The Bitcoin price is stuck in a tight range following yesterday’s U.S. Federal Reserve (Fed) announcement on monetary policy. Macro forces have taken over global markets increasing the correlation across all asset classes.

For a deep dive into how the Fed 75 basis point hike affected the Bitcoin price, and a look into the crypto market’s internal dynamics, check out the analysis from our Editorial Director Tony Spilotro. Link below:

At the time of writing, the Bitcoin price trades at $18,900 with a 2% and 7% loss in the last 24 hours and 7 days, respectively. The entire crypto top ten by market cap is recording losses on similar time periods with the exception of XRP which continues to trend to the upside with a 29% gain over the past week.

Why The Bitcoin Price Needs To See More Capitulation

As NewsBTC reported yesterday, the crypto market has completed every major price catalyzer in the short term with the Ethereum “Merge”. Now, the market is moving in tandem with macroeconomic factors and with traditional markets.

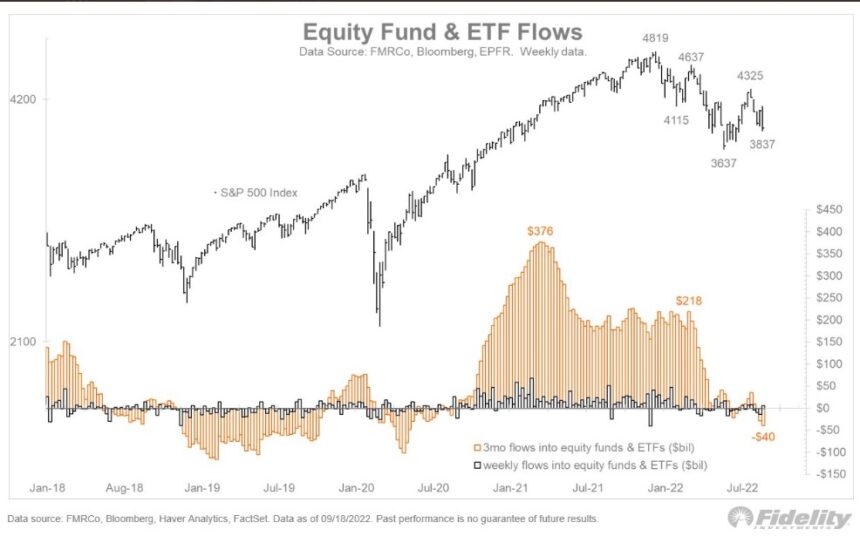

This might provide room for a relief rally or for more downside if major financial indexes trend in one direction or the other. According to Jurrien Timmer, Director of Macro for investment firm Fidelity, there has been “little capitulation” for the S&P 500.

Despite the fact that the equity index has been on a downtrend since reaching an all-time high at 4,819 into its current levels at 3,837, Timmer believes the market has been resilient and might need to see more capitulation before forming a bottom. Via Twitter, the expert said the following sharing the chart below:

It’s surprising how little capitulation there has been in the market. Yes, the sentiment surveys are all negative, but actual flows have not been. This seems consistent with the lack of volatility in the market (…).

The above coincides with analyst Dylan LeClair look into previous Bitcoin cycles. The analyst believes BTC forms a bottom following a “final capitulation” of the mining sector. This event might lead to a crash in the network hashrate, which is yet to be seen. LeClair said:

I believe with macroeconomic conditions as the catalyst, something similar will repeat. We’re not there yet.

Will Bitcoin Re-Test Its…

Click Here to Read the Full Original Article at NewsBTC…