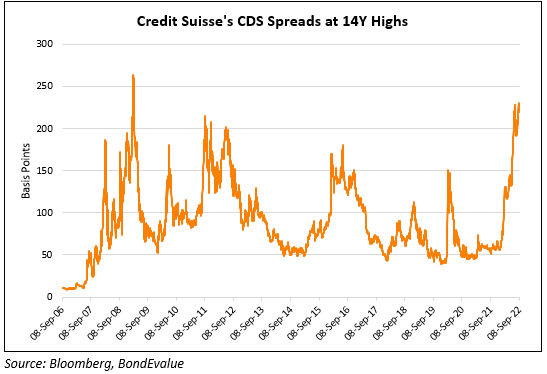

It’s been more than a decade since the financial crisis in 2007-2008 when Lehman Brothers, the fourth largest investment bank in the U.S., collapsed and filed bankruptcy. Close to 14 years later, Credit Suisse and Deutsche Bank, two of the world’s largest banks, are suffering from distressed valuations and the banks’ credit default insurance levels are approaching degrees not seen since 2008.

Credit Suisse and Deutsche Bank Valuations Have Dive-Bombed — Investors Discuss the Systemic Risk to the Global Economy

During the first week of October, the world economy continues to look bleak as energy and gas prices have reached record highs, inflation in many countries is the highest in 40 years, supply chains are fractured, equity markets have shed significant value, and the tensions between the West and Russia has elevated.

Amid this nasty economy, two of the largest investment banks are floundering from distressed valuations. Market data shows that Credit Suisse Group AG (NYSE: CS) and Deutsche Bank AG (NYSE: DB) are trading at extremely low values not seen since the 2008 financial crisis.

At the end of August, Deutsche Bank analyzed the issues tethered to Credit Suisse, and the bank’s analysts noted that there was a $4.1 billion gap that needs to be filled in order to combat the financial institution’s financial well-being. Furthermore, Credit Suisse’s credit default insurance (CDS) levels resemble the same CDS levels Lehman Brothers had just before the bank’s bankruptcy.

Credit Suisse CEO Ulrich Koerner recently explained that his company is facing a “critical moment” and he stressed that the Swiss-based financial institution has a “strong capital base and liquidity position.”

Large Investor Says Credit Suisse CDS Is Trading Like a ‘Lehman Moment,’ Wallstformainst CEO Says ‘Anyone Who Fully Trusts Credit Suisse’s accounting Also Believes in Unicorns and the Tooth Fairy’

Not everyone agrees with Koerner as a report from investing.com details that a “large investor that deals with Credit Suisse says the investment bank is a disaster, [and] CDS is trading like a ‘Lehman moment’ [is] about to hit.” The managing partner at Compcircle Gurmeet Chadha, however, doesnt think a major market anomaly will reveal itself.

“Since 2008, once a year Credit Suisse [and] once in [two] years Deutsche bank is about to default,” Chadha tweeted. “In Every correction – this speculation starts coming. In my little…

Click Here to Read the Full Original Article at Bitcoin News…