One of the most significant events within the Bitcoin ecosystem is the Bitcoin halving, an event that reduces the reward for mining new blocks by half. The event next month occurs approximately every four years and has profound implications for the cryptocurrency industry.

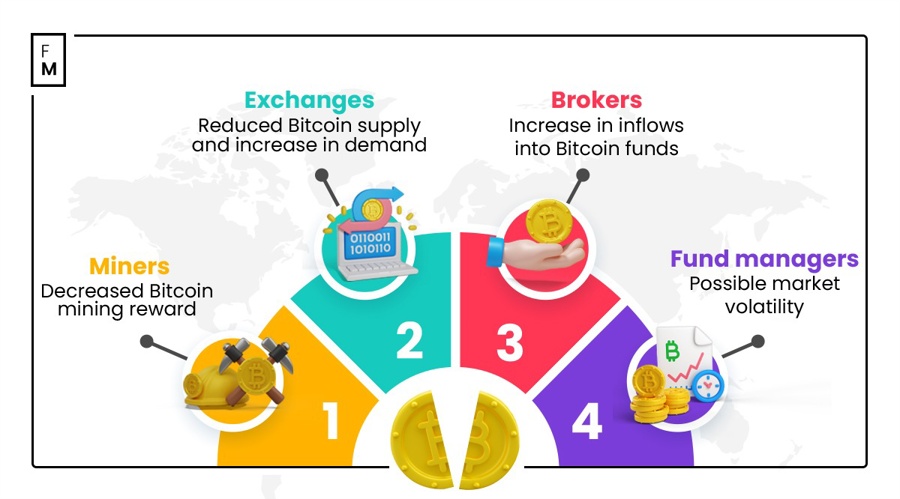

The halving is a pivotal moment for the crypto industry, influencing everything from miners’ revenue to overall market sentiment. Industries like mining, exchanges, and funds are just a few that can be impacted. Some ways the halving can affect such industries include:

- For miners, the immediate effect is a decrease in income unless there’s a significant rise in Bitcoin’s price. This can lead to a shakeout of less efficient miners and a temporary drop in the network’s hash rate.

- From the perspective of a crypto business or an exchange, the reduced supply of new Bitcoin could lead to increased demand and bullish market sentiment, assuming demand remains constant or increases. Anticipation alone often leads to substantial price volatility before and after the halving event, with a bias to the upside.

- Fund managers and investors may want to take notice of the historical trend where Bitcoin has experienced significant price increases following past halvings. While past performance doesn’t always indicate future results, the halving is a cornerstone event that can’t be ignored in any comprehensive crypto investment strategy.

Furthermore, for brokers and exchanges, effective ways to deal with the Bitcoin halving might involve planning to manage things like liquidity, trading volumes, and customer engagement.

It’s official.

$70,000 #bitcoin before the 2024 halving, before ZIRP, and before significant M2 growth—what does it mean?

~$800T of fiat assets are about to try to get an allocation to bitcoin, which is only $1.3T today, and much of that $1.3T is not for sale. pic.twitter.com/ZDvyWuZIIZ

— Joe Burnett (🔑)³ (@IIICapital) March 9, 2024

One thing to keep in mind may be to ensure the exchange has sufficient liquidity to accommodate the increased trading activity that often follows the halving. This may involve optimizing trading algorithms, enhancing order-matching systems, and bolstering liquidity reserves.

Exchanges may also want to do all they can to keep customers informed about potential disruptions and changing market conditions around the time of the halving event. Engaging users through educational content, market insights, and promotional campaigns can help maintain…