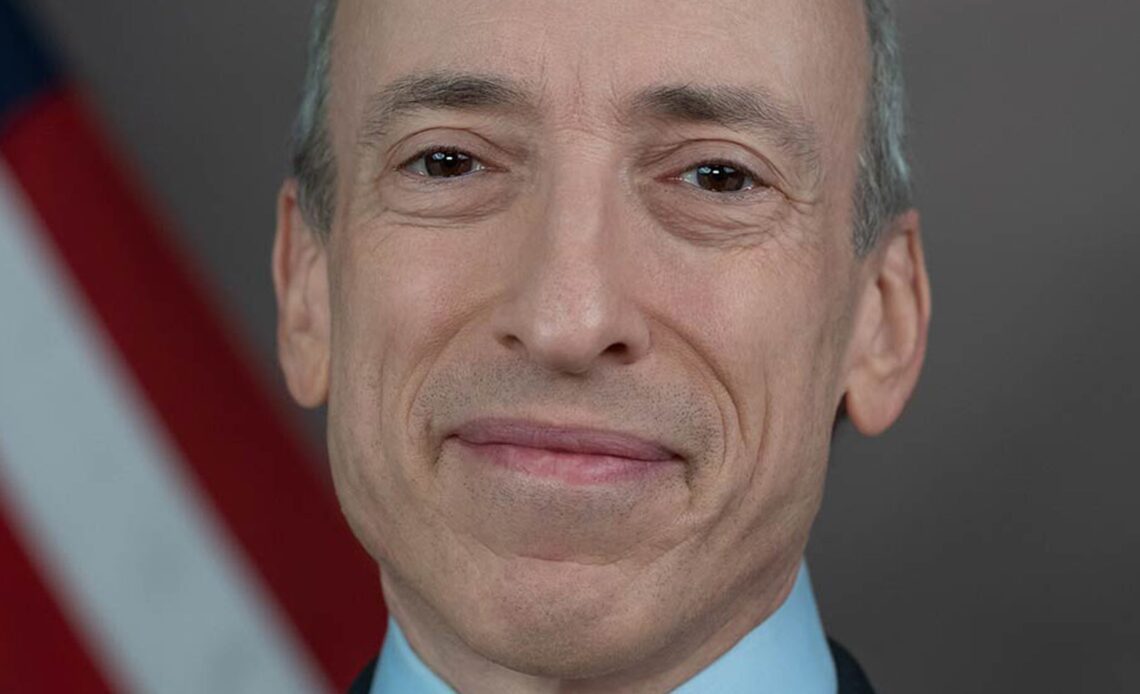

Crypto has made “non-compliance . . . [its] business model,” at least according to U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler. With that belief pervasive among the regulators primarily tasked with regulating securities in the United States, it is no surprise that enforcement actions involving cryptocurrencies are at an all-time high.

In just a few years, we have watched a largely unregulated “Wild-West” be transfigured into a central focus of for the SEC, and, to a lesser extent, the Commodities and Futures Trading Commission (CFTC) and Department of Justice (DOJ).

Ethan G. Ostroff and Michael S. Lowe are partners and Samuel F. Rogers and Brett E. Broczkowski are associates for national law firm Troutman Pepper.

Make no mistake, these regulators have not hidden the ball, at least with respect to their appetite for enforcement efforts. They have taken steps to ensure their efforts against the leading crypto players are widely received, including going after household-name celebrities who regulators maintained could have misled investors or illegally promoted cryptocurrency. These enforcement actions have garnered mainstream media attention with some resolved through multi-million-dollar settlements.

See also: The Many Layers of the SEC’s First NFT Enforcement Action | Opinion

Perhaps the most surprising aspect of these enforcement actions, however, is how they have been brought to task. One might expect a new wave of tough legislation aimed at regulating cryptocurrencies and other digital assets. But you’d be wrong. Enforcement activity tells a very different tale. These enforcement actions are founded upon law that is, in some cases, 90-years-old.

As regulators continue to ramp up enforcement efforts by relying on novel interpretations of existing law, two questions arise: What is next? And what will break first, our antiquated securities laws or the crypto industry?

What’s next? Crypto wallets.

Having closely observed the actions of regulators, we envision crypto wallets and certain digital asset transactions will be the next target.

Drawing from prior federal enforcement actions and signals from these agencies in publications and notices, we anticipate that digital asset enforcement will grow in two ways: the Securities Exchange Act of 1934 (“Exchange…

Click Here to Read the Full Original Article at Cryptocurrencies Feed…