In an era where the boundaries between traditional finance (TradFi) and crypto continue to blur, the tokenization of real-world assets (RWAs) stands out as one of the hottest trends. This trend, which allows tangible assets like vehicles and real estate to be bought and sold as tokens on a blockchain, promises to revolutionize the efficiency and speed of asset transactions.

Just last week, BlackRock, the world’s largest asset manager, has positioned itself at the forefront of this movement with the launch of a $100 million tokenization fund, which has already attracted over $240 million in investment within its first week.

Larry Fink, CEO of BlackRock, has been vocal about the potential of tokenization, stating that RWAs “could revolutionize, again, finance.” This comment has contributed to a notable surge in the valuation of several RWA crypto tokens in recent weeks. In light of these developments, crypto analysts from Layergg have identified a specific crypto project that they believe could garner significant interest from BlackRock.

Why BlackRock Could Choose Aptos

The project in question is Aptos, which has been earmarked for its potential in the RWA space. According to Layergg’s analysis shared on X (formerly Twitter), the narrative surrounding RWA and tokenization, bolstered by BlackRock’s involvement, suggests a nascent yet rapidly growing interest in this sector.

They highlight that mid to low cap RWA projects listed on Binance have performed exceptionally well, indicating a broader market interest spurred by narrative-driven investment strategies. However, the favorite crypto project for BlackRock could be Aptos.

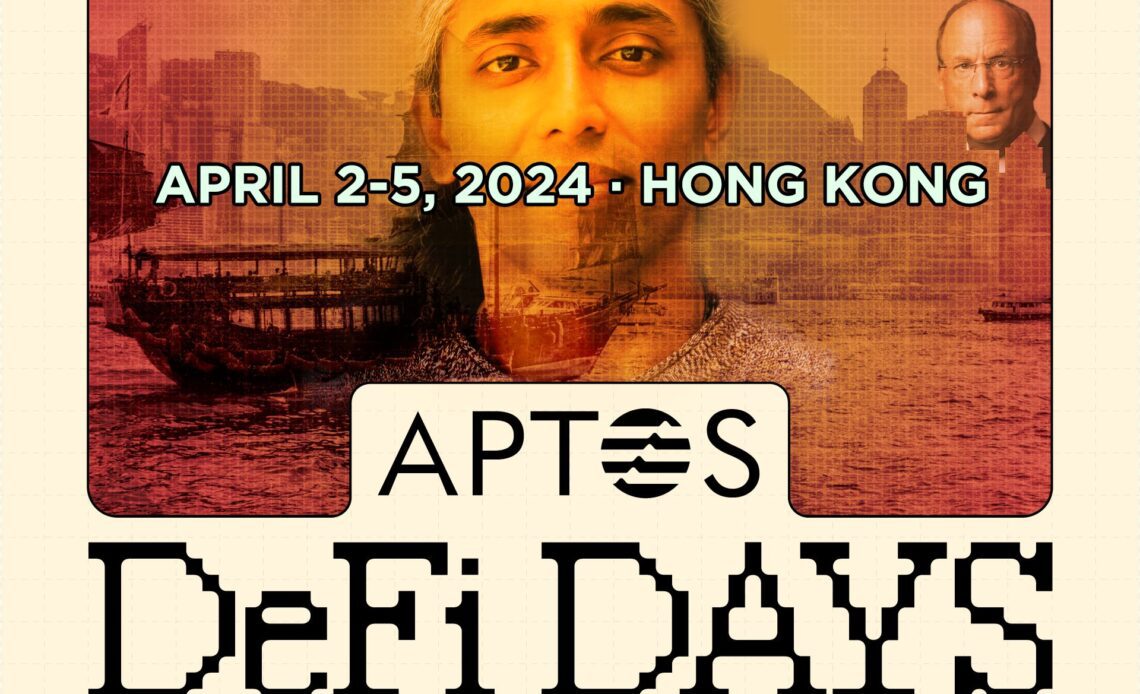

A closer look at Aptos reveals several factors that might make it an attractive partner for BlackRock. Firstly, Aptos is poised to make a significant announcement related to RWA in April, coinciding with the Aptos DeFi DAYS event from April 2 to 5.

This announcement is speculated to involve a partnership with a global asset management firm, potentially BlackRock. “A partnership with a global asset management firm is expected to be announced. It is speculated that this may include BlackRock,” the analysts remarked.

The basis for this speculation includes Aptos CEO Mo Shaikh’s previous tenure at BlackRock, suggesting pre-existing industry connections that could facilitate such a partnership.

Moreover, Aptos…

Click Here to Read the Full Original Article at NewsBTC…