The Federal Reserve has its last FOMC meeting on July 27 before it breaks for 2 months. All eyes are on whether FED chair Jerome Powell will follow the market consensus of 75 basis points (bp) or look to a more aggressive 100bp as inflation continues to soar.

The FED’s interest rate decision is expected at 2 PM ET on Wednesday, with the GDP data coming at 8.30 AM Thursday.

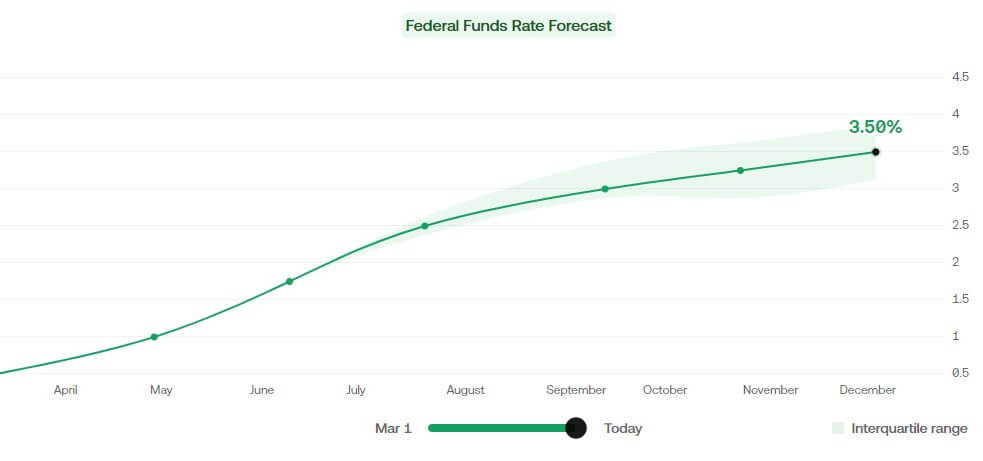

According to a ZeroHedge preview of the FOMC meeting and economists surveyed by Reuters, there is “only a 10% chance of a 100bp move.” The economists surveyed see the July 27 meeting as the peak hike for inflation, with increases slowing to 50bp in September and 25bp in November.

Avoiding a recession

The FED meeting comes just days after the White House looked to publicly redefine the commonly accepted method of establishing when an economy is in a recession. Data on GDP in the US is expected Thursday, which could confuse the markets should the information show a two-quarters decline in GDP.

Two-quarters of negative GDP growth is often cited as the definition of a recession. However, the current White House administration chooses not to use this metric. Metrics from “the labor market, consumer and business spending, industrial production, and incomes” will instead be added to the data to create a “holistic” view of the health of the economy.

Market turbulence

Market analysts and commentators such as Guy from Coin Bureau expect “some market turbulence” Wednesday ahead of the FED meeting.

Interest rate decision today. The last opportunity for the Fed to bring down inflation before their 2 month holiday.

Expect some market turbulence!

— Coin Bureau (guy.eth) (@coinbureau) July 27, 2022

Morgan Stanley’s Michael J. Wilson told Yahoo! Finance,

“equity markets “may be trying to get ahead of the eventual pause by the Fed that is always a bullish signal. The problem this time is that the pause is likely to come too late.”

The attempt to “get ahead” could be partly responsible for the recent uptrend in crypto prices. Bitcoin broke $24k on July 20 but has since been in decline into the FOMC meeting Wednesday. At the time of writing, Bitcoin is at $21.3K, up 3% daily.

Broader markets

Across the broader market, oil prices rose ahead of the meeting after a report revealed a drop in crude oil inventories in the US. The S&P rose 5% in July, indicating that sentiment may be switching towards a more bullish outlook.

CNBC reported that Gold prices could see volatility as…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…