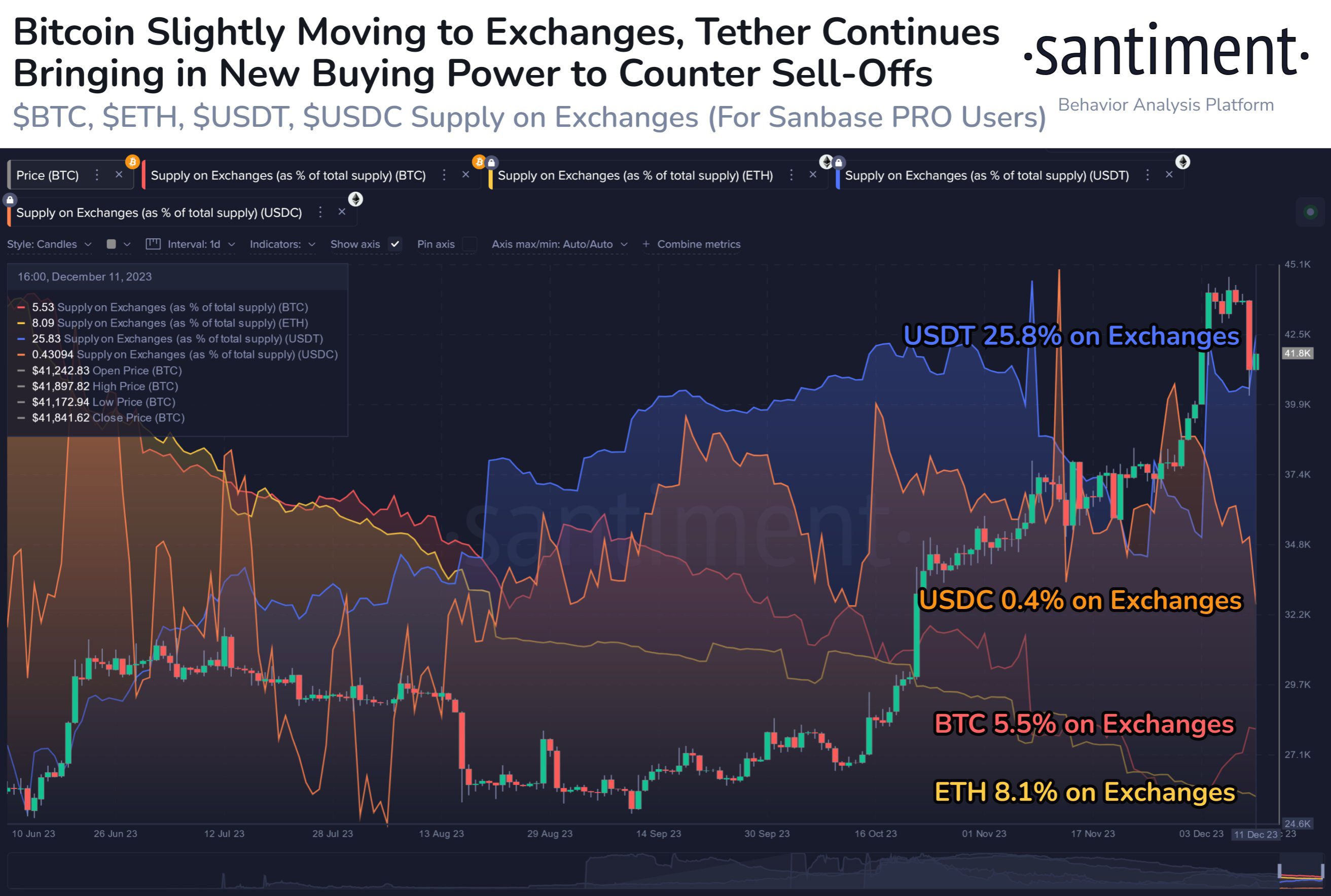

Top stablecoin USDT has flowed onto crypto exchanges in the past six months, a potentially bullish indicator, according to the crypto analytics firm Santiment.

The firm notes that Bitcoin (BTC) has been moving back “mildly” onto exchanges this month due to trader uncertainty.

Santiment, however, says that USDT exchange inflows have also countered the BTC sell-off. There’s now nearly 7% more of the Tether-issued stablecoin on exchanges than six months ago, representing new buying power that’s a “great sign for bulls,” according to the analytics firm.

Nearly 26% of USDT’s total supply now sits on exchanges.

Santiment also says that more crypto traders started predicting market tops and publicizing bearish projections after digital asset prices dropped over the weekend. The firm, however, notes that “markets move the direction the crowd least expects.”

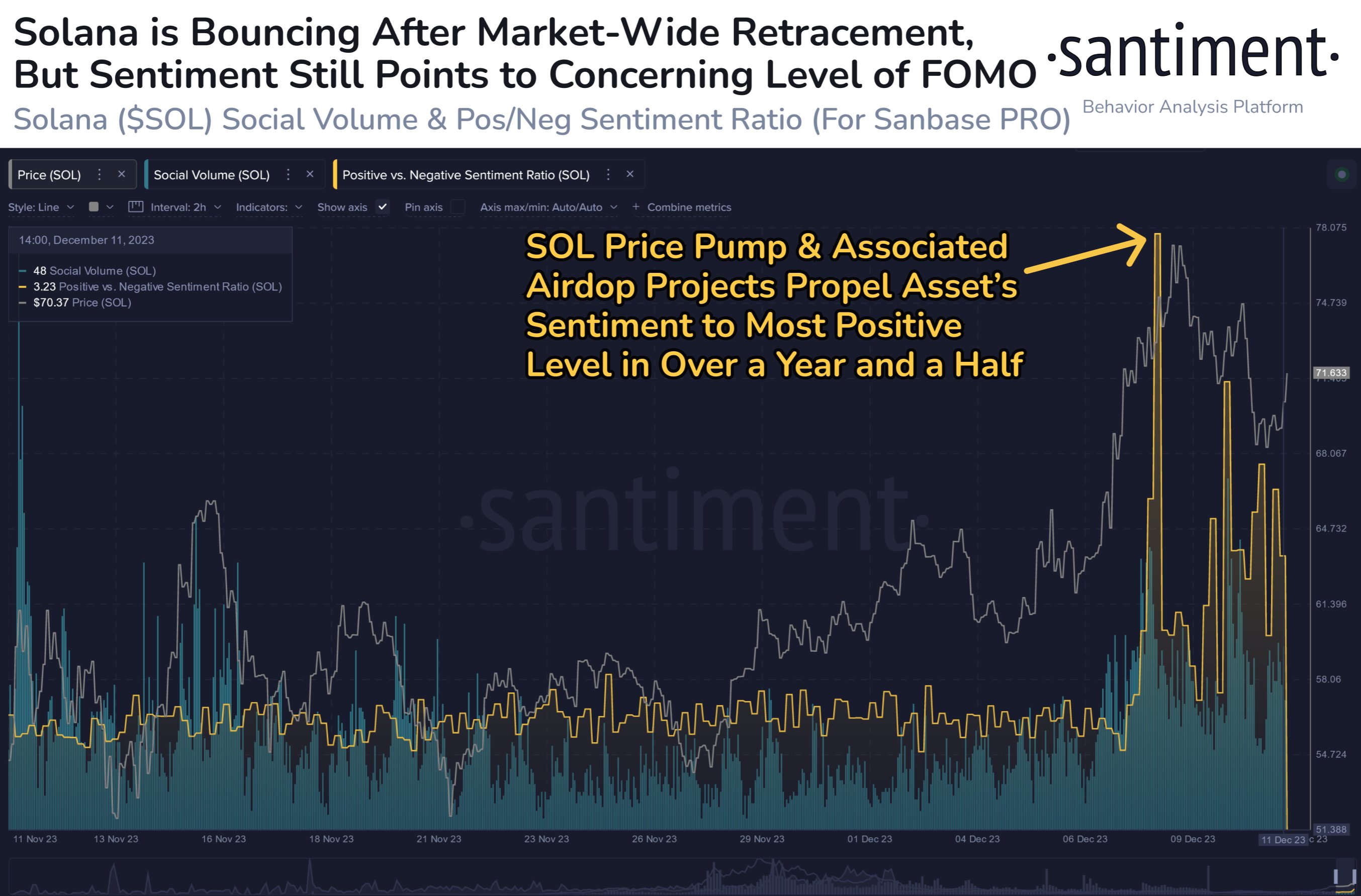

Santiment notes that altcoins have been recovering quickly from the weekend’s price drops, particularly Ethereum (ETH) challenger Solana (SOL). The firm does caution though that SOL’s positive social sentiment may need to cool down before the asset can make a serious run to the upside.

SOL is trading at $67.34 at time of writing. The sixth-ranked crypto asset by market cap is up nearly 11% in the past seven days.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Click Here to Read the Full Original Article at The Daily Hodl…