On Saturday, several centralized crypto trading platforms and payment processors stopped USDC auto conversions. However, USDC experienced a significant trading volume on decentralized exchange (dex) platforms such as Uniswap, Curve, and Pancakeswap. Uniswap alone recorded $10.13 billion in trades over the past day, with more than 55% of those swaps involving USDC against wrapped ether, and the stablecoin tether. During the last 24 hours, USDC emerged as the most dominant trading pair on dex platforms.

USDC Trades Below $0.975 Accounted for More Than $26 Billion on Saturday

Based on statistics, the stablecoin usd coin (USDC) recorded $26.73 billion in global trade volume during a 24-hour period. On Saturday, USDC depegged from the U.S. dollar, reaching a low of $0.877 per coin. As a result, crypto firms such as Binance, Coinbase, Crypto.com, and Bitpay paused USDC payments and auto conversions.

However, despite centralized exchanges halting USDC conversions, the stablecoin accounted for 29% of the $90.70 billion in 24-hour global crypto trades. According to statistics from coingecko.com, over the last day, $15.66 billion was settled on dex trading platforms, with $10.13 billion of that amount resulting from trades on Uniswap version three (v3).

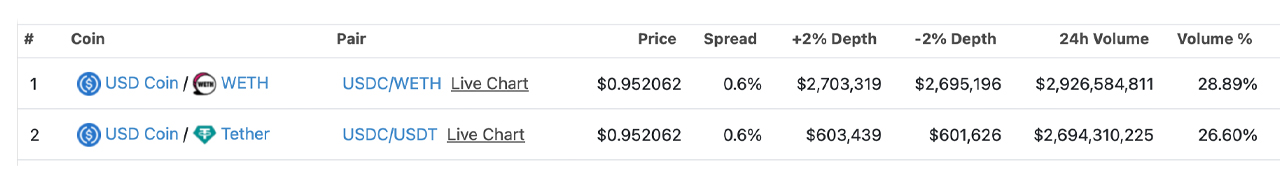

The two most dominant trading pairs on Uniswap were USDC/WETH and USDC/USDT, with USDC swaps with wrapped ether accounting for $2.92 billion, and USDC trades with tether equating to $2.69 billion. Together, USDC/WETH and USDC/USDT represented 55.48% of all trades on Uniswap v3 on Saturday.

USDC/DAI accounted for 5.8% of Uniswap v3’s trades, amounting to $587 million in volume. Additionally, USDC saw numerous other trades with various crypto assets listed on the dex platform. On Curve’s Ethereum-based dex, $179 million in USDC/DAI swaps occurred during the day. USDC was a prominent Curve pair with several other stablecoins like USDT, FRAX, GUSD, MIM, among others.

Curve 3pool share is the bellwether of crypto sentiment💥

During today’s USDC depeg, ppl panic sold USDC & DAI for USDT. USDT share in 3pool collapsed to 2%

Ironically, when Tether FUD happened during Terra crash & FTX collapse, USDT was the “infamous” & left 85% in 3pool🤔 pic.twitter.com/VNo3ykxiob

— Panda Jackson (@pandajackson42) March 11, 2023

Curve’s 3pool experienced a decrease in its share of USDT to 2% as traders sold USDC during the depegging incident. On Saturday, the…

Click Here to Read the Full Original Article at Bitcoin News…