The crypto market has been on a tear in 2025, and the latest 99Bitcoins Q2 State of Crypto Market Report, authored by Manisha Mishra and sponsored by KCEX, lays it all out. The quarter saw institutional demand surge, Bitcoin ($BTC) hit a then-ATH of $111,980, and crypto hiring spike 753%.

Despite the rally, the total market cap was still 12% below its $3.7 trillion peak, hinting at room to run. With stablecoin adoption booming and long-term holders stacking, Q2 may have been the real start of this cycle’s breakout.

Read the full report here: State of Crypto Q2 2025 – 99Bitcoins

A Record-Breaking Quarter for Bitcoin

Bitcoin lit up Q2 with a 25.66% gain, smashing past resistance to hit a then-record $111,980 on May 22. That put it well ahead of gold’s 7.21% rise and most equity indices, marking a sharp reversal from Q1’s pullback.

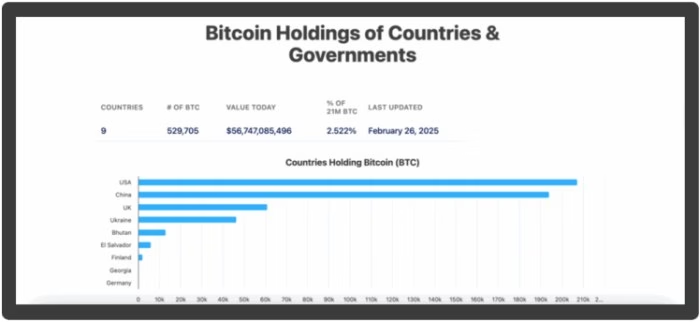

According to 99Bitcoins’ Q2 report, the rally was driven by institutional inflows, ETF demand, and growing sovereign interest, with governments now holding 2.5% of Bitcoin’s total supply. Meanwhile, spot ETF flows consistently outpaced miner issuance, tightening supply just as demand surged.

Chris Wright of 21Shares summed it up:

“We believe that Bitcoin ETFs will attract 50% more inflows this year compared to last year. This would result in net inflows of approximately $55 billion in 2025, representing an increase of around $20 billion year-over-year.”

A golden cross in late May confirmed the uptrend, following a clean breakout from months of consolidation. It’s a textbook bullish structure.

With price action and fundamentals in sync, Q2 marked the clearest shift yet: Bitcoin is back, but powered by institutions, not retail.

Institutions Took the Wheel, Retail Turned to Altcoins

According to the 99Bitcoins report, this bull run has a different driver behind the wheel. And it’s not Reddit. 9 out of 10 experts interviewed in the Q2 report said retail traders have shifted their focus to the best altcoins, chasing faster gains while institutions quietly accumulated Bitcoin.

The on-chain data backs it up. Glassnode shows that 30% of $BTC’s supply is now held by centralized entities, with large players dominating inflows. Meanwhile, Google Trends reveals that retail interest in “Bitcoin” searches stayed surprisingly low throughout Q2, even as $BTC hit new highs.

Confidence among long-term holders also climbed. UTXO activity dropped, and the amount…

Click Here to Read the Full Original Article at NewsBTC…