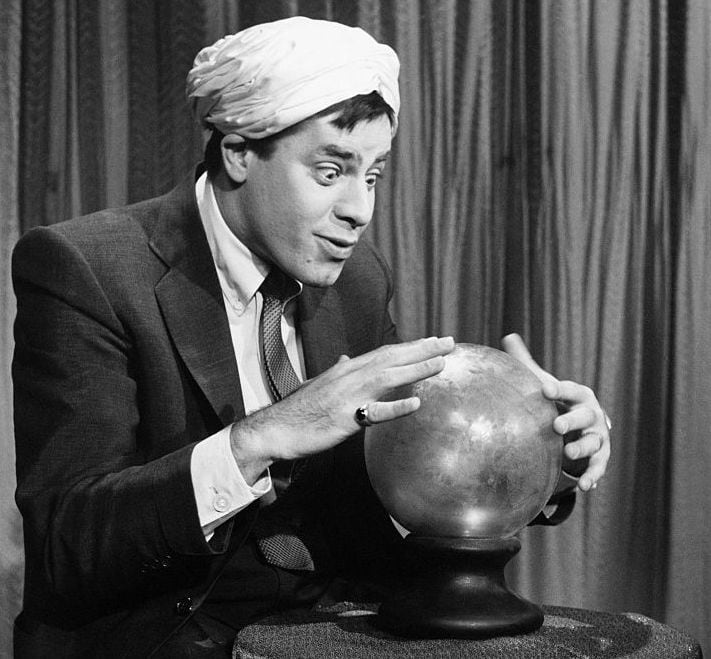

December is the month when pundits make predictions for the year ahead. It’s a tiresome ritual.

As George Costanza said in an infamous episode of TV’s “Seinfeld” (you know the one): “Care to make it interesting?”

Instead of interviewing “experts” or, worse, suffering my armchair prognostications about what lies ahead for crypto in 2024, let’s take a look at what the prediction markets are saying.

This post is part of CoinDesk’s “Crypto 2024” predictions package.

They may not be right, but participants in these markets are putting their money where their mouths are. So we can be fairly sure they are telling us what they really think, not what they want you to think, or what they think you want to hear. Sometimes, just the questions they ask can themselves be revealing.

What are prediction markets?

(If you already know the answer to that question, feel free to skip to the next section.)

In prediction markets, participants bet on the outcome of real-world events, from the deadly serious (the war in the Middle East) to the frivolous (Taylor Swift’s love life). They are typically framed as yes-or-no questions, and participants can buy “yes” contracts or “no” contracts. When the trade settles, those who bet on the correct prediction get $1 per contract purchased and those who bought the incorrect one get zero.

For example, for the market on whether Christopher Nolan will win the best director Oscar for “Oppenheimer,” “yes” contracts were recently trading at 68 cents, indicating the market sees a 68% chance he will get the nod.

More than just a speculative game, these markets arguably have positive spillover effects for the public, by offering an alternative source of expert opinion, a counterweight to fallible legacy sources of information. For example, the prediction markets reportedly called the 2020 election more accurately than the polls. Cable news pundits generally aren’t punished for being incorrect. In prediction markets, bettors stand to lose money if their predictions turn out wrong, giving them an incentive to express what they truly believe.

Their beliefs might be wrong, but the financial risk should theoretically discourage uninformed wagers, and conversely the upside for betting correctly should attract traders with real insights … all else equal.

Traditionally, prediction…

Click Here to Read the Full Original Article at Cryptocurrencies Feed…