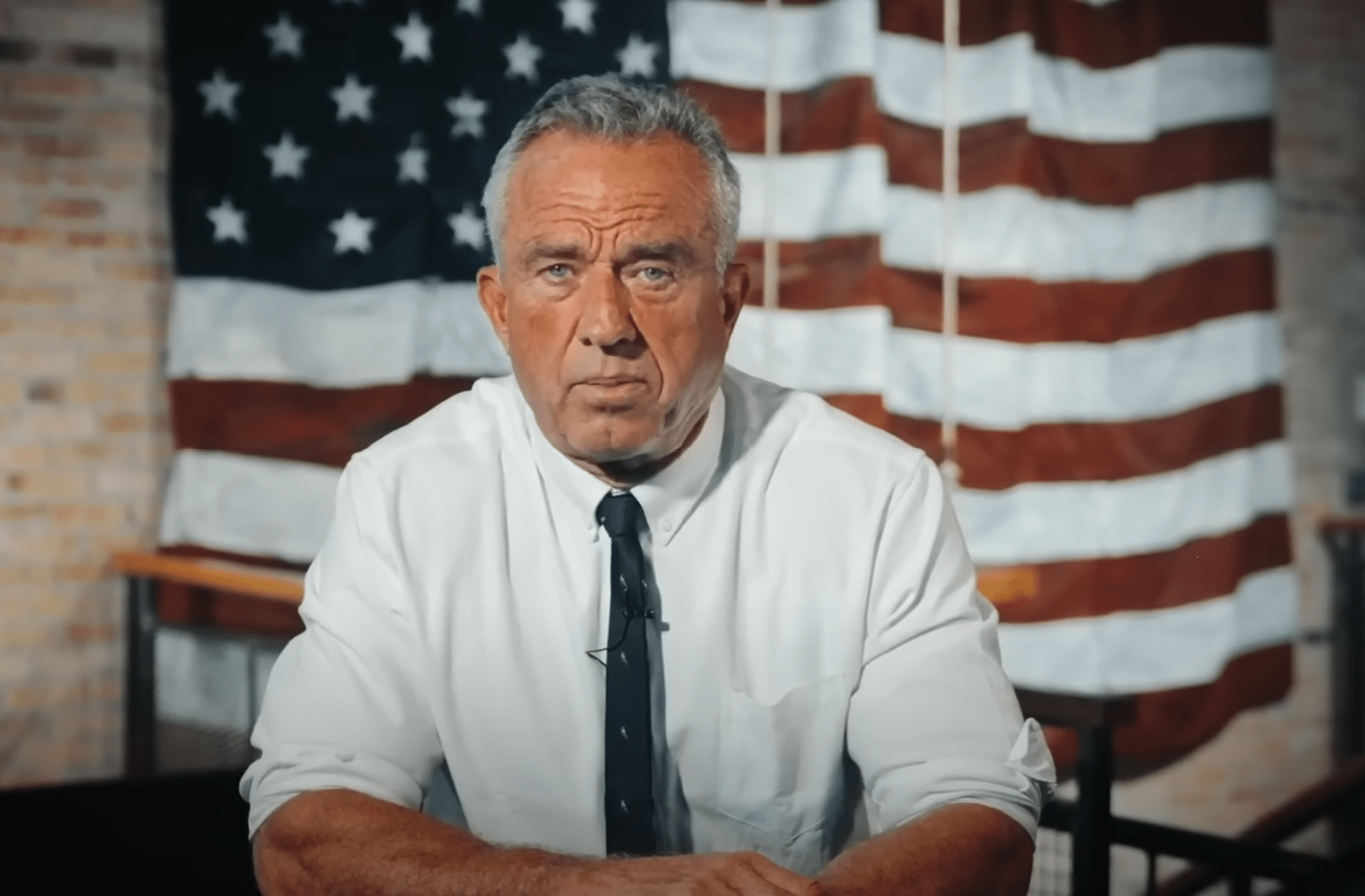

During the industry day of the annual Bitcoin conference in Nashville, Tennessee, Robert Kennedy Jr., an independent candidate for the US presidency, unveiled an ambitious financial policy plan that could transform the United States into the world’s largest holder of Bitcoin. The policy centers on the strategic acquisition of Bitcoin, valued at $619 billion, to match the current US gold reserves. This move, according to Kennedy Jr., is aimed at redefining monetary policy and enhancing fiscal discipline within the federal government.

Kennedy Jr. Vs. Donald Trump

During a roundtable discussion with Scott Melker and Caitlyn Long, CEO of Custodia Bank, Kennedy Jr. emphasized the philosophical alignment between his policies and the Bitcoin community’s ideals of personal freedom, property rights, and governmental integrity. “This is more than about increasing the size of your pile,” Kennedy Jr. said, underlining Bitcoin’s potential to enhance self-sovereignty and counteract what he describes as a “destructive war economy” driven by fiat currency.

“Bitcoin is not only an offramp to this inflationary highway which is the highway to hell, but it also is a way of restoring integrity to our government. It’s a way of restoring personal freedoms, it’s a way the middle class can isolate itself from inflation which is just a form of government theft,” the independent candidate stated.

Related Reading

Kennedy Jr. drew a contrast between his consistent advocacy for Bitcoin and the recent supportive gestures from former President Donald Trump, who will speak at the conference on Saturday. Kennedy pointed out Trump’s prior skepticism and his recent controversial decision to potentially appoint JPMorgan CEO Jamie Dimon as Treasury Secretary, which Kennedy criticized as contrary to the ethos of draining the political “swamp.”

He added, “President Trump also was connected with Steve Mnuchin who tried to end person-to-person Bitcoin transactions,” emphasizing the need for a cautious approach towards Trump’s newfound enthusiasm for Bitcoin.

Moreover, Kennedy Jr. detailed his plan to incrementally integrate Bitcoin into the US treasury. Starting with the issuance of treasury bills anchored to a basket of hard currencies—including platinum and gold—Kennedy proposed a phased approach that would begin with 1% of new treasury issuances backed by these hard assets, scaling up to 100% over time.

US Would Need To Buy $619…

Click Here to Read the Full Original Article at NewsBTC…