GFC vs. 2023

It seems contraction in the U.S. economy is starting to appear. However, a recession is not scheduled for the time being. Comparing previous eras and recessions might fit human psychology, but it will undoubtedly be different. But most likely, the Federal Reserve will continue to hike rates until something materially breaks.

We have had a banking crisis, which is fundamentally different from 2008. In 2008, we had mortgage defaults and saw a knock-on effect with house prices falling drastically. At the same time, banks had deep losses on loans on their balance sheets. SVB was fundamentally different as depositors panicked about severe unrealized losses on their treasury portfolio.

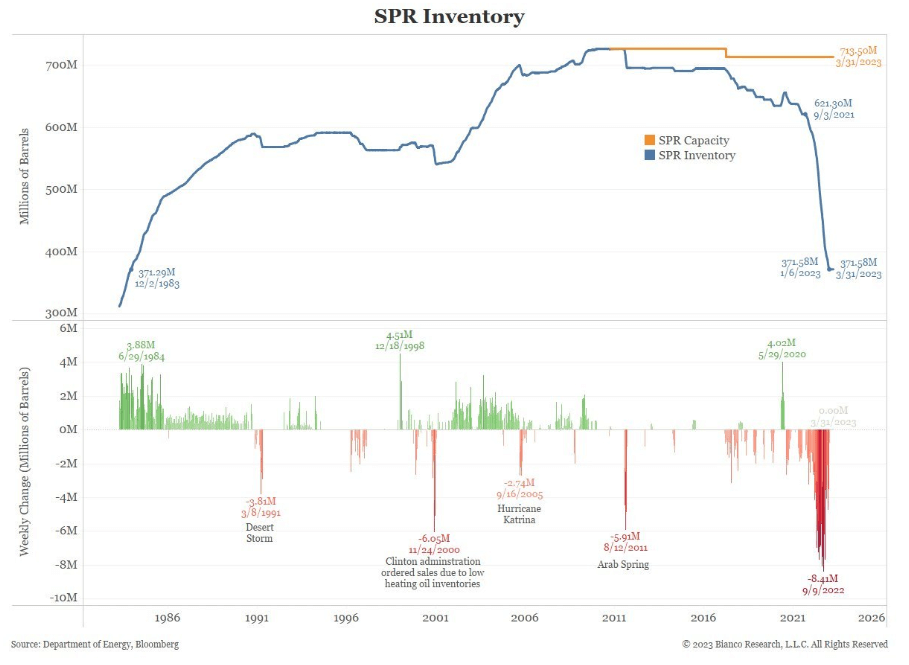

OPEC +

To start the week, we had OPEC + announcement of cutting over 1m barrels/day starting next month, while 2m barrels/day are being cut from October. CryptoSlate analyzed the repercussions of these cuts; not only is this pure signal of demand collapsing. It also left the Biden administration in trouble after drawing down on the Strategic Petroleum Reserve while failing to build on the reserves when prices were surpassed. Crude Oil WTI (NYM $/bbl) closed the week at $80/ barrel while it was as low as $67, with some analysts expecting triple digits.

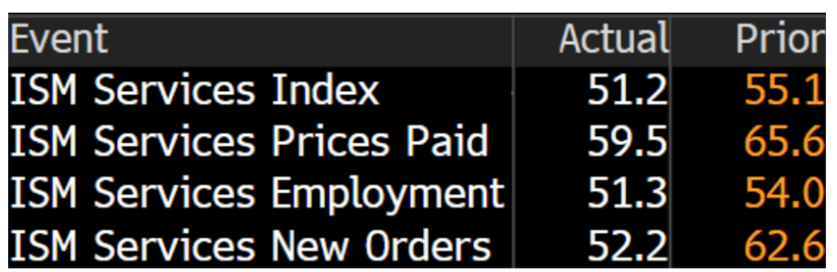

U.S. manufacturing slumps

The March ISM manufacturing survey continued its decline, staying within the contraction zone of 46.3, undershooting expectations. In addition, JOLTS data printed 9.93 million vs. the 10.5 million expected. This was the smallest print since April 2021. While every part of ISM Services PMI also continued to drop. New orders are down to 52.2 from 62.6.

Unemployment at record lows

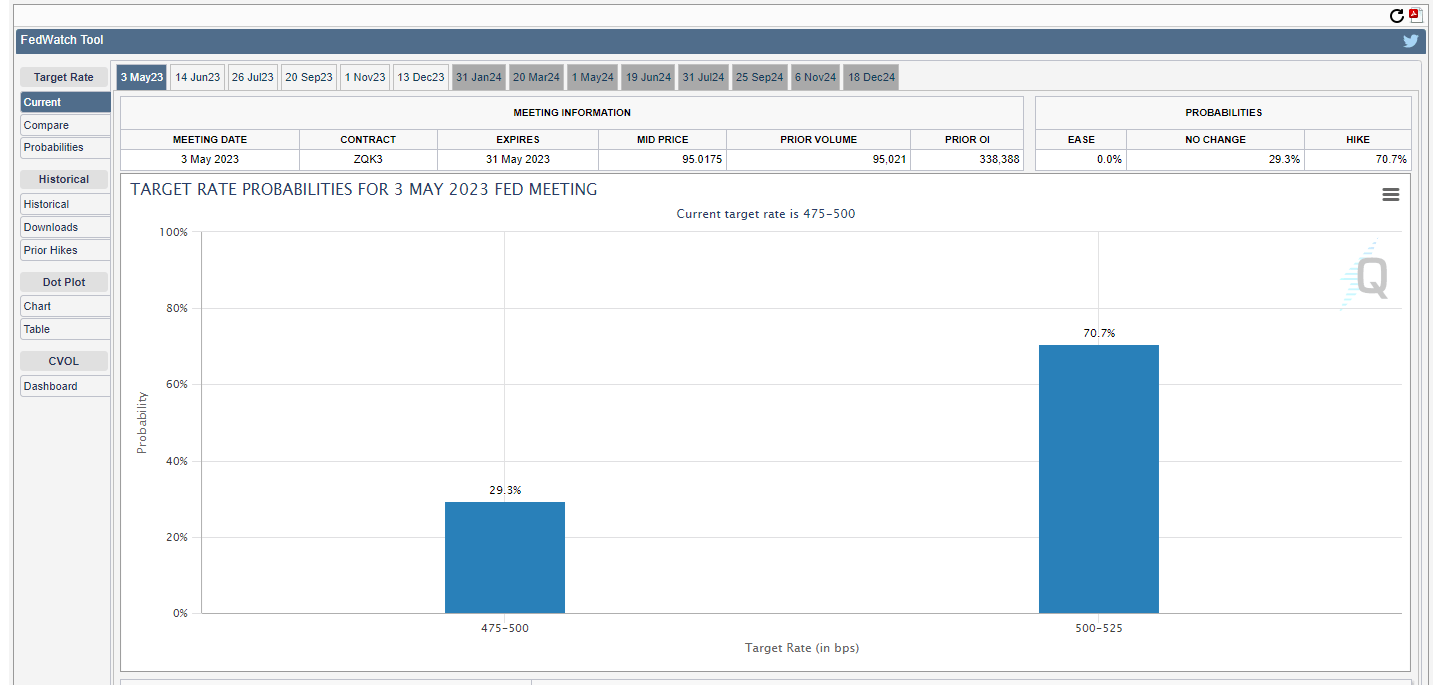

Staggeringly, unemployment dropped to 3.5% from 3.6%. At the same time, the U.S. Bureau of Labor Statistics employment report showed 236,000 nonfarm jobs added for March. Economists expected 239,000 jobs.

As a result, we now see a 69% chance of another .25 rate hike at the May FOMC. This would put the federal funds rate over 5%.

Fed balance sheet update

Thursday afternoon clock watch of the fed balance sheet is now becoming a main event. The fed balance sheet fell by $74 billion this week, roughly reduced by $100 billion in the past two weeks. The fed balance sheet is now shrinking faster than before the SVB collapse.

This shows fewer banks and less distressed assets are needed to be supported by the Fed. In addition, BTFP loans rose to $79…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…