Bitcoin (BTC) has declined by more than 55% six months after it reached its record high of $69,000 in November 2021.

The massive drop has left investors in a predicament about whether they should buy Bitcoin when it is cheaper, around $30,000, or wait for another market selloff.

The more you look at prior $BTC price history the more one can think it’s not the bottom

After 190 days from the all-time high, Bitcoin still had another 150 to 200 days until it hit bottom last couple of cycles (red box)

If time is any indicator, could be another 6 to 8 months pic.twitter.com/C1YHnfOzxC

— Rager (@Rager) May 20, 2022

This is primarily because interest rates are lower despite Federal Reserve’s recent 0.5% rate hike. Meanwhile, cash holdings among the global fund managers have surged by 6.1% to $83 billion, the highest since the 9/11 attacks. This suggests risk aversion among the biggest pension, insurance, asset and hedge funds managers, the latest Bank of America data shows.

Many crypto analysts including Carl B. Menger see greater buying opportunities in the Bitcoin market as its price searches for a bottom.

But, instead of suggesting a lump-sum investment (LSI), wherein investors throw down a huge sum to enter a market, there’s a seemingly safer alternative for the lay investor, called the dollar-cost averaging, or DCA.

Bitcoin DCA strategy can beat 99.9% of all asset managers

The DCA strategy is when investors divide their cash holdings into twelve equal parts and buy Bitcoin with each part every month. In other words, investors purchase more BTC when its prices decline and less of the same asset when its prices rise.

The strategy has so far provided incredible results.

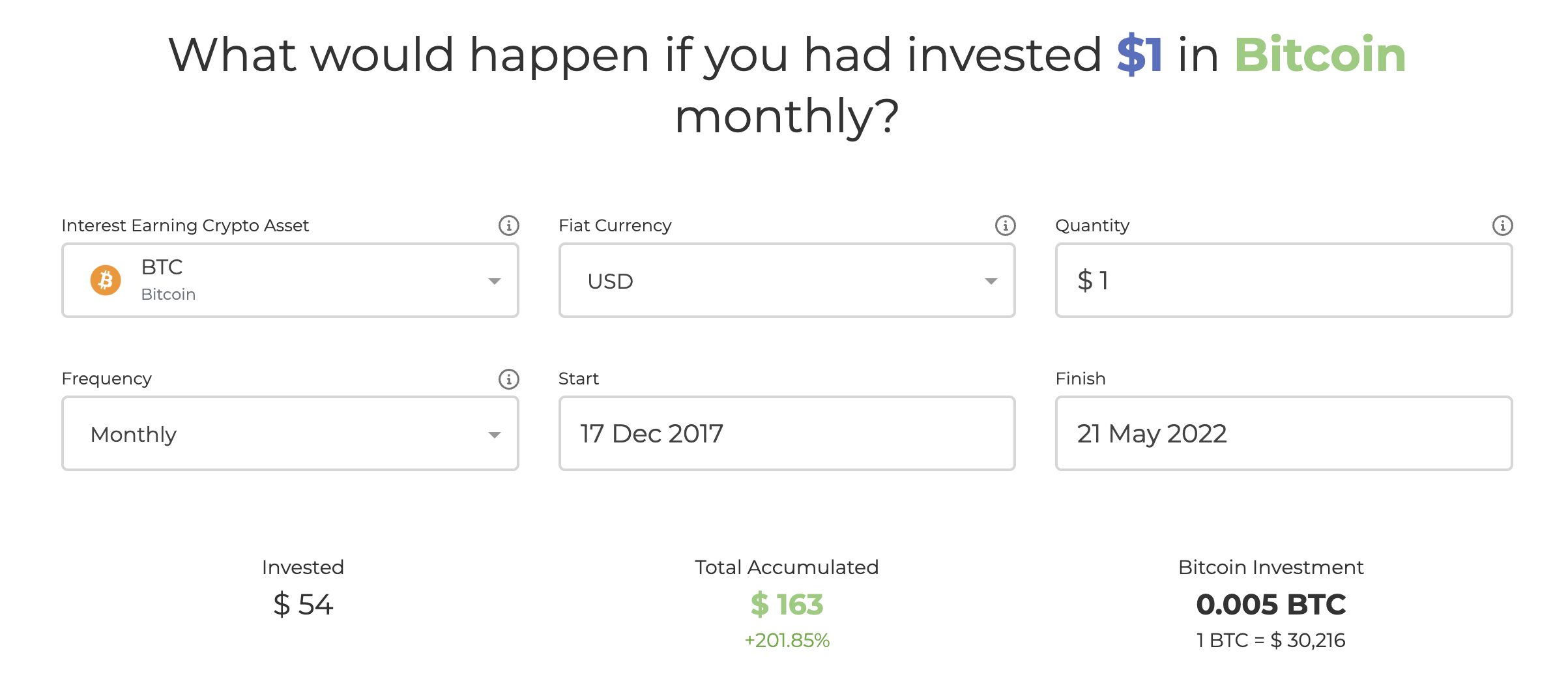

For instance, a dollar invested into Bitcoin every month after it topped out in December 2017 — near $20,000 — has given investors a cumulative return of $163, according to CryptoHead’s DCA calculator. That means around a 200% profit from consistent investments.

Click Here to Read the Full Original Article at Cointelegraph.com News…