Key Takeaways

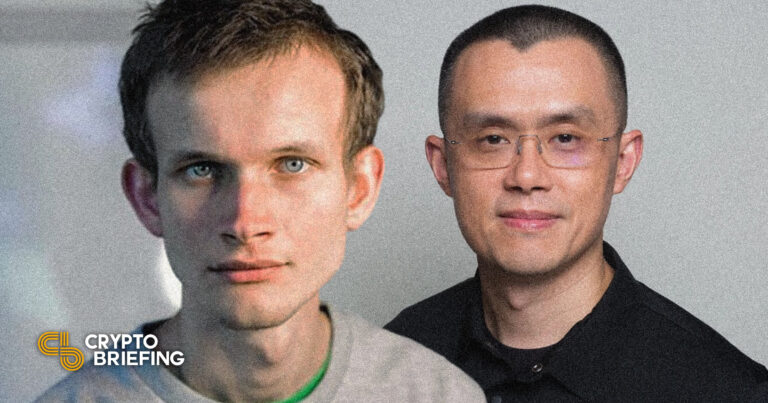

Binance CEO Changpeng “CZ” Zhao has reiterated the importance of transparency in the cryptocurrency industry following FTX’s collapse.

He has confirmed that Vitalik Buterin will create a “proof-of-reserves” protocol that will initially be tested by Binance.

Zhao explained that Binance operates in a different way to FTX but admitted that crypto exchanges are “inherently quite risky businesses.”

Share this article

CZ shared his reflections on the FTX collapse on a Twitter Spaces discussion with the Binance community Monday afternoon.

Binance CEO CZ Weighs in on FTX Implosion

Days after posting a tweet storm that ignited a bank run on the now-bankrupt FTX exchange, Binance CEO Changpeng “CZ” Zhao has given further comments on the company’s rapid demise.

On a Monday Twitter Spaces discussion hosted by Binance, Zhao weighed in on FTX’s industry-shaking bankruptcy. FTX filed for Chapter 11 bankruptcy Friday after it emerged that the firm was insolvent. Binance expressed interest in buying out the exchange but walked away from the arrangement citing due diligence checks; it later emerged that former CEO Sam Bankman-Fried secretly moved $10 billion worth of customer funds to bail out his trading firm Alameda Research following Terra’s meltdown.

Commenting on the saga, Zhao reiterated the need to increase transparency in the industry. “Anything we can do to increase transparency is good,” he said. Binance disclosed its crypto holdings in a blog post following FTX’s collapse. The world’s top exchange has also announced plans to provide proof of the funds held on its balance sheet. On the Spaces call, Zhao said that Ethereum creator Vitalik Buterin had agreed to create a “proof-of-reserves” protocol that will use Binance as a “guinea pig.”

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

Zhao referred to some of FTX and Alameda’s questionable practices prior to last week’s meltdown, reassuring listeners that Binance takes a more conservative approach to its operations. “We are not taking loans from other people, we are not taking VC investments,” he said. “We’re especially not taking VC investments and then giving money back to the VCs,” he said. However, he admitted that all crypto exchanges are “inherently quite risky businesses.”

Zhao also took the opportunity to post a warning of other possible dominoes to fall. “If [a company’s] assets do not include a large percentage of stablecoins, that is a risky sign,” he said. Zhao’s warning comes amid concerns that Crypto.com could be facing insolvency, with some pointing to the exchange’s lack of stablecoin holdings. The company’s CEO Kris Marszalek dismissed the rumors in an “ask me anything” discussion Monday.

The cryptocurrency industry is still processing the FTX incident, which commenced in earnest with Zhao’s warning that Binance would sell its FTT holdings. The most recent developments in the story include a suspicious hack on the embattled exchange over the weekend, in which over $400 million worth of crypto was moved to external wallets. As new rumors and theories on how Bankman-Fried ran his empire circulate in the crypto space, users are still unable to access their funds.

On the Spaces call, Zhao commented on the shocking nature of the revelations, which some are saying could befit a Netflix drama. “If I was writing a fiction [novel], I couldn’t imagine this stuff,” he said.

Disclosure: At the time of writing, the author of this piece owned ETH and several other crypto assets.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source