On June 21, Bitcoin (BTC) surged past the $30,000 mark for the first time in two months, a significant milestone for the volatile cryptocurrency.

This rally contributed to an uptick in derivatives trading, increased spot trading, and increased coins withdrawn from exchanges, as identified in a recentCryptoSlate Alpha insight.

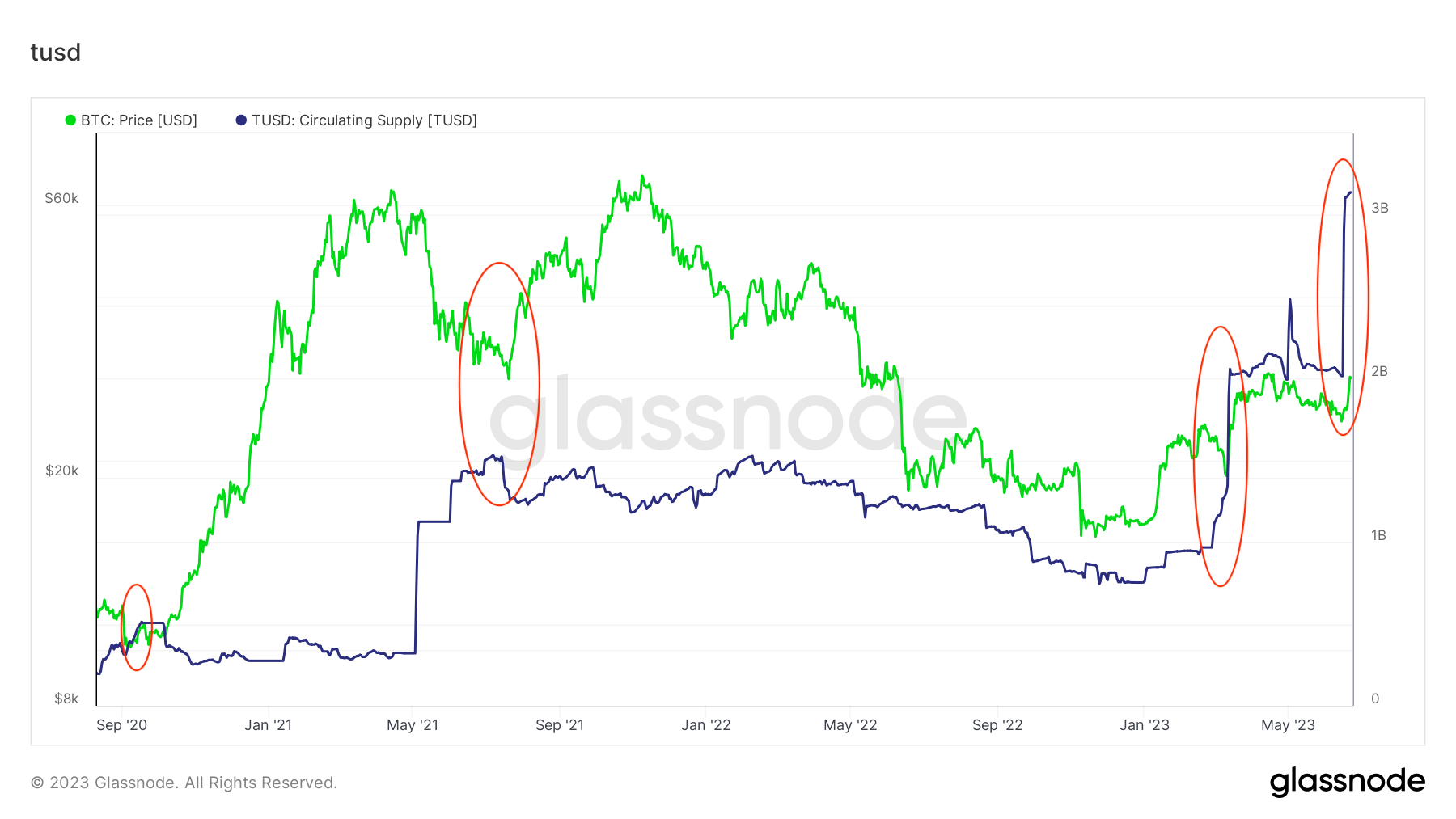

In the week leading up to Bitcoin’s rally, the circulating supply of the TrueUSD stablecoin saw a significant increase. Data shows that the stablecoin’s supply rose from just over $2 billion on June 14 to $3.13 billion on June 21, marking a substantial 56.5% increase.

This surge in the stablecoin’s supply is not an isolated incident.

Historical on-chain data reveals a pattern of high spikes in TUSD’s circulating supply correlating with similar spikes in Bitcoin’s price. This correlation suggests that the increased availability of the stablecoin might have played a role in facilitating the recent Bitcoin rally.

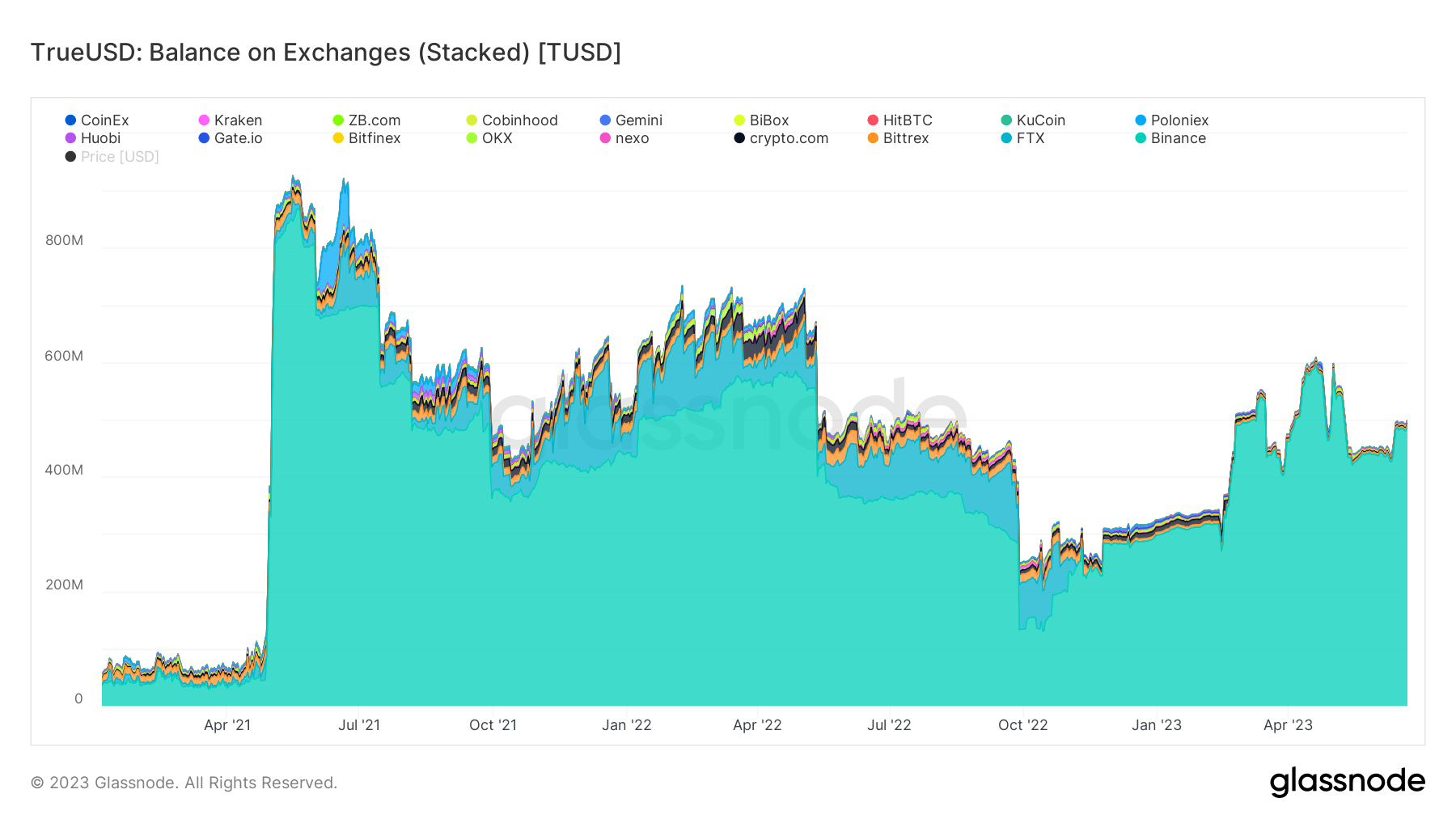

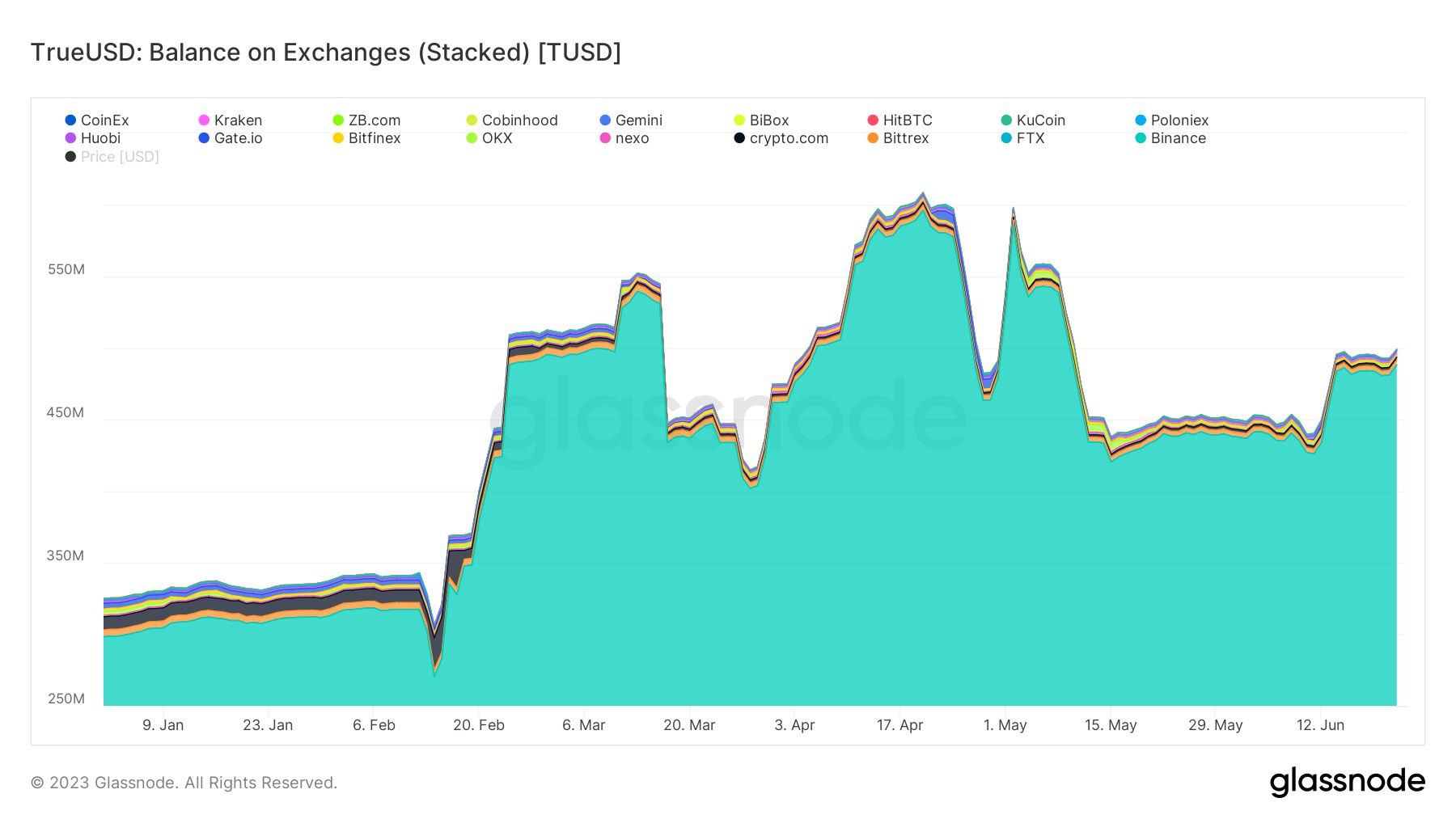

Binance, one of the world’s largest cryptocurrency exchanges, has historically accounted for most of TUSD’s ERC-20 supply.

Since the beginning of the year, the supply of TUSD on Binance has increased by 63.7%. In the ten days leading up to June 21, the supply grew by 14.5%.

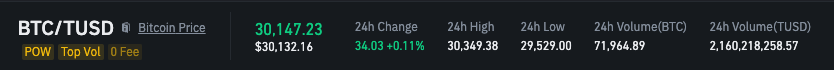

Binance introduced zero maker fees on TUSD spot and margin trading pairs on June 21, the same day Bitcoin rallied past $30,000. This move likely contributed to an increase in BTC/TUSD trading volume. According to data from Binance, the daily trading volume between the pair was just under 72,000 BTC and 2.1 billion TUSD on June 23.

While it’s important to note that correlation does not imply causation, the timing of the TUSD supply spike and Bitcoin’s rally is intriguing. The role of stablecoins in the crypto market is complex and multifaceted, and their influence on the price movements of cryptocurrencies like Bitcoin has been a favorite topic among analysts.

The post TUSD supply spiked ahead of Bitcoin’s $30K rally appeared first on Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…