Wall Street

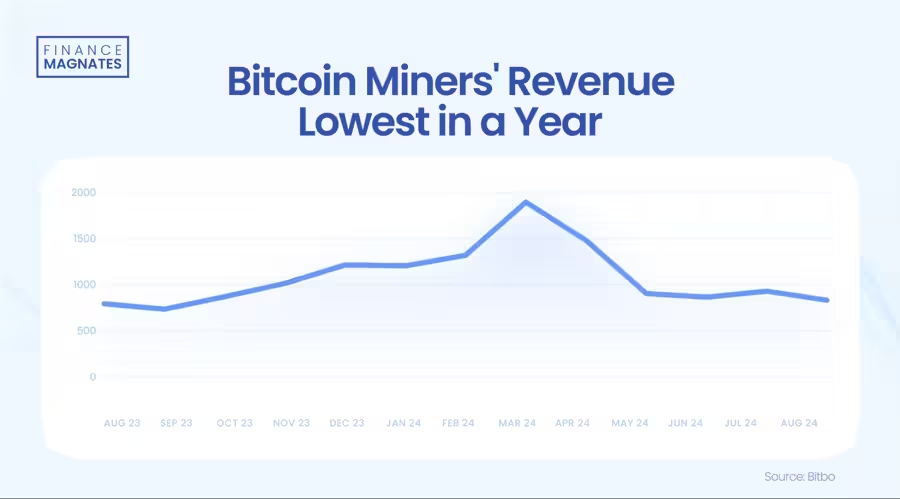

Bitcoin (BTC) miners faced their toughest month of the year in August, with

revenues plummeting to levels not seen since September 2023. The downturn

highlights the growing challenges in the cryptocurrency mining sector, as

increased competition and technical hurdles continue to squeeze profit margins.

According

to data from analytics

firm Bitbo, miners’ revenue for August totaled $827.56 million,

marking a significant 10.5% decrease from July’s $927.35 million. This figure

represents a staggering 57% drop from the 2024 peak of $1.93 billion recorded

in March, coinciding with Bitcoin’s all-time high of over $73,500.

Source: Bitbo

The decline

in revenue comes despite Bitcoin ‘s current trading price of $57,315, more than

double its value from the previous low-revenue period in September 2023.

Industry experts attribute this paradox to a combination of factors, including

reduced transaction volumes and a substantial increase in mining difficulty.

Fred Thiel, CEO, MARA, Source: LinkedIn

“During the

second quarter of 2024, our BTC production was impacted by unexpected equipment

failures and transmission line maintenance at the Ellendale site operated by

Applied Digital, increased global hash rate, and the April halving event,” said

Fred Thiel, CEO of publicly traded miner Marathon Digital Holdings. The

company’s revenue for the second quarter was

$145.1 million, missing the FactSet…