HodlX Guest Post Submit Your Post

Wall Street is placing a lot of hope on blockchain technology to streamline asset trading. Analysts predict that $5 trillion worth of assets could be tokenized on blockchains by 2030.

However, stringent market regulations and the SEC’s reputation for being leery of cryptocurrencies could put a brake on the financial sector’s ambitions.

According to a report by asset management firm Bernstein, tokenization of assets translates into a $5 trillion opportunity over the next five years, with $2 trillion in currency and bank deposits and $3 trillion in stablecoin and CBDC tokens.

Analysts added that stablecoins and CBDC tokens, along with yield farming in decentralized markets, will compete with bank deposits as investments and savings vehicles.

The Citi Global Perspectives and Solutions 2023 report echoes this sentiment, projecting that by 2030, $4-5 trillion in tokenized digital securities will be circulating, with $1 trillion being attributed to DLT- (distributed ledger technology) based trade finance.

A total of $1.9 trillion of non-financial corporate and quasi-sovereign debt, $1.5 trillion of real estate funds, $0.7 trillion of private equity/venture capital and $0.5-$1 trillion in securities financing and collateral, as well as $1 trillion in trade finance, would be tokenized by 2030.

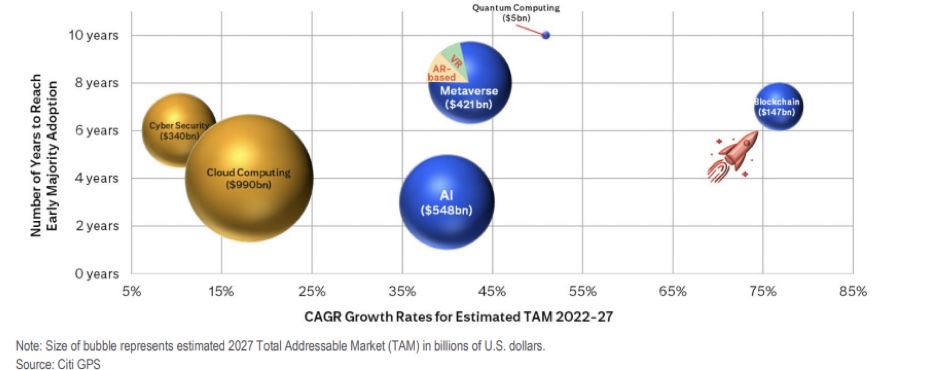

According to estimates, blockchain’s total market addressable by 2027 will be $147 billion.

What’s the deal with blockchain on Wall Street

Wall Street is restricted when it comes to investing in and trading certain financial assets like fixed income, private equity and other alternatives compared to public equities, resulting in under-allocation of such assets and a premium for assets with operational access.

Some assets might have been assumed to be unpopular among investors because they’re hard to access or expensive to manage.

Nowadays, different components of financial market infrastructure are operated through different systems, some of which were developed in the time of COBOL and Telex.

Payments have their own technology, as do asset discovery and pre-trade matching, while clearing and settlement are operated separately.

Several layers of the financial industry handle the same data, but they do it in their own isolated systems, so a lot of information has to be exchanged.

Exchange trading involves a complex communication scheme. Cross-border payments pass through multiple hoops on the correspondent…

Click Here to Read the Full Original Article at The Daily Hodl…