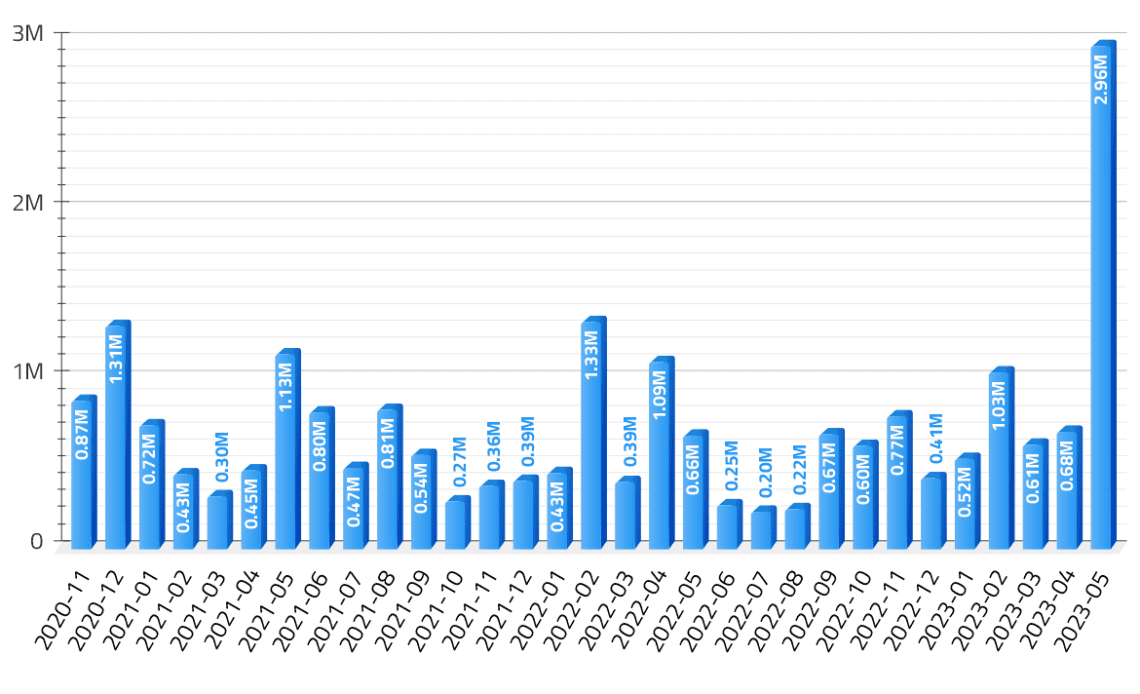

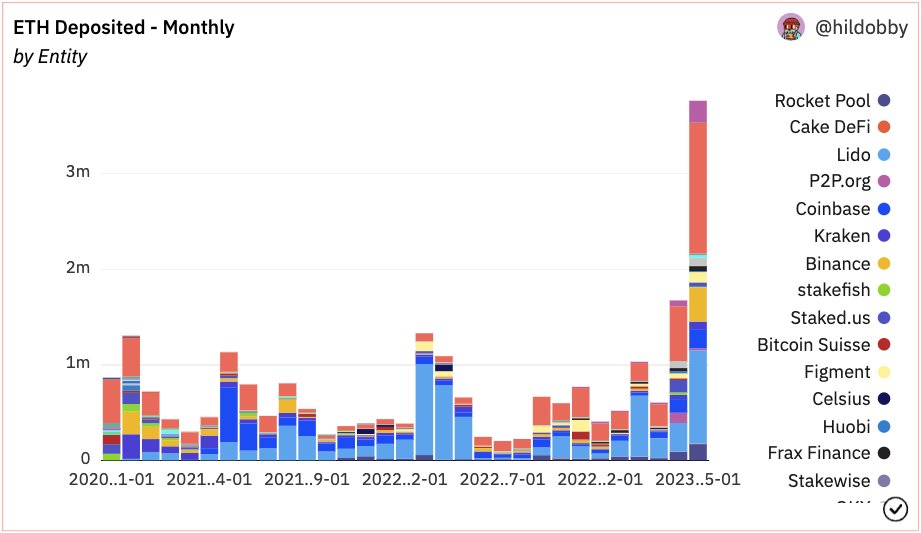

The number of staked Ether (ETH) in May reached a new all-time high of 2.96 million ETH, or approximately 2.46% of the total ETH supply.

The amount of staked ETH in May does not include withdrawals and is more than twice as big as the second-highest staked amount of ETH registered in February 2022.

The significant surge in staked ETH comes within a month of the much anticipated Shapella upgrade on April 12, allowing validators to withdraw their staked ETH after two years. Many at the time believed the heavy unstaking of ETH could prove to be a bearish event for the Ethereum network. However, less than 1% of all staked ETH was estimated to be sold after Shapella.

In the first week of the unstaking event, nearly a million ETH were withdrawn by validators from the Beacon chain. However, with the start of May, the number of staked ETH already surpassed the number of withdrawals. At present, almost 18% of all ETH staking was done in the month of May.

The record surge in Ethereum staking in the month of May was attributed to a number of factors, the most prominent being the United States debt ceiling saga, deterring confidence in the U.S. dollar, the downfall of banks and the high APR offered on the ETH staking. According to research analyst Brian McColl,

“The US Debt ceiling saga and the earlier events with banks going bankrupt surely affected Ether’s popularity and more and more users prefer to stake their money in ETH rather than keep them in the bank.”

The debt ceiling or debt limit in the U.S. is a statutory cap on the total amount of national debt that the U.S. Treasury may incur, limiting the amount of money that the federal government may borrow to pay off its existing debt.

Related: Bitcoin hodlers exited ‘capitulation’ above $20K, new metric hints

As Cointelegraph reported earlier, President Joe Biden and House majority leader…

Click Here to Read the Full Original Article at Cointelegraph.com News…