CryptoQuant chief executive Ki Young Ju thinks “something is happening behind the scenes” as permanent holder addresses gobble up Bitcoin (BTC).

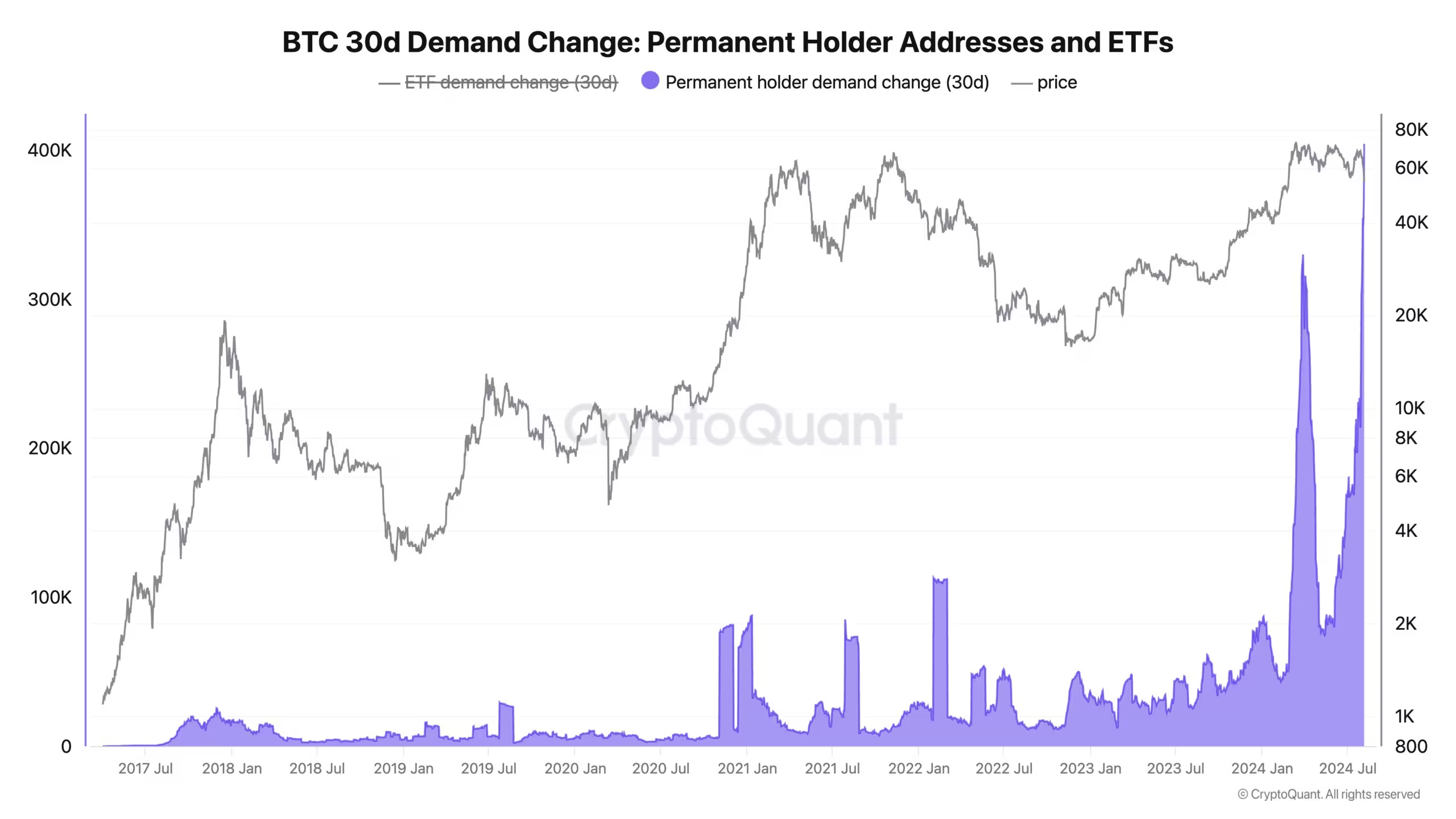

Young Ju tells his 360,800 followers on the social media platform X that 404,448 Bitcoin have moved to permanent holder addresses over the past 30 days, a clear sign of accumulation.

“Within a year, some entities — whether they’re TradFi (traditional finance) institutions, companies, governments, or others — will announce that they’ve acquired Bitcoin in Q3 2024.

And retail investors will regret not buying it because they were worried about the German government selling, Mt. Gox, or whatever macroeconomic shit was going on.”

The analytics firm CEO also notes that several on-chain factors look bullish for BTC.

“• Hashrate Recovery: Miner capitulation is nearly over, with hashrate nearing ATH (all-time high). U.S. mining costs are ~$43,000 per BTC, so hashrate likely stable unless prices dip below this.

• Whale Accumulation: Significant BTC inflows into custody wallets. Permanent Holder addresses increased by 404,000 BTC, including 40,000 BTC in U.S. spot ETFs (exchange-traded funds) over the last 30 days. New whales are accumulating.

• Retail Absence: Retail investors are mostly absent, similar to mid-2020.

• Reduced Old Whale Activity: Old whales (3+ years) sold their holdings to new whales between March and June. There is no significant selling pressure from old whales at this time.”

However, Young Ju does note that macroeconomic risks could lead to Bitcoin sell-offs.

“There were large crypto deposits by Jump Trading recently, and Binance hit YTD high in daily deposits.”

The CryptoQuant CEO also says some on-chain indicators have flipped bearish and could make market recovery challenging if they stay that way for more than two weeks.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The…

Click Here to Read the Full Original Article at Bitcoin News – The Daily Hodl…