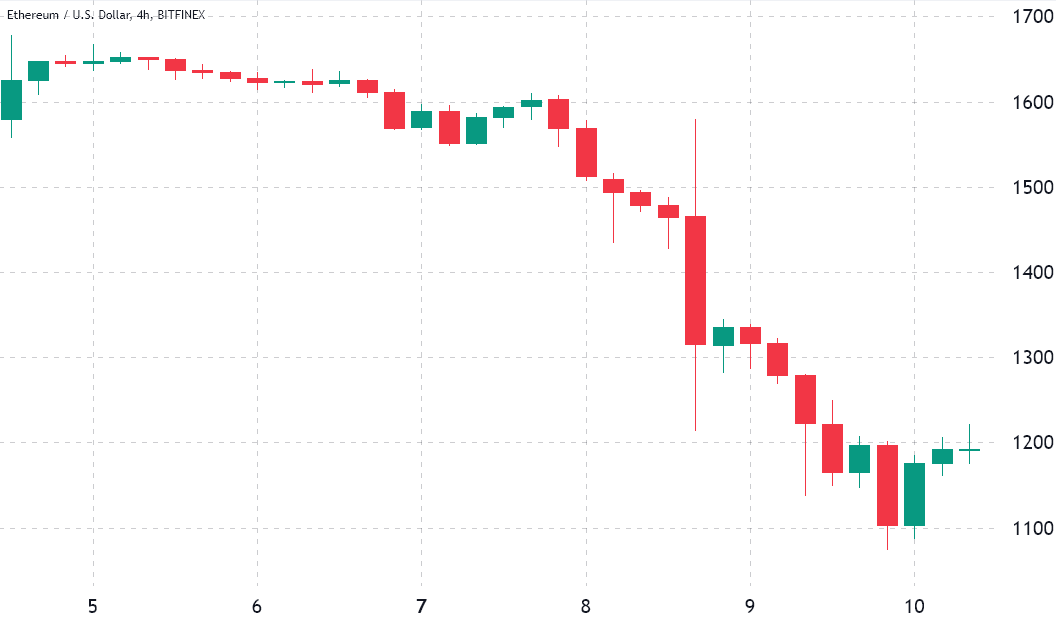

Ether (ETH) price shed roughly 33% between Nov. 7 and Nov. 9 after an impressive $260 million in future contracts longs (buyers) were liquidated. Traders using leverage were surprised as the price swing caused the largest impact since Aug. 18 at derivatives exchanges.

The $1,070 price level traded on Nov. 9 was the lowest since July 14, marking a 44% correction in three months. This adverse price move was attributed to the FTX exchange’s insolvency on Nov. 8 after clients’ withdrawals were halted.

It is worth highlighting that a 10.3% pump in 1 hour happened on Nov. 8, immediately preceding the sharp correction. The price action mimicked Bitcoin’s (BTC) movements, as the leading cryptocurrency faced a quick jump to $20,700 but later dropped toward $17,000 in a 3-hour window.

The previously vice-leader in futures open interest shared a disguised and toxic relationship with Alameda Research, a hedge fund and trading firm also controlled by Sam Bankman-Fried.

Multiple questions arise from FTX and Alameda Research’s insolvency, directed to regulation and contagion. For example, the United States Commodity Futures Trading Commission (CFTC) commissioner Kristin Johnson said on Nov. 9 that the recent case demonstrates that the sector needs more oversight. Moreover, Paolo Ardoino, chief technology officer of the Tether (USDT) stablecoin, tried to extinguish rumors of exposure to FTX and Alameda Research by posting on Twitter.

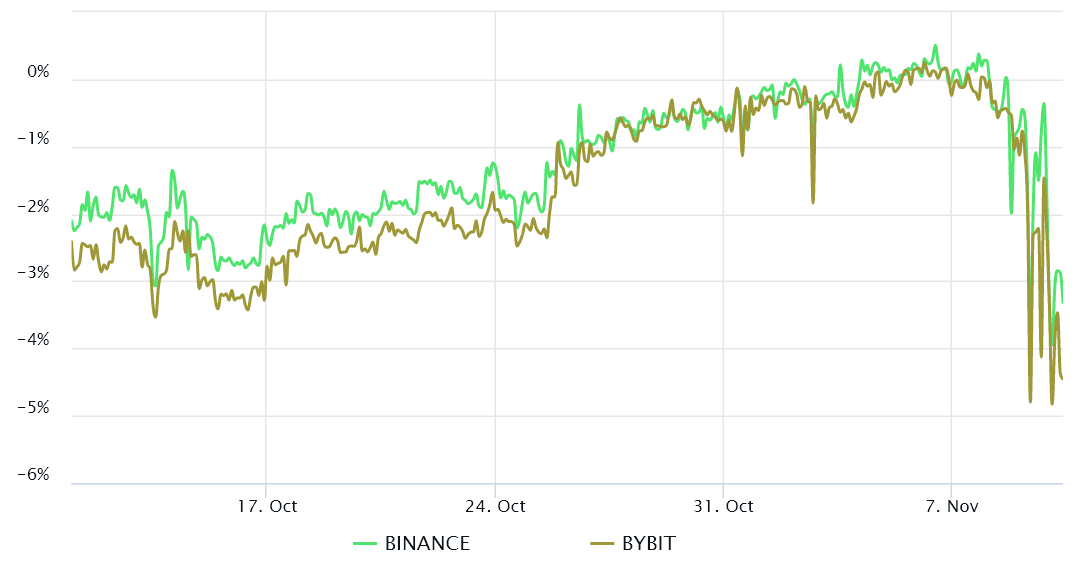

Let’s take a look at crypto derivatives data to understand whether investors remain risk-averse to Ether.

Futures markets have entered backwardation

Retail traders usually avoid quarterly futures due to their price difference from spot markets. Still, they are professional traders’ preferred instruments because they prevent the fluctuation of funding rates that often occurs in a perpetual futures contract.

The indicator should trade…

Click Here to Read the Full Original Article at Cointelegraph.com News…