Background

In May 2022, UST and LUNA, which once recorded a total market cap of over $40 billion, collapsed overnight, and plenty of users suffered huge losses as a result. Following the crash, algorithmic stablecoins have once again become a popular crypto topic. USN, a stablecoin native to an emerging public chain named NEAR, was launched almost at the same time as UST collapsed. The fall of UST showed this nascent stablecoin how the death spiral of an algorithmic stablecoin can engulf and destroy everything like a terrifying black hole, and users also wonder whether USN could avoid a similar ending in the future.

About USN

As the first NEAR-native algorithmic stablecoin, USN is soft-pegged to the US Dollar and backed by a Reserve Fund that contains collaterals such as NEAR and USDT. USN is positioned to be an effective way to bootstrap liquidity in the NEAR ecosystem while adding a new layer to NEAR’s utility as a token. USN’s core stability mechanisms consist of on-chain arbitrage and the Reserve Fund based on the Currency Board principle. Decentral Bank (https://decentral-bank.finance/), the DAO developing and supporting USN, manages the smart contracts of $USN and its Reserve Fund. The DAO can vote to stake the NEAR from the Reserve Fund and distribute the staking rewards to the users of protocols that integrate USN.

USN’s issuance mechanism

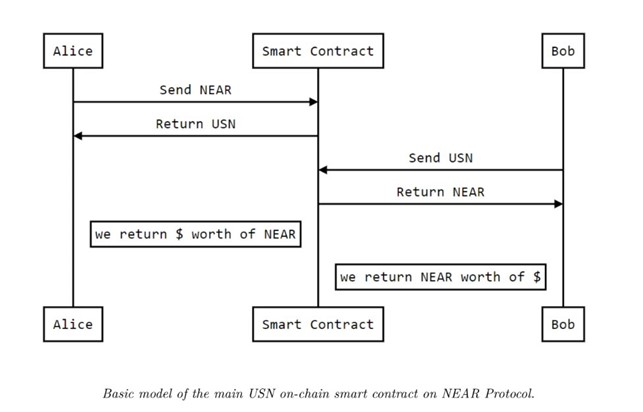

The initial supply of USN is double-collateralized by NEAR and USDT via the Reserve Fund. Decentral Bank issues the initial supply of USN through over-collateralization of the initial collateral (NEAR) at a ratio of 2:1. Subsequently, the new USN will be directly minted with NEAR or other stablecoins at a 1:1 ratio. In other words, after initial issuance, users can mint new USD with NEAR or other stablecoins at a 1:1 ratio, and they can also directly convert NEAR into new USN in the Sender wallet. However, unlike Terra’s UST minting mechanism, NEAR used for such conversions is not directly burned but will be channeled into Decentral Bank’s Reserve Fund. Meanwhile, when USN is burned, an amount of NEAR that’s worth the equivalent value will be added, which resembles UST’s burning mechanism.

Pegging mechanism

USN’s 1:1 peg to the US Dollar is secured through on-chain arbitrage and the Reserve Fund. USN maintains its peg through a smart contract which allows for the exchange of NEAR for USN with 0 slippage and minimal commissions. As soon as USN loses its peg, arbitrageurs will exploit the…

Click Here to Read the Full Original Article at NewsBTC…