Bloomberg Intelligence’s senior macro strategist Mike McGlone says that two major catalysts could send Ethereum (ETH) much higher.

In a tweet to his 58,000 followers, McGlone says that rising demand for ETH and a declining supply are bullish signs for the smart contract platform.

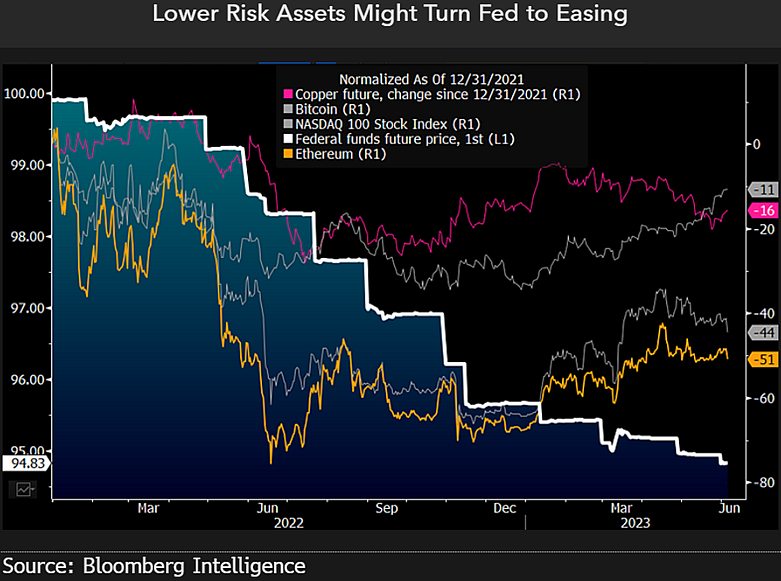

However, the macro strategist says headwinds from continued Federal Reserve rate hikes and weakening technicals for financial markets may limit ETH price action to the upside.

“Solid Ethereum Supply/Demand vs. Fed, Weak Technicals: BI Crypto. Demand and adoption appear to be low and rising vs. diminishing supply, which is positive for the Ethereum (ETH) price, but an unfavorable Fed and technical backdrop at the start of June may keep a lid on prices.”

McGlone’s chart looks at economic indicators such as copper futures and federal funds futures, which indicate an economic slowdown may be coming.

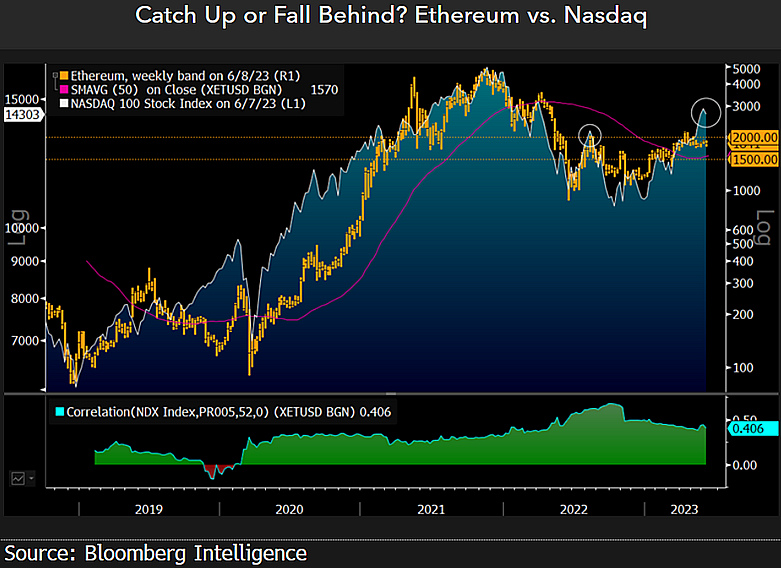

McGlone also looks at the performance of Ethereum against the Nasdaq 100 Stock Index and notes that ETH is struggling to cross the $2,000 level despite the Nasdaq’s recent surge.

“Divergent Weakness and Ethereum’s $2,000 Ceiling – The inability of Ethereum to stay above $2,000 despite a 52-week high in the Nasdaq 100 Stock Index in 2Q may portend a resistance ceiling for the crypto. The token may depend on the stock index to lift all boats.”

Ethereum is trading for $1,845 at time of writing, up 0.7% during the last 24 hours.

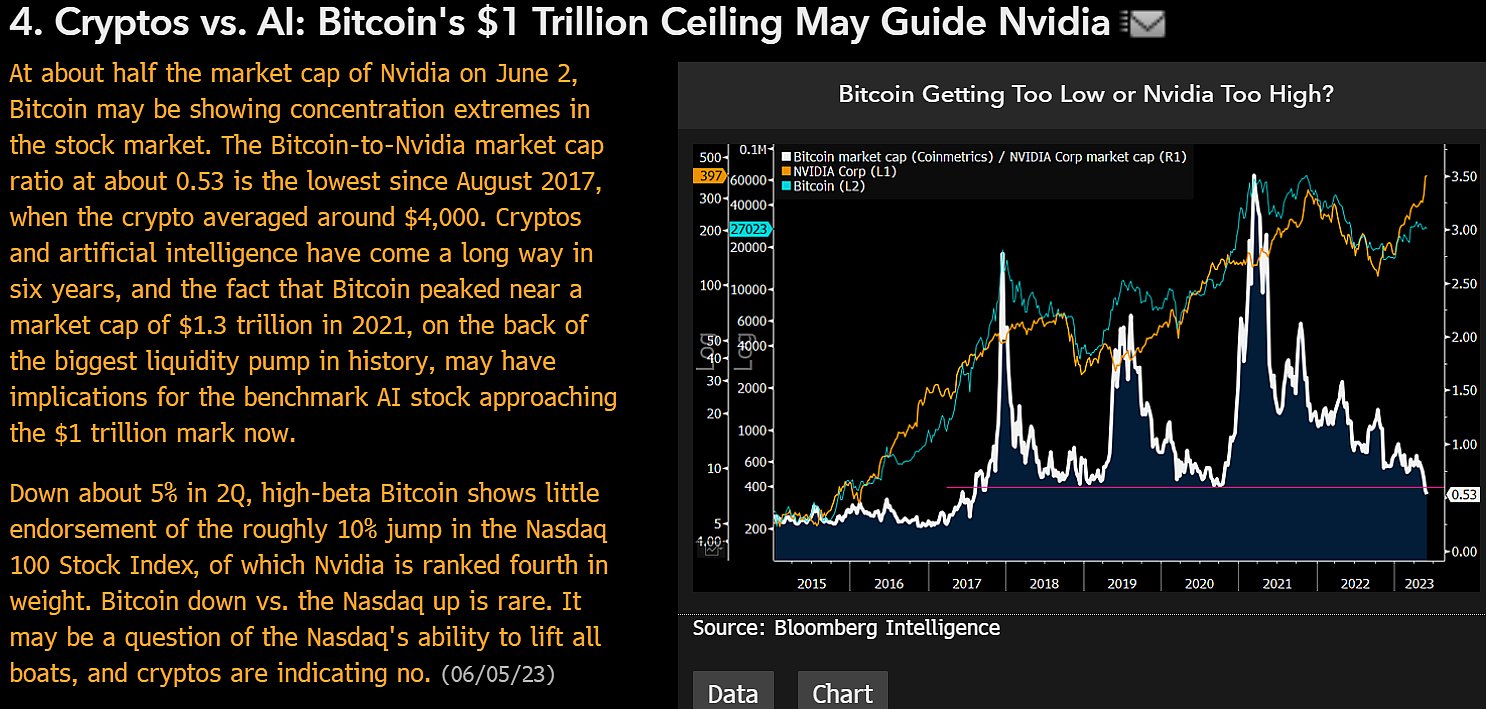

McGlone notes that Bitcoin (BTC) is also down against the Nasdaq, which has taken off in the near term largely due to the potential of artificial intelligence (AI).

“Cryptos vs. AI: Bitcoin’s $1 Trillion Ceiling May Guide Nvidia – Down about 5% in 2Q, high-beta Bitcoin shows little endorsement of the roughly 10% jump in the Nasdaq 100 Stock Index, of which Nvidia is ranked fourth in weight. Bitcoin down vs. the Nasdaq up is rare.”

Bitcoin is worth…

Click Here to Read the Full Original Article at Ethereum News – The Daily Hodl…