QuickSwap uses an AMM model to provide token pools for users to swap, stake and supply liquidity for token assets.

The following key features of QuickSwap make up its DEX infrastructure:

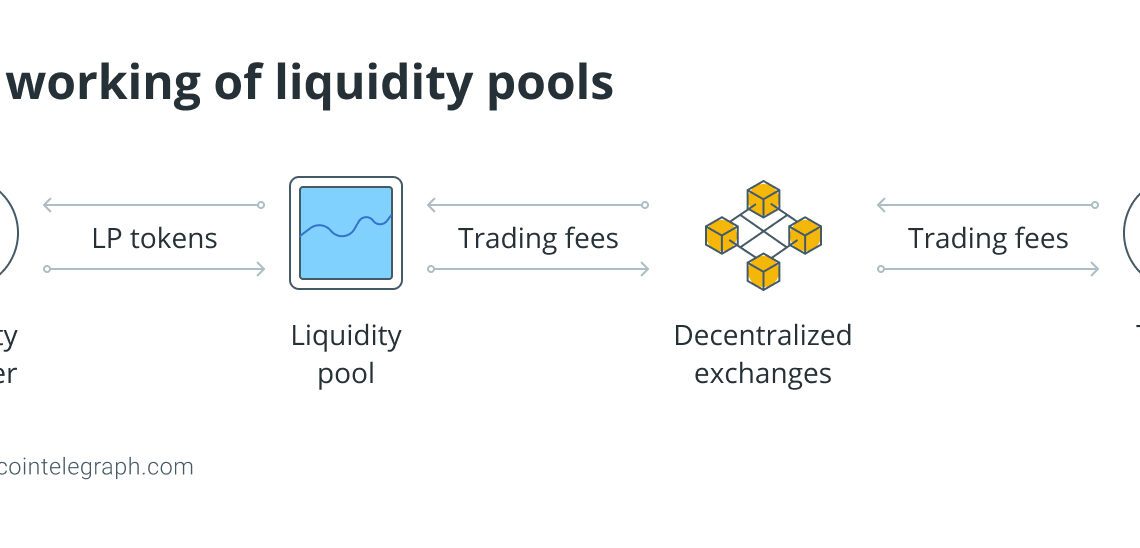

Liquidity pools

Liquidity pools are a collection of digital assets that enable trading on a DEX. They are a crucial component in DeFi since they supply the much-needed liquidity required for traders to operate on DEXs.

To create liquidity pools on QuickSwap, users lock their cryptocurrency into the protocol’s smart contracts, enabling others to use the locked assets. Consider it akin to a publicly accessible cryptocurrency reservoir. Those who fund this reservoir — aka liquidity providers — receive a portion of the transaction costs for each user interaction in exchange for supplying liquidity.

On QuickSwap, liquidity providers receive 0.25% of the trade fees proportional to their share of the pool.

Another interesting feature of QuickSwap is the change from the order book trade method. Traditionally, exchanges used order books for swap trades. Order books are a real-time collection of buy and sell orders where buyers decide the price that they are willing to pay, place their order price, and then wait for their order to be fulfilled. When a seller matches that price, the order is executed.

This order book method often creates a sub-optimal user experience with sometimes long wait times, low liquidity or lack of order execution, reliance on a third party to help fulfill orders, and higher chances of scams and hacks.

QuickSwap automates this through smart contracts allowing users to swap ERC-20 tokens. When a user wants to exchange one token with another, they send their chosen tokens to the QuickSwap smart contract. The smart contract then calculates the amount of the second token that the user will receive based on the current market price without relying on third-party buy/sell requests for the token being traded. The price determination is done by QuickSwap’s AMM model.

Automated market maker

The QuickSwap AMM model determines the asset prices and provides instant liquidity. It essentially democratizes access to liquidity through its algorithmic code. The QuickSwap AMM is like a financial robot or code that can propose a price between two assets. Instead of the traditional order book, it uses the assets in the liquidity pool to determine the price based on the percentage of tokens in the pool at that…

Click Here to Read the Full Original Article at Cointelegraph.com News…