Bitcoin (BTC) stayed rangebound at the Oct. 6 Wall Street open with traders already planning for a “violent” breakout.

Bitcoin whale activity highlights the importance of $19,000

Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it moved up and down by only a matter of a few hundred dollars on the day.

$20,000 formed a focus for the pair, which meandered in step with consolidating U.S. equities and dollar strength.

With no spot catalyst in sight on short timeframes, on-chain analytics resource Whalemap turned to largescale buy and sell points to sketch out likely support and resistance.

To the downside, $19,174 marked the site of whale buy-ins, suggesting its continued strength as a line in the sand.

Bullish progress, meanwhile, would have to contend with a cloud of resistance at $21,500.

“Don’t be distracted by the noise,” the Whalemap team commented alongside a chart showing the key levels overnight.

As Cointelegraph reported, $19,000 was already on the radar, reflecting the broader aggregate price sold for the BTC supply — Bitcoin’s so-called “investor cost basis.”

Elsewhere, others targeted $21,000 as a likely turning point should a spate of bullishness kick in.

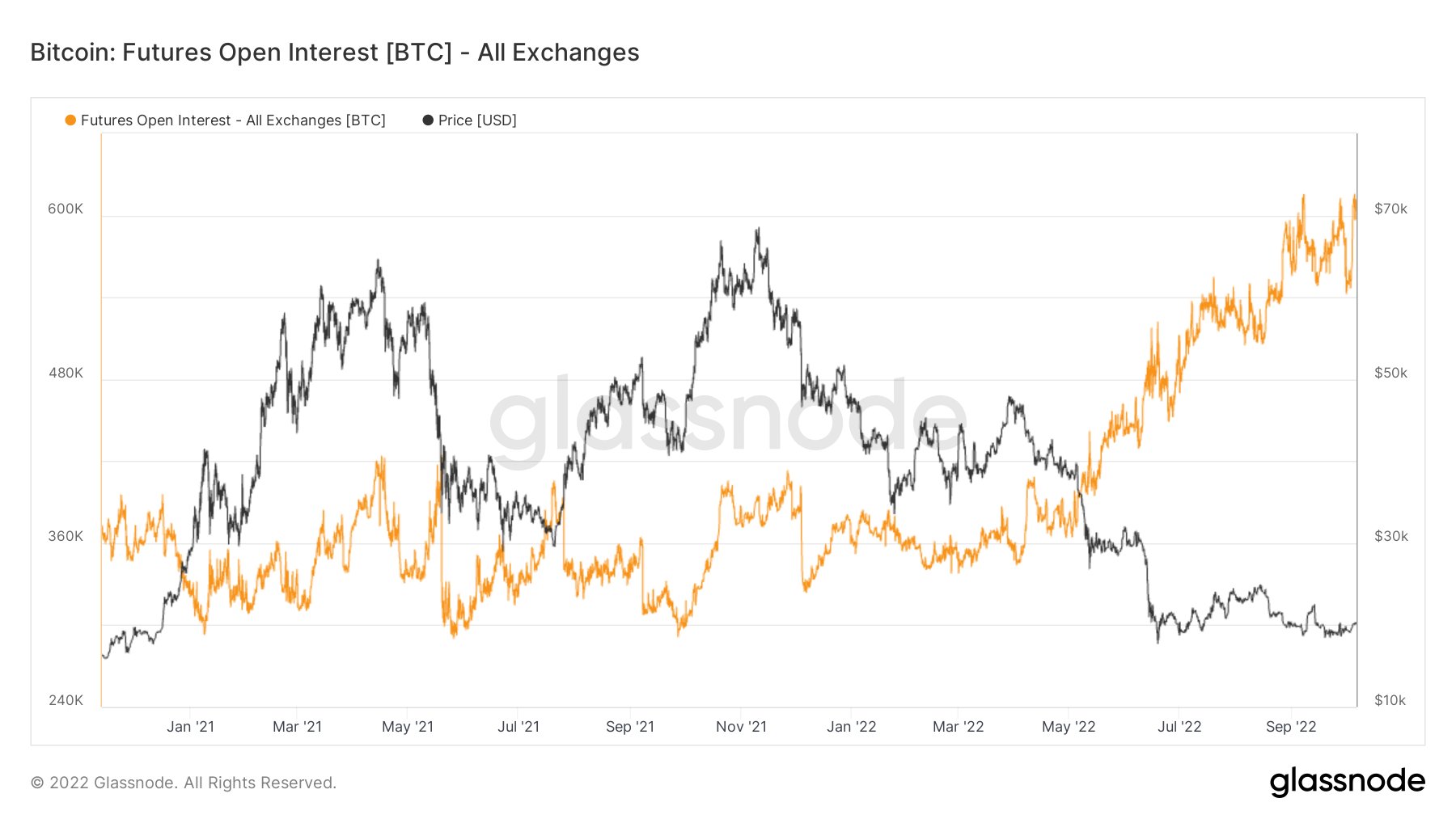

Futures open interest approaches a record 604,000 BTC

On longer timeframes, meanwhile, popular trading account Daan Crypto Trades flagged an impending triangle breakout for BTC/USD after weeks of comparative sideways trading.

Related: BTC price still not at ‘max pain’ — 5 things to know in Bitcoin this week

“$BTC The only two lines you need for the next week,” he summarized.

On derivatives markets, traders were steadily adding dry powder which could fuel a “violent” end to the status quo.

“As bitcoin consolidates around $20,000, BTC denominated futures open interest sits just below all time highs at 604k BTC,” Dylan LeClair, senior analyst at UTXO Management wrote in a dedicated thread on the day.

“Whether up or down, when bitcoin breaks out of its current range, it’ll likely be a violent move.”

LeClair noted that the all-time high in open interest was mainly collateralized by stablecoins, marking a distinct change from the heavy upside volatility seen in April 2021, when BTC/USD hit $58,000.

The views and opinions…

Click Here to Read the Full Original Article at Cointelegraph.com News…