Bitcoin (BTC) starts the last week of September with a retest of $26,000 as a stubborn range persists.

An unimpressive weekly close sets the tone for the culmination of what is a traditionally lackluster month for BTC price action.

Having shaken off a hectic week of macroeconomic events, Bitcoin has plenty more to weather before September is up. United States GDP figures for Q2 will come on Sep. 28, with Personal Consumption Expenditures (PCE) data following the day after.

The highlight, however, will likely come in the form of a speech from Jerome Powell, Chair of the Federal Reserve, a week after it opted to hold U.S. interest rates at current elevated levels.

Inflation remains a major talking point into Q4, and Bitcoin still lacks direction as week after week goes by without a clear upward or downward trend emerging.

Will this week be different? The countdown to the monthly close is on.

BTC price weekly chart prints “death cross”

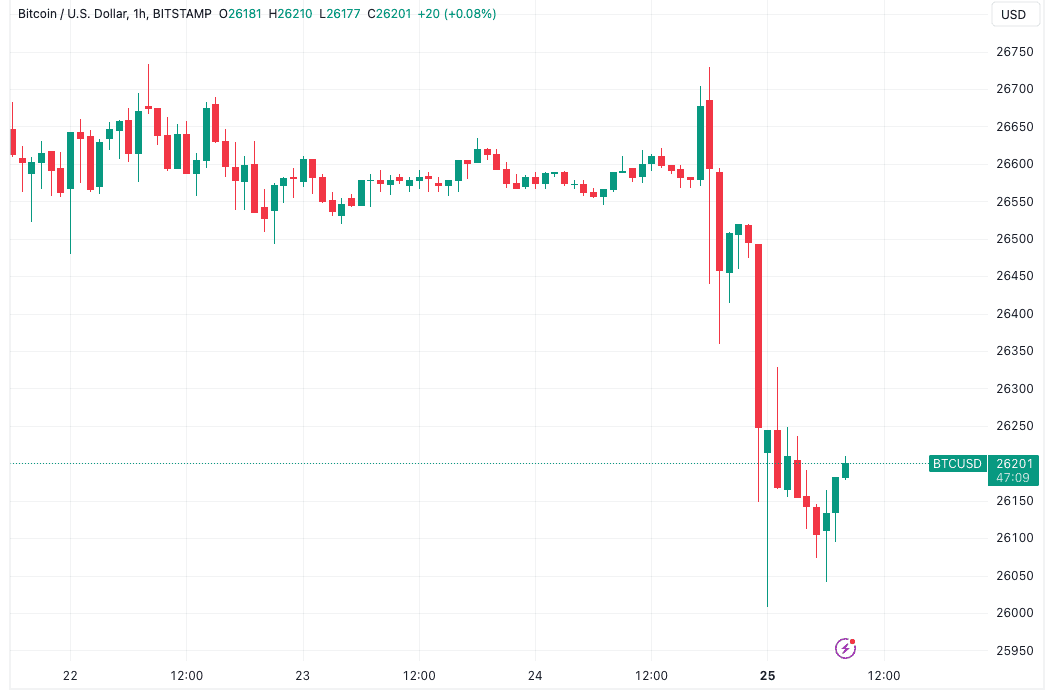

BTC price performance, while steady over the weekend, deteriorated after the Sep. 24 weekly close.

BTC/USD took a trip to $26,000, data from Cointelegraph Markets Pro and TradingView shows, with this level still managing to hold as support at the time of writing prior to the week’s first Wall Street open.

Eyeing the state of play on exchanges, commentators noted liquidations occurring for both long and short BTC positions.

Both sides almost liquidated.

Nice long squeeze. Bulls trapped. https://t.co/FxUGbwxx3v pic.twitter.com/us8Cxno5PZ

— IT Tech (@IT_Tech_PL) September 24, 2023

Bitcoin is still near two-week lows, bolstering arguments from already cautious analysts over what might come next.

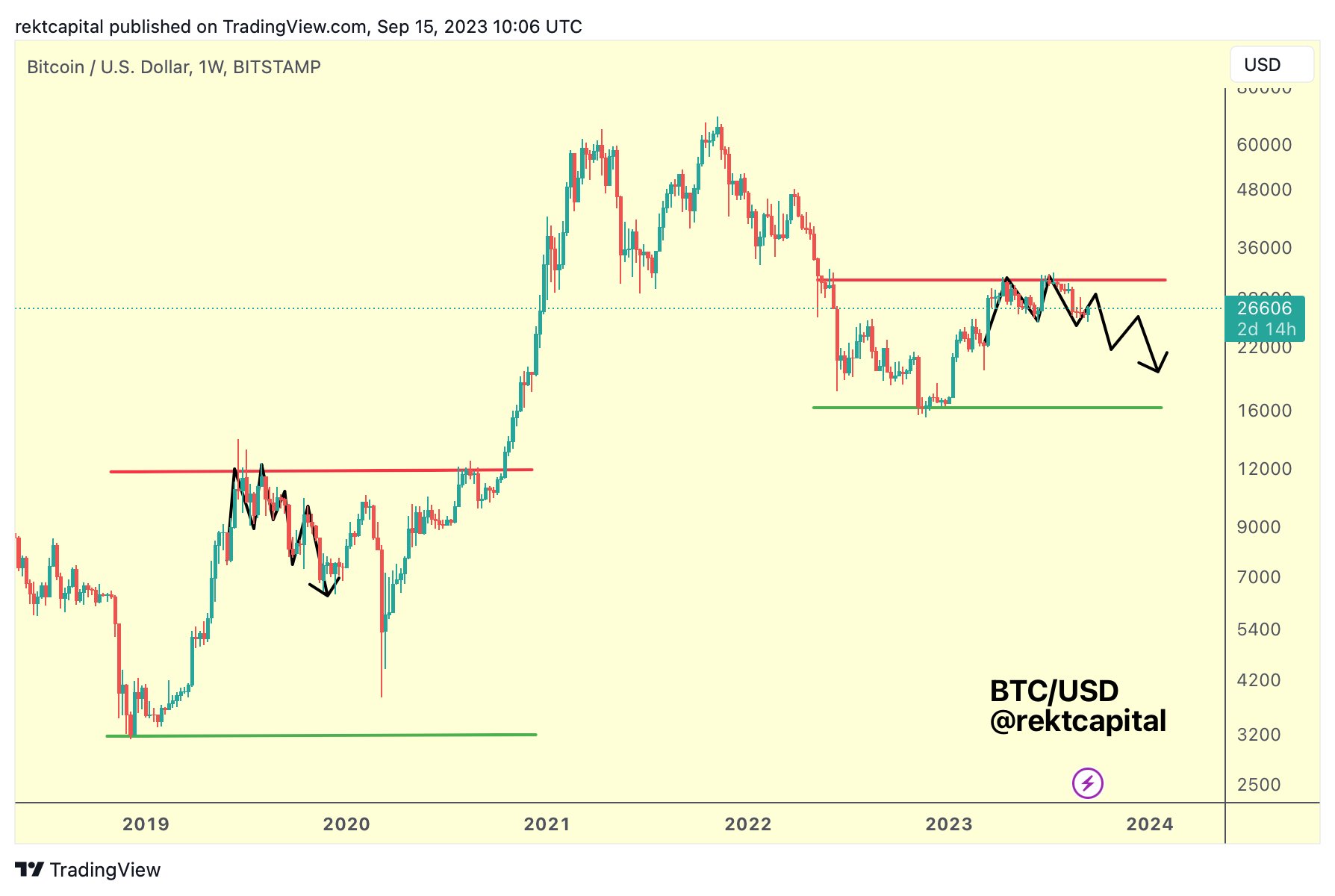

Popular trader and analyst Rekt Capital continued to track what he suggested could be a repeat of previous BTC price behavior. 2023, he argued at the weekend, might end up looking just like 2019 — its counterpart from last cycle.

“Bitcoin could follow the same bearish fractal from 2019 to drop lower in this Macro Range,” he suggested alongside a comparative chart.

In subsequent debate on X, Rekt Capital put the potential fractal downside target at near $20,000.

Keith Alan, co-founder of monitoring resource Material Indicators, meanwhile spied a so-called “death cross” on weekly timeframes.

Here, the falling 21-week simple moving average (SMA) has crossed under its rising 200-week counterpart — a phenomenon which highlights the comparative weakness…

Click Here to Read the Full Original Article at Cointelegraph.com News…