The ongoing battle between the U.S. Securities and Exchange Commission and prospective issuers of bitcoin (BTC) spot ETFs is dominating current crypto headlines. An approved bitcoin ETF would increase access and signal a bullish new chapter for crypto.

Investors who limit their exposure to the small concentration of mega-cap assets formed by bitcoin and ether, however, may not capture the full value proposition of digital assets in their portfolios.

Broadening the digital asset investment universe beyond the largest single assets empowers crypto portfolios in the following ways:

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

Improving diversification

Both within crypto and in the context of an investor’s broader asset allocation, increasing the breadth of digital asset holdings may lead to better diversification characteristics while also avoiding the risks of single-token concentration.

Investors should consider the following two questions regarding the portfolio-level benefits of allocating to digital assets:

- Does crypto provide long-term diversification characteristics versus traditional assets?

- If so, is bitcoin enough to capture this benefit fully (i.e., is it worth allocating to other tokens)?

Below we look at rolling correlations of the top 25 crypto assets to explore these questions:

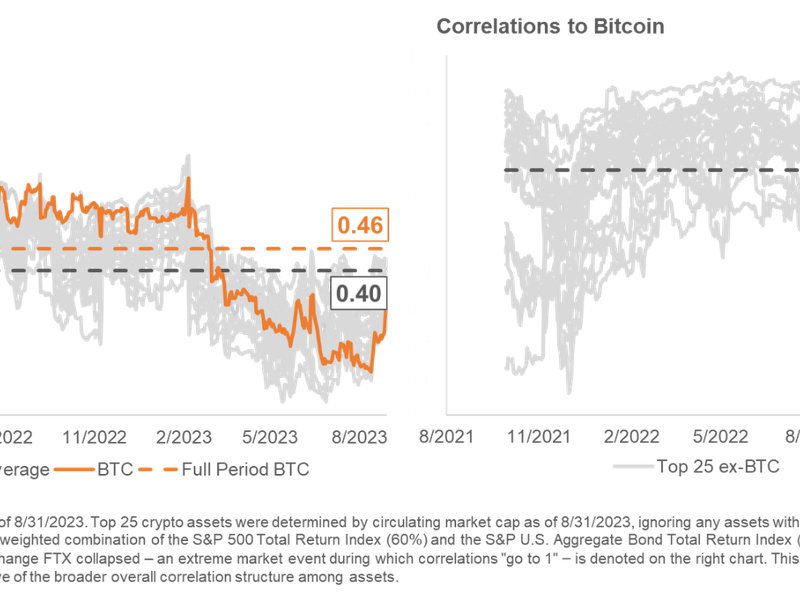

Figure 1: Rolling 60-day correlations to U.S. 60/40 portfolio (left) and to bitcoin (right), Aug. 1, 2021 to Aug. 31, 2023. Source: Truvius.

The chart on the left shows rolling correlations of daily returns for the 25 largest crypto tokens to a U.S. 60/40 stock/bond portfolio. Over the trailing two-year period, digital assets maintained strong diversification characteristics to traditional portfolios with full-period correlations of less than 0.50 for each crypto asset. This relationship is also more attractive when comparing the correlation of the full set of tokens to that of bitcoin, improving from 0.46 for BTC alone to an average of 0.40 across all top 25 assets.

The chart on the right shows correlations of non-BTC crypto assets to bitcoin. The variation of the correlations, along with modest overall levels, leaves the stigma that “all crypto is the same” looking…

Click Here to Read the Full Original Article at Cryptocurrencies Feed…