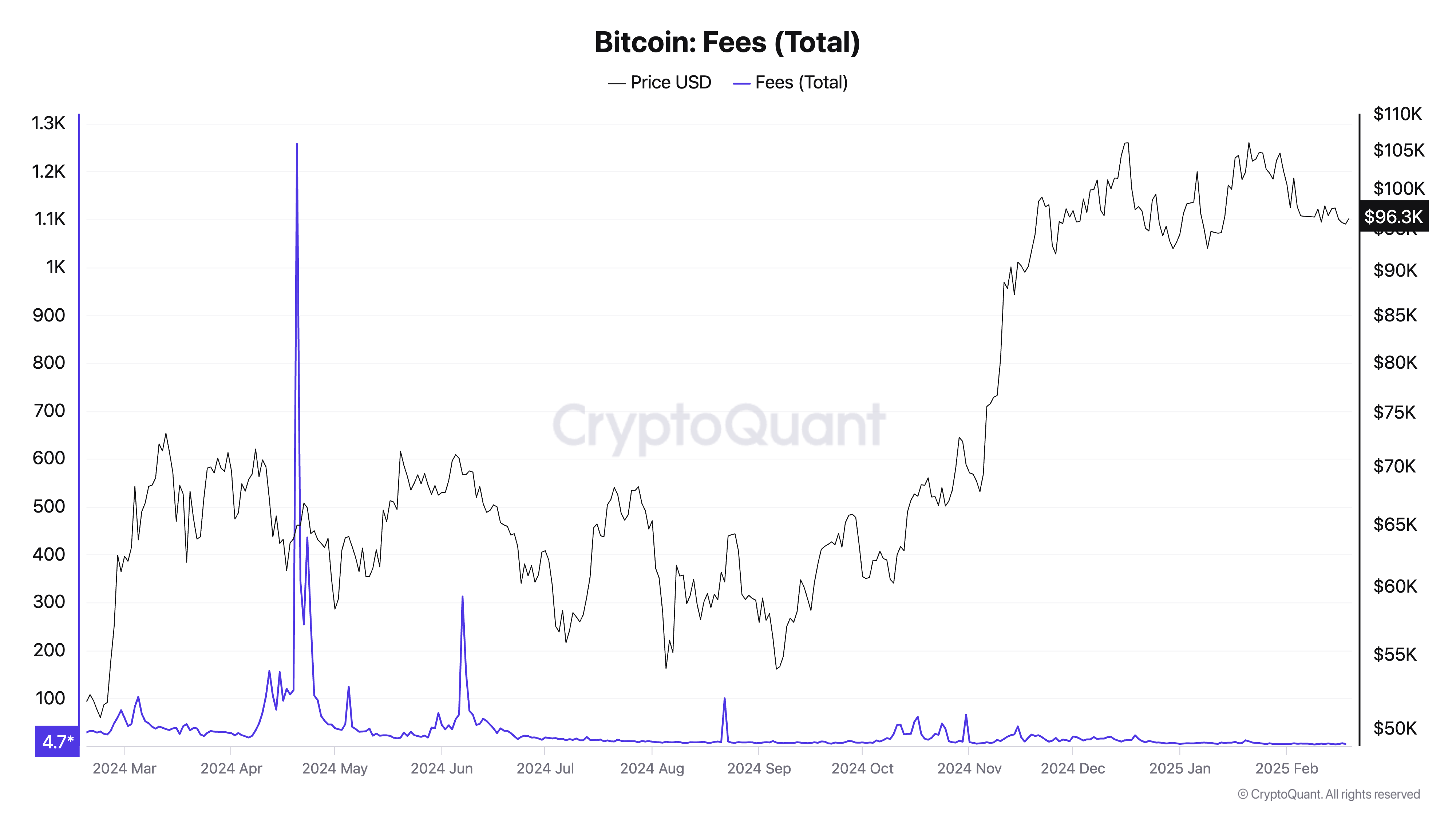

Bitcoin transaction fees tell a similar story. After periods of high congestion and surging fees during the April 2024 halving and subsequent market rallies, fees have now dropped to historically low levels, staying near 1–2 sat/vByte.

This environment creates an ideal window for UTXO consolidation, where large holders and exchanges can merge their outputs to optimize for future efficiency. The decline in UTXOs isn’t an indication of selling but rather a technical move to minimize transaction costs before the network experiences another period of high fees.

Lower transaction counts also align with this shift. The declining number of on-chain transactions suggests that fewer unique transactions are being made, but this doesn’t necessarily mean demand for Bitcoin has fallen. Instead, it indicates that fewer entities are moving coins frequently.

The growing number of institutional custody solutions is likely reducing the need for on-chain transfers. Unlike retail traders who move BTC between exchanges or wallets regularly, institutions typically hold their Bitcoin in cold storage for extended periods, making their activity less visible on-chain.

A key factor dispelling the notion of bearishness is Bitcoin’s price resilience. Despite a sharp decline in UTXOs and transactions, Bitcoin has remained stable above $90,000, showing no signs of market exhaustion.

The missing link in the on-chain decline narrative is the role of spot Bitcoin ETFs. Since their launch, these ETFs have absorbed a massive percentage of BTC…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…