It’s another crypto

winter and there is a downsizing wave sweeping through the cryptocurrency

industry.

On Tuesday, Coinbase announced

that it was pruning its

workforce by 18% in preparation

for a recession it says could lead to another crypto winter.

Two weeks earlier,

Gemini said it was cutting its

staff base by 10%, citing “current

macroeconomic and geopolitical turmoil.”

In addition, BlockFi, a crypto

lending service, and Crypto.com, a Singapore-based cryptocurrency exchange,

have announced similar actions.

This morning we announced that after taking significant time to plan and consider, we are reducing our headcount by roughly 20%. This is not a decision we take lightly and is one that brings us great sadness.

— Zac Prince (@BlockFiZac) June 13, 2022

While BlockFi said it

was reducing its headcount “by roughly 20%,” Crypto.com on Saturday said it was

letting go of 260 workers or 5% of its corporate workforce.

On the contrary, Binance on Wednesday said it was undergoing talent recruitment for 2,000 open job positions in its exchange.

KuCoin, a Seychelles-headquartered cryptocurrency exchange, also said it has no plan to make any significant changes to its hiring plan for 2022.

“Every year, KuCoin works on its business strategy that already implies some anti-crisis management measures; so we are always ready to react to such market changes,” the exchange wrote in a document shared with Finance Magnates

So, what is with all

these mass layoffs?

Behind the Retrenchments

These downsizing actions

come at a period the cryptocurrency industry is grappling

with continued market volatility and struggling to get back on its feet after the Terra-Luna

crash.

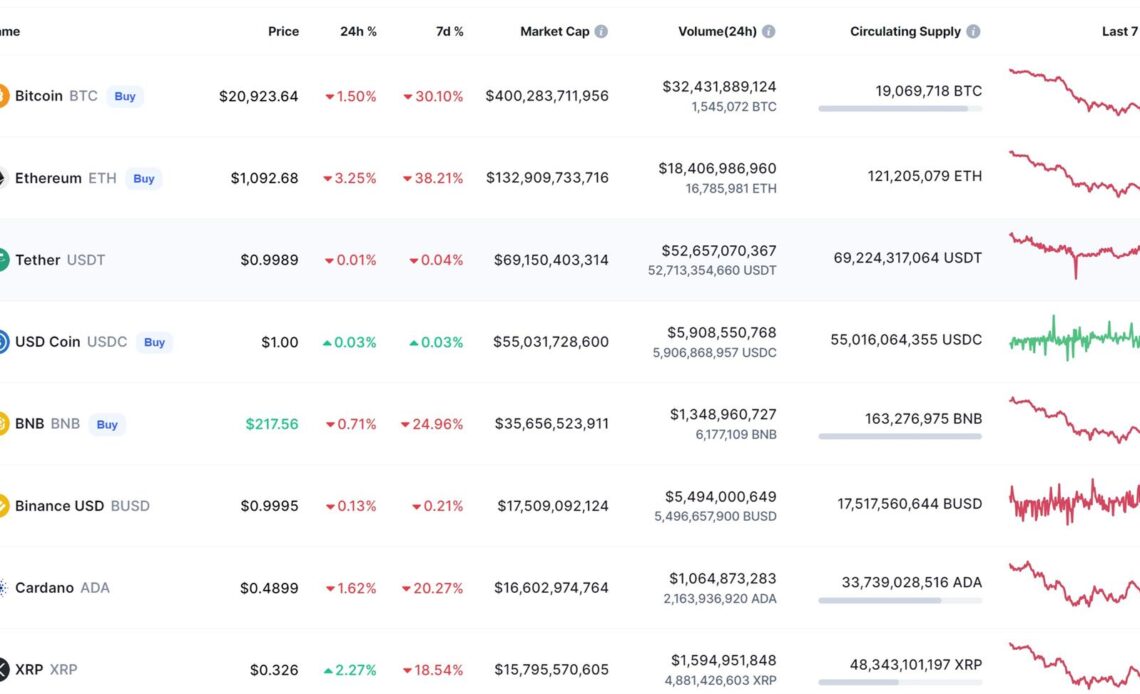

At the start of the

week, crypto market capitalization dropped below $1 trillion to levels last

seen in early 2021.

Specifically, Bitcoin

slumped 14%, dropping below $24,000, which is the lowest since December 2020.

Also, data from CryptoCompare

shows that the total assets under management across…