The economist Benjamin Graham, known to some as the father of value investing, once compared the market to a voting machine in the short run and a weighing machine in the long run. While Graham likely would have been skeptical at best about crypto and its built-in volatility had he lived to see it, his economic theory nevertheless applies to certain aspects therein.

Since the emergence of altcoins, the blockchain space has operated almost exclusively as a “voting machine.” Many projects have, by and large, been financially unsuccessful and even detrimental to investors and the space at large. They have, instead, turned crypto into a memelord popularity contest, and their success on that front can hardly be understated. Sometimes that competition is based on who promises the best future use case — but whether that future actually arrives is another issue altogether. Often it’s based on who markets themselves best, through sophisticated-looking infographics or ridiculous token names and a series of associated “dank” memes. Whatever it is, the success of the majority of projects is based on speculation and little else. This is what Graham was referring to as that “voting machine.”

So, what’s wrong here? Many prescient people have made life-changing money while playing the game, and the constant talk of funding and building potentially world-changing decentralized tech is the norm, so it seems like the space could be an ideal environment for founders and developers, right? It isn’t. These successes have often come at the expense of unsophisticated, desperately misguided investing rookies. Furthermore, most of that value ends up in the hands of the ubiquitous so-called vaporware merchants who propagate little more than misplaced value and broken promises. So, where is Graham’s weighing machine, and when will it start to enact its force? As it happens, right now.

Related: The decoupling manifesto: Mapping the next phase of the crypto journey

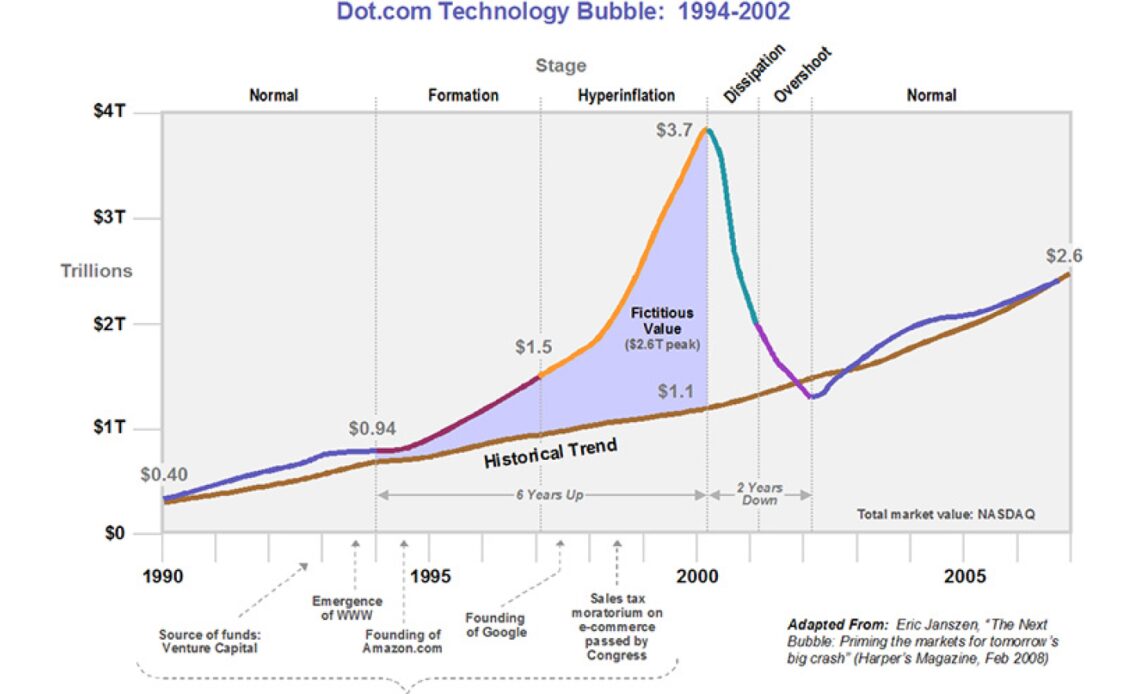

The crypto crash vs. the dot-com bubble

The dot-com bubble is an ideal historical precedent for our purposes. The two spaces share an exuberance to shoehorn developing tech into problems that don’t exist, excessive access to capital, ambitious promises with no hard tech backing them, and finally, a gross misunderstanding of what any of this is even about on the part of the investor (see the domain claims for pets.com, radio.com, broadcast.com, etc.)

Why did those companies ever even gain favor? Simply…

Click Here to Read the Full Original Article at Cointelegraph.com News…