Bitcoin (BTC) volatility is finally giving BTC bulls what they want — but why now?

After drifting lower for months and spending recent weeks in a tiny trading range, BTC/USD has delivered 24-hour gains in excess of 7%.

Hitting its highest levels since mid-September, the largest cryptocurrency is rewarding those who refused to sell and punishing shorters to the tune of around $1 billion.

The change of trend has come quickly and caught many by surprise, as evidenced by that liquidation tally.

Behind the scenes, however, little has changed — macroeconomic conditions have not undergone major upheaval compared to a week ago, and internal problems for Bitcoin, such as miner strain, remain the same.

What could have caused BTC price action to break out of what could end up being a downtrend finally breaking after an entire year?

Cointelegraph takes a look at three major factors influencing crypto market strength in the current environment.

Fed could change its tune on rate hikes

When Cointelegraph reported on why the crypto market saw fresh losses last week, the United States Federal Reserve was first on the list.

Concerns focused on unwavering policy keeping the U.S. dollar strong and rates surging higher for the foreseeable future — the worst case scenario for risk assets.

Nonetheless, the past week has seen the results of that policy spill over into other economies, notably Japan, which made repeated interventions in its exchange market to prop up the flagging yen.

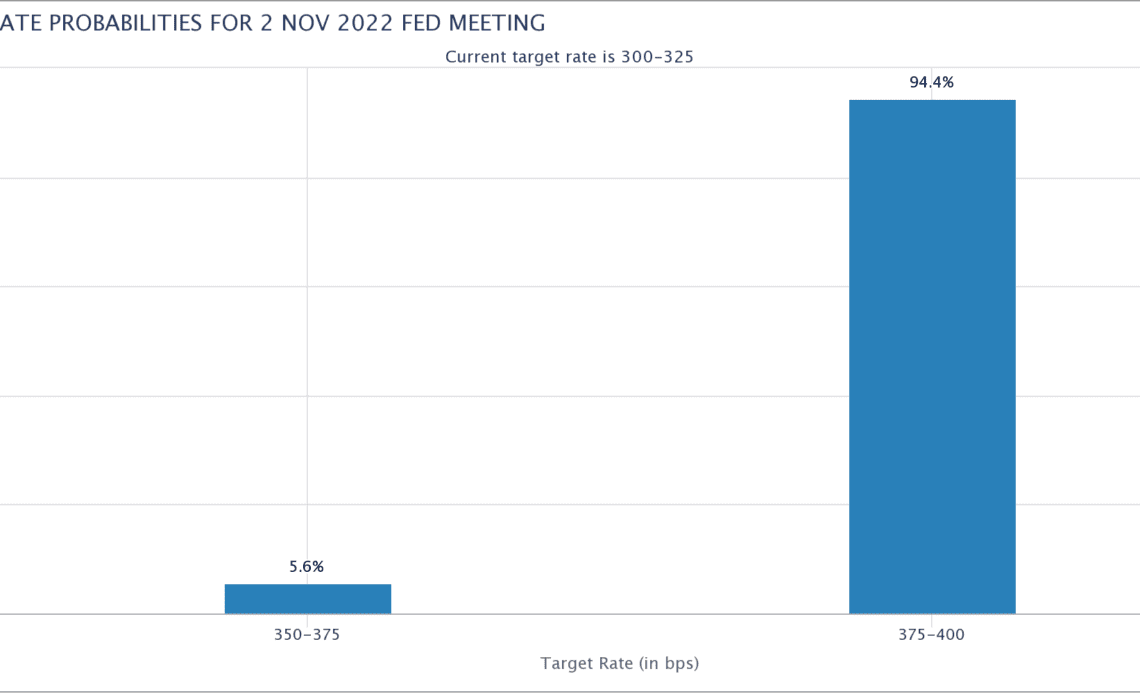

At the same time, rumors are gathering over the outlook for rate hikes as the Fed runs out of room to maneuver. After next month’s hike, suspicions are that policy will begin to U-turn, making smaller hikes in subsequent months before reversing altogether in 2023.

Important upcoming dates for the Fed are:

- Oct. 28: Personal Consumption Expenditures (PCE) price index

- Nov. 1-2: Federal Open Market Committee (FOMC) meeting, rate hike decision

As such, any signal that the Fed is preparing to soften its hawkish stance is being seized on by markets weary from a year of quantitative tightening (QT).

November’s FOMC meeting is still overwhelmingly expected to result in a 0.75% rate hike, matching September and July, according to CME Group’s FedWatch Tool.

Bitcoin volatility snaps record low levels

Analyzing data from Cointelegraph Markets Pro and TradingView, it becomes clear that BTC/USD has been too quiet for too long.

This is especially visible in the…

Click Here to Read the Full Original Article at Cointelegraph.com News…