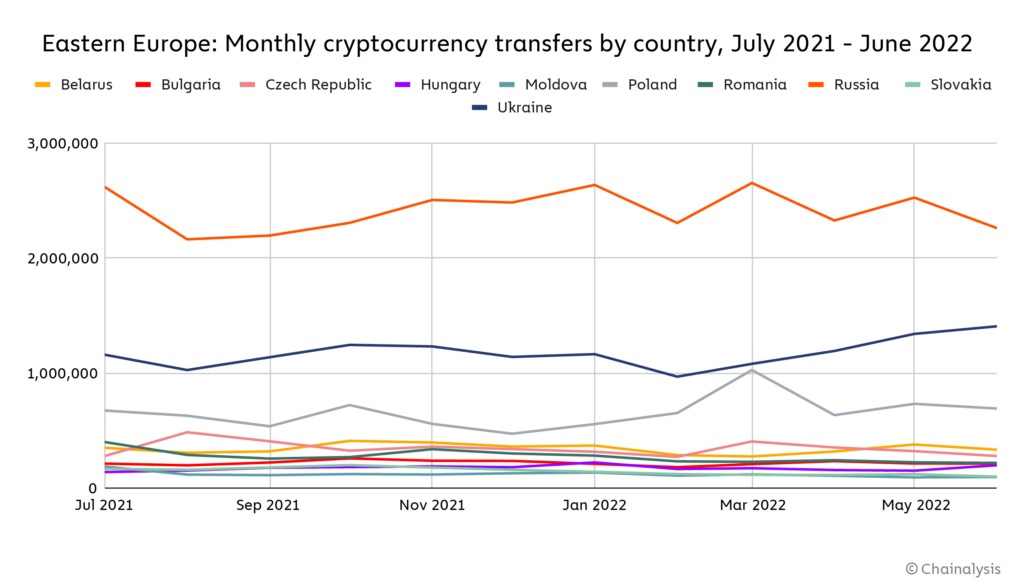

The deadly conflict that started with Russia’s assault on Ukraine has increased crypto-related activity in both countries, according to Chainalysis. Fiat inflation and sanctions pressure led to several spikes in transaction volumes this year, the blockchain forensics firm has found, while Eastern Europe as a whole sustained its role in the global crypto ecosystem.

Russians and Ukrainians Turn to Crypto Amid Consequences of Escalating Military Clash

The Russian invasion of Ukraine and ensuing military conflict that’s currently escalating have affected all aspects of life in the two nations, and cryptocurrency is no exception, Chainalysis said in an excerpt from its upcoming 2022 Geography of Cryptocurrency Report. Citizens of both countries have felt the war’s economic impact and experienced high inflation.

Shortly after the hostilities began in late February, Russian and Ukrainian cryptocurrency transfers saw an increase. In the following weeks and months trends diverged, and while Russian transactions wavered in a relatively narrow range, possibly influenced by restrictions on services, Ukrainian transactions steadily rose through June.

In March, right after the war started, Ukrainian hryvnia-denominated trade volume jumped 121% to $307 million, while Russian ruble-denominated trade volume rose 35% to $805 million. “After that, we see volumes drop off for both countries, ebbing and flowing through August, but never reaching their March highs,” the authors of the study noted.

Amid currency controls introduced under the martial law imposed by Kyiv, including restrictions on the cash purchases of U.S. dollars or euros and transfers abroad, some Ukrainians may have looked to exchange their hryvnia holdings for cryptocurrency, according to Tatiana Dmytrenko, a high-ranking adviser in Ukraine’s Ministry of Finance and member of the World Economic Forum’s Digital Assets Task Force. Crypto trading volumes declined when these measures were relaxed in July.

Chainalysis quotes a money laundering specialist who commented on similar activity in Russia, where currency restrictions were also applied. “The major question not just for oligarchs but also ordinary Russians became, ‘How do you get money out of Russia?’” said the expert who chose to remain anonymous. “Many began looking for new places where they could cash out their crypto,” he added citing the UAE, Turkey, Kazakhstan, and Georgia as jurisdictions where Russians could…

Click Here to Read the Full Original Article at Bitcoin News…