Despite the influx of substantial capital into these new spot Bitcoin ETFs, with CoinShares reporting $1.18 billion in inflows into digital asset ETFs globally last week, the expected positive impact on Bitcoin’s price hasn’t materialized. This raises questions about the underlying mechanics of these ETFs and their influence on Bitcoin’s value.

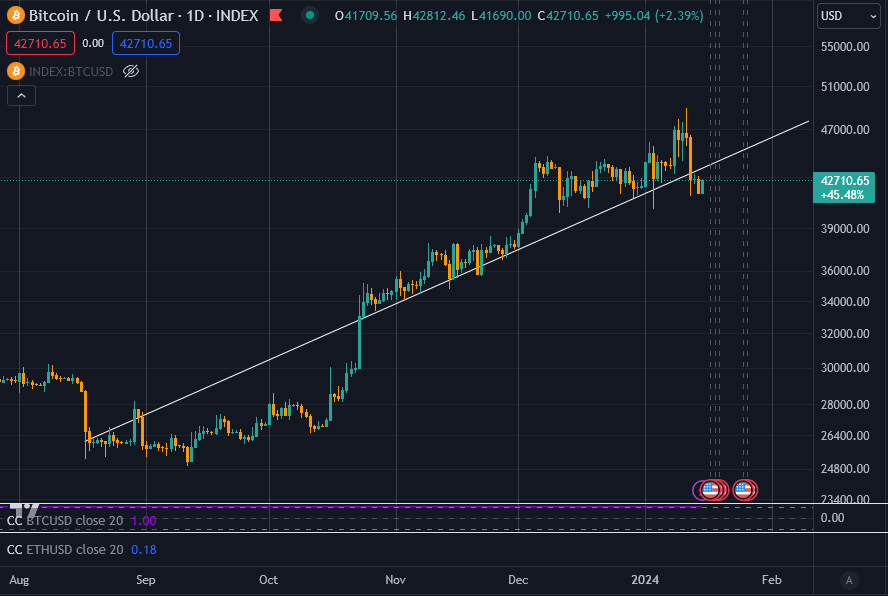

Let’s first ensure we correctly frame the situation. The recent price run-up picked up steam when BlackRock announced their filing for a spot Bitcoin ETF on June 15, 2023. At that time, Bitcoin’s price was around $25,000. Subsequently, there was a 70% increase to around $42,000, where it essentially traded sideways.

As the ETFs launched, Bitcoin spiked to $49,000 but sold off rapidly to around $42,000. Looking at the chart, it’s rational to suggest that perhaps Bitcoin was overbought at above $44,000 for this point in the cycle.

With that in mind, let’s look at how Bitcoin purchases work in relation to the spot Bitcoin ETFs that were recently sanctioned.

How Bitcoin is valued for ETF purposes.

The operation of spot Bitcoin ETFs is more complex than it appears. When individuals buy or sell shares of an ETF, like the one offered by BlackRock, Bitcoin is not bought or sold in real time. Instead, the Bitcoin that represents the shares is purchased at least a day earlier. The ETF issuer creates shares with cash, which is then used to buy Bitcoin. This indirect mechanism means that direct transfers of Bitcoin between ETFs do not occur. Therefore, the impact on Bitcoin’s price is delayed and does not reflect real-time trading activity.

Essentially, with an ETF like BlackRocks, the share price on any given day is meant to represent the average price for Bitcoin across standard trading hours, not the live price of Bitcoin at any given time. Most ETFs use ‘The CF Benchmarks Index’ to calculate the price of Bitcoin for any given day; the CF Benchmarks website describes it as;

“The CME CF Bitcoin Reference Rate (BRR) is a once a day benchmark index price for Bitcoin that aggregates trade data from multiple Bitcoin-USD markets operated by major cryptocurrency exchanges.”

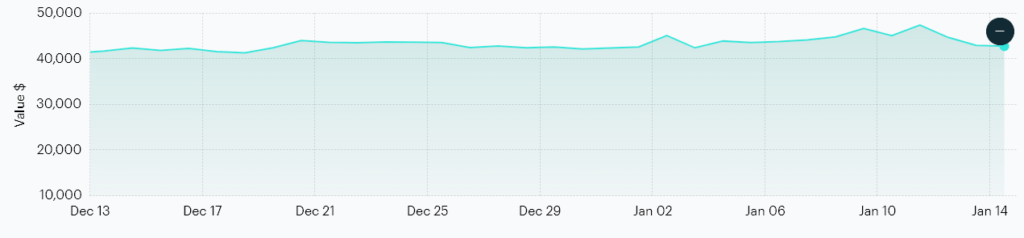

It uses an average price across Bitstamp, Coinbase, Gemini, Itbit, Kraken, and LMAX Digital. According to CF Benchmarks, this is what the price of Bitcoin looks like. Notice its recent high was $47,525 on Jan. 11.

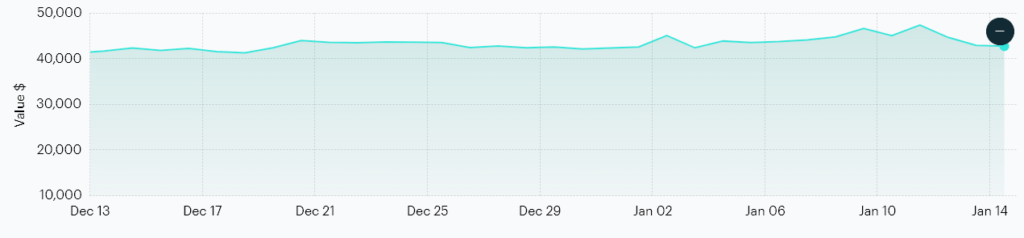

Here is the same period and Y-axis scale using CryptoSlate data on a 1-hour timeframe. As of press time, Bitcoin is worth…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…