A crypto whale was spotted over the weekend scooping up massive amounts of altcoins from the Ethereum ecosystem following the listing approval spot ETH exchange-traded funds (ETFs) from the U.S. Securities and Exchange Commission (SEC).

First reported by blockchain tracking firm Lookonchain, a whale with a series of wallets bought Ethereum just above the $3,000 mark just before news of a likely ETH ETF approval surfaced.

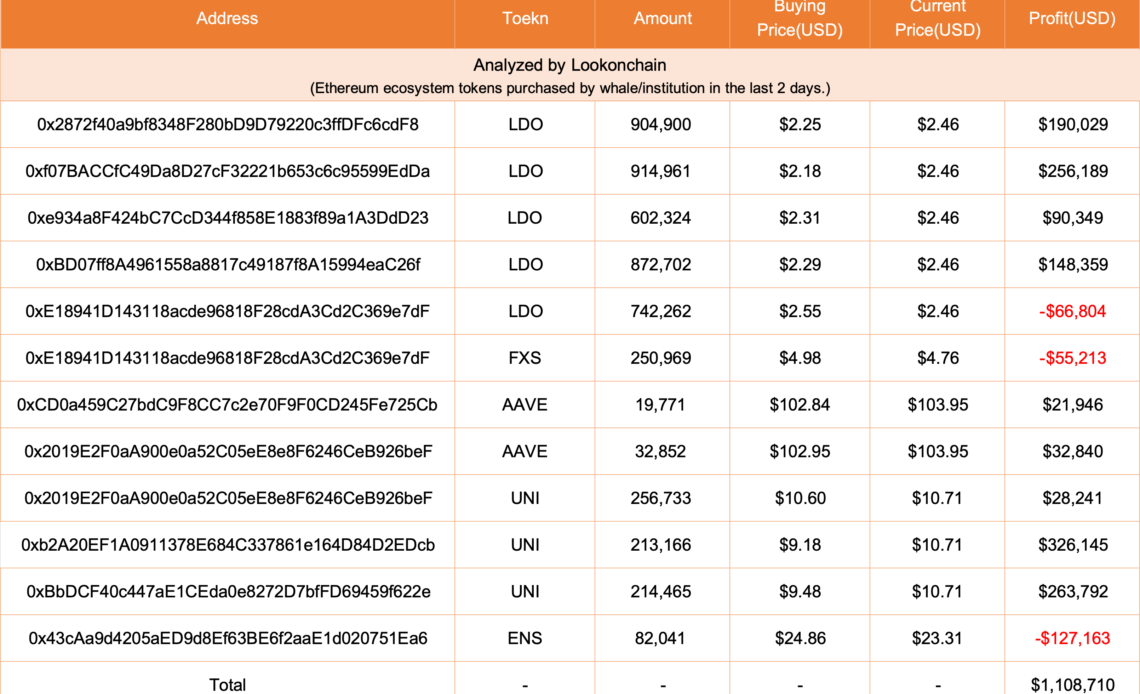

Shortly after the ETFs got a green light from the SEC, the whale began to accumulate Ethereum-based altcoins, such as Lido (LDO), Uniswap (UNI), Aave (AAVE), Ethereum Name Service (ENS) and Fraxshare (FXS).

“Before the ETH ETFs news, a whale spent 26.67 million USDT to buy 8,733 ETH at $3,054.56 and has an unrealized profit of ~$6 million.

After the SEC approved form 19b-4 for ETH ETFs, the whale bought $24.7 million worth of Ethereum ecosystem tokens and has an unrealized profit of ~$1.1 million.

He deposited 19.75 million USDT to Binance and withdrew 4.04 million LDO ($9.3 million), 684,364 UNI ($6.7 million), 52,623 AAVE ($5.4 million), 82,041 ENS ($2 million) and 250,969 FXS ($1.25 million) from Binance.”

Lookonchain also spotted a whale on the Solana (SOL) network rotating their core holdings further out the risk curve, opting for Dogecoin (DOGE) rival dogwifhat (WIF).

“A whale spent 17,966 SOL ($2.98 million) to buy 953,177 WIF at $3.13 in the past 5 hours, causing the price of WIF to increase by ~7%.

This whale previously spent 1 million USDC to buy 355,417 WIF at $2.81 on May 21st and then sold it at $3.07 for 1.09 million USDC on May 22, making $90,000.”

At time of writing, WIF is trading at $2.99.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence…

Click Here to Read the Full Original Article at Ethereum News – The Daily Hodl…