The crypto market is yet to recover from a spike in selling pressure over the weekend, with Ethereum and other cryptocurrencies almost reaching double-digit losses. Bitcoin has been one of the worst performers these past few days and might weaken during September.

In the coming weeks, market participants will have their attention set on the Ethereum “Merge”, the event that will complete this network’s migration to a Proof-of-Stake (PoS) consensus. The narrative surrounding this event has allowed ETH’s price to lead the market in the past week.

As a consequence, Bitcoin has been moving sideways with heavy price action. Data shared by Joshua Lim, Head of Derivatives at Genesis Trading, looked at the metric called BTC Dominance, the percentage of the crypto market cap comprised of Bitcoin, and the ETHBTC ratio.

On the latter, Lim claims the metric stands at multi-year highs, despite the downside price action experience by the largest cryptocurrencies since December 2021. The ETHBTC ratio is 0.0733 and its all-time high stands at 0.0880.

The last time the metric was close to its current levels was at the beginning of the downtrend, last December. Will “The Merge” finally allow ETH to enter uncharted territory in this metric? Lim said while sharing the chart below:

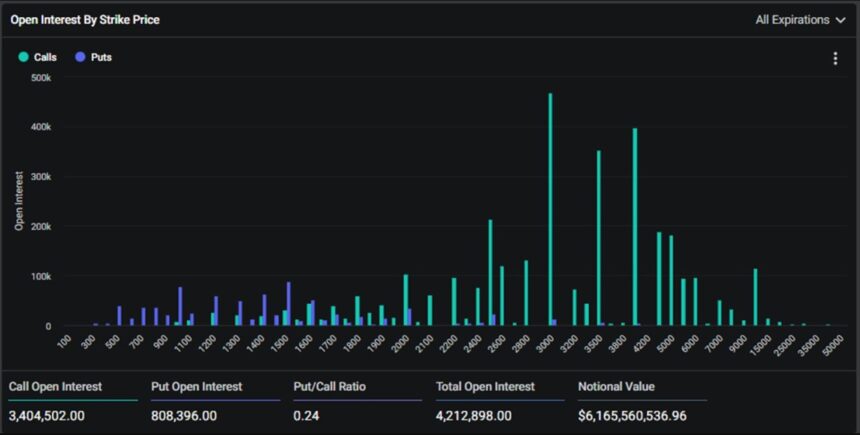

(…) the “flippening” when ETH mkt cap = BTC mkt cap occurs at ETH/BTC ratio of 0.0159. sizable positioning in ETH calls reflects mkt consensus of continued ETH outperformance charts below show ETH put/call ratio is only 0.24, substantially lower than BTC’s at 0.53.

Market participants seem to be betting on Ethereum approaching the $3,000 and $3,800 area. The Call Open Interest, the number of option contracts betting on ETH’s price increase, stands at 3,4 million while the Put Open Interest, the number of contracts betting on the opposite, stands at 808,396.

Institutions Favor Ethereum While They Go Short Bitcoin?

The Bitcoin Dominance metric is also at historical lows of 40%. The downside trend in the crypto market has been labeled a “Bear Market”, during these periods the Bitcoin dominance often trends to the upside, but this is yet to happen as the metric moves into support.

A significant portion of BTC’s price current price action, Lim argued, is due to institutions getting exposure to the asset. When the macro-economic landscape turns bearish, institution sells their Bitcoin. The expert explained:

BTC is already a sizable % of the…

Click Here to Read the Full Original Article at NewsBTC…