According to some United States lawmakers in the House Financial Services Committee, the lack of diversity in the financial technology space could be hurting many companies’ bottom lines.

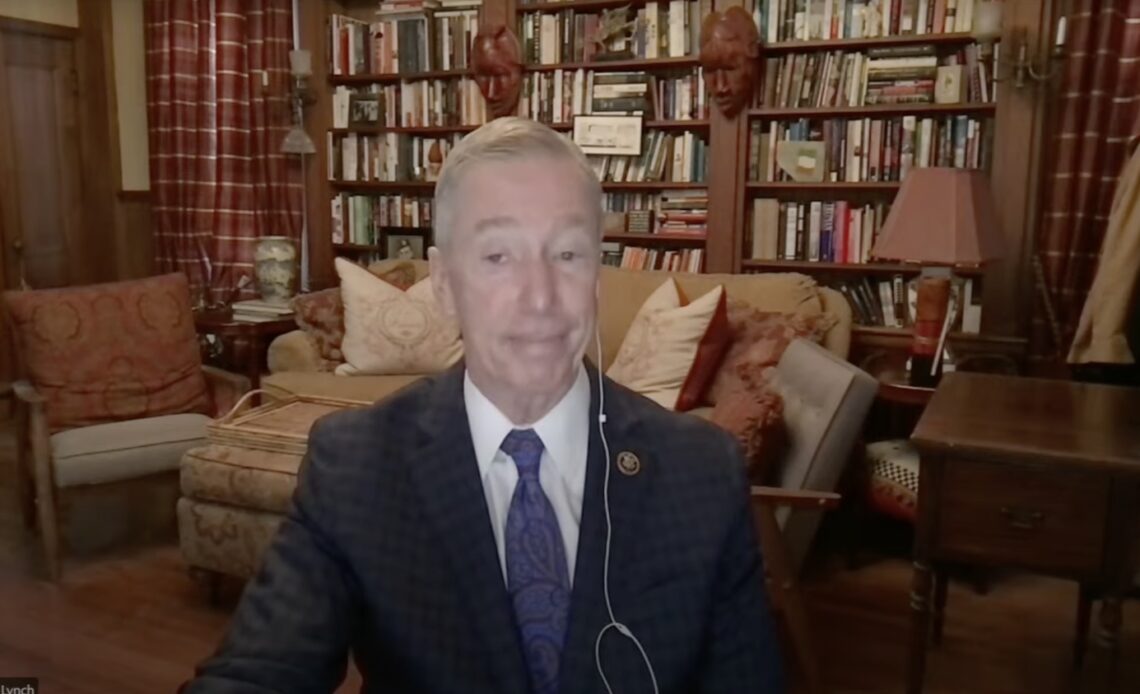

In a Thursday virtual hearing on “Combatting Tech Bro Culture,” U.S. lawmakers and witnesses discussed how women and people of color were underrepresented in leadership positions in the financial technology industry, including crypto firms. Massachusetts Representative Stephen Lynch cited data that only 2% of venture capital funding went to firms in which the founders were women, while only 1% went to those with black founders, and 1.8% for Latinx.

According to Lynch and some on the committee, this trend suggested an “old boys club” culture in companies including those involved with cryptocurrencies, in which many of those in leadership positions were white men. They claimed that many firms seemingly less deserving of funding were able to bring in money more easily due in part to relationships between leadership.

“While lack of diversity is a trend in almost every industry that venture capitalists invest in, it is particularly troubling in the fintech space,” said Lynch. “The largest fintechs, including digital banks, payment processors, and cryptocurrency providers, actually market their products to women and people of color. Yet when we look at the founders and leadership teams, they clearly do not reflect the communities that they claim to serve.”

“Multiple studies found that companies with diverse leadership, specifically with more than one gender and/or one race, are ethically representative, are more innovative and make more money,” said California Representative Maxine Waters. “I assume that venture capital firms are heavily profit driven, but it seems they’re ignoring clear data on how to boost those profits.”

Related: Crypto innovators of color restricted by the rules aimed to protect them

Lynch cited the recent crisis around crypto lending platform Celsius — whose leadership team consists mostly of men — as an example of VC money not necessarily going to where it’s best utilized:

“Venture capital firms continue to gamble on poor investments such as cryptocurrency companies like Celsius, which recently froze all customer deposits, while on the other hand women and founders of color with well thought out, substantive business plans remain in the waiting…

Click Here to Read the Full Original Article at Cointelegraph.com News…