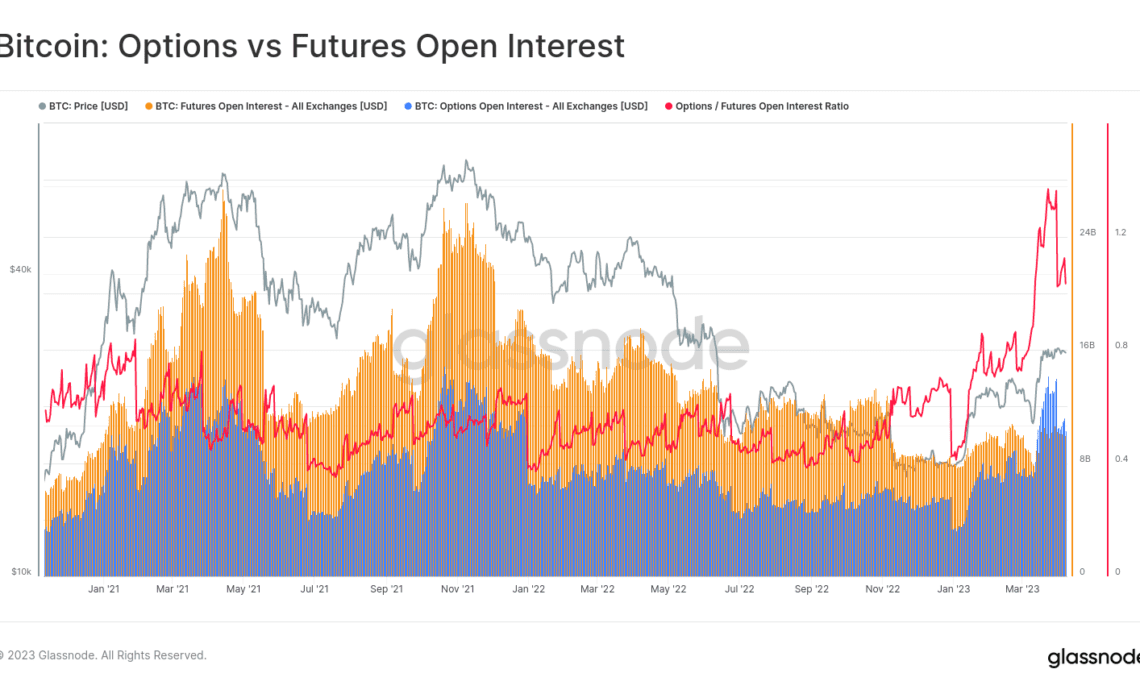

Bitcoin bulls are starting to bet big on higher BTC prices as open interest for options skyrockets, according to analytics firm Glassnode.

According to Glassnode, Bitcoin options open interest (OI) has cracked the $10.3 billion mark, and is now higher than futures OI for the first time in history

Options OI reflects the total dollar value of all options contracts that have not been settled. In this case, Glassnode says the soaring OI stems from traders buying up large amounts of call options in Bitcoin, which give them the right to buy BTC at a certain price regardless of the actual spot price.

“For the first time, the amount of Open Interest in Bitcoin Options contracts ($10.3 billion) has surpassed that held in Futures contracts ($10.0 billion).

Futures OI has been relatively flat in 2023.

This results from significant call option buys, as investors start to speculate on higher BTC prices.”

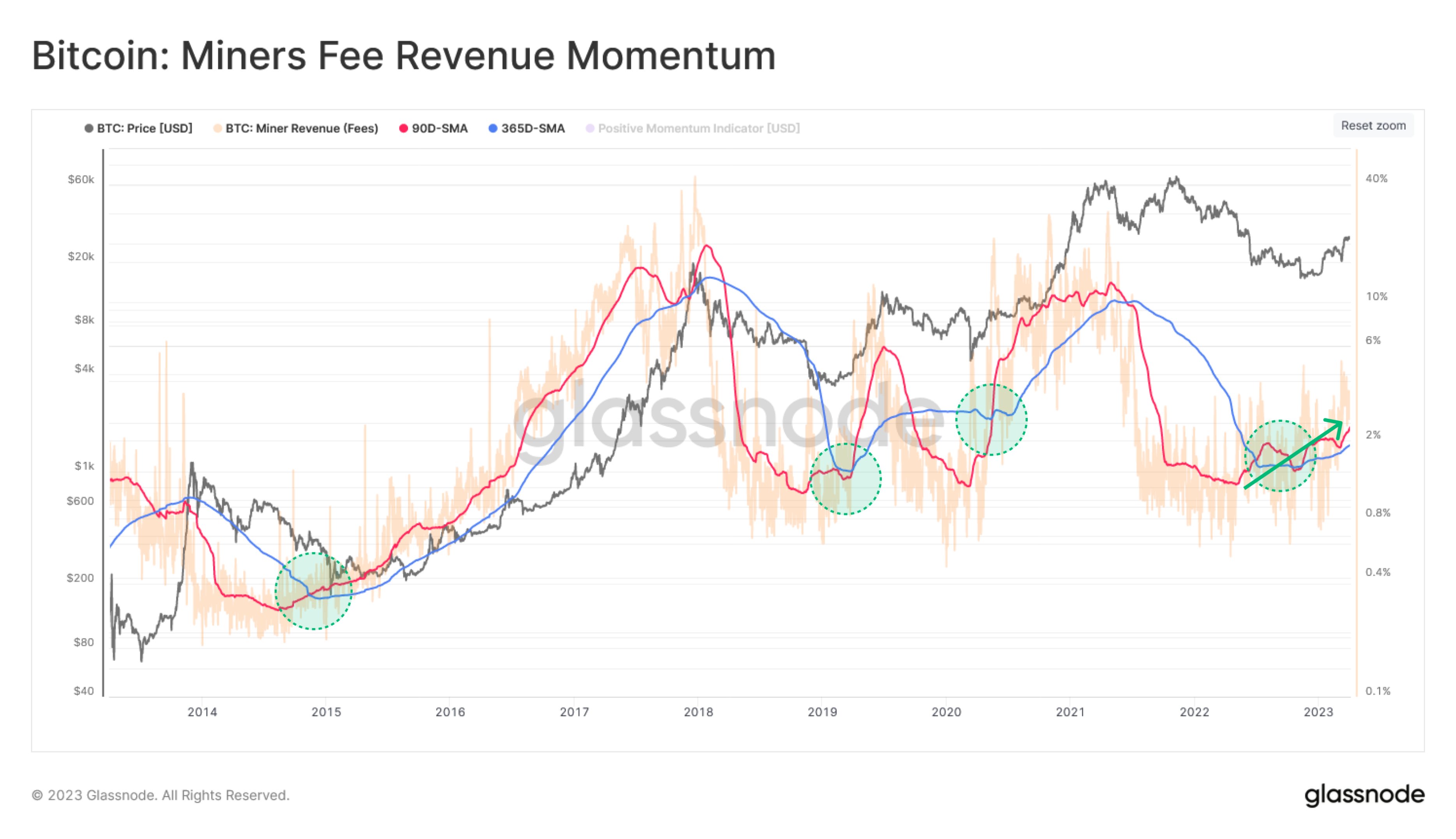

Glassnode recently reported on Bitcoin miners’ fee revenue, which gauges activity on the Bitcoin blockchain based on the amount of fees that miners are collecting. The metric is currently flashing signs that demand is growing for Bitcoin, according to the firm.

“Currently, the 90-day [simple moving average] for fees is outpacing its yearly average, suggesting new demand is entering the market.”

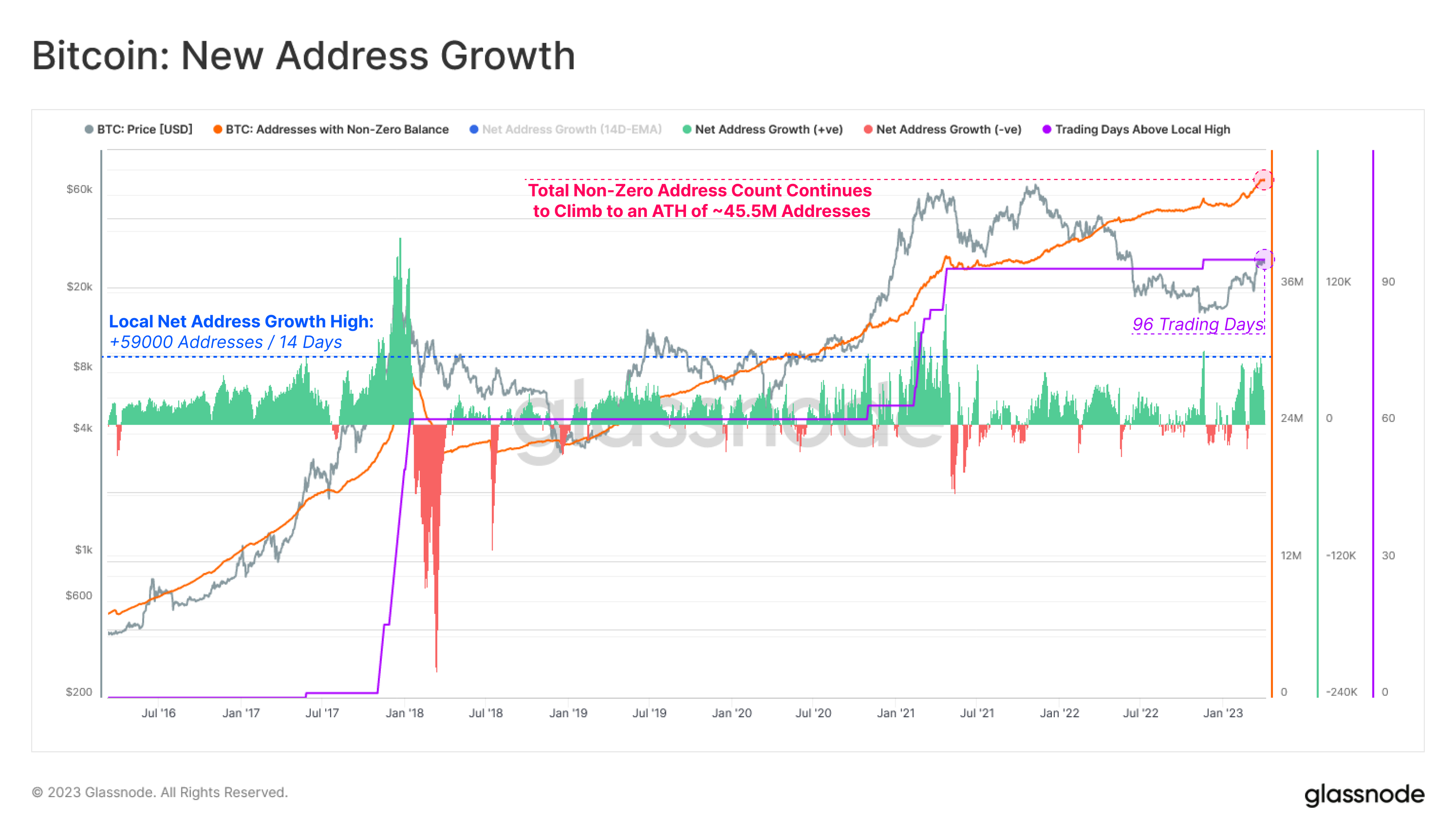

Glassnode also noted that the number of non-zero Bitcoin addresses has jumped to an all-time high of about 45.5 million.

“This suggests the degree of on-chain activity is currently improving.”

At time of writing, Bitcoin is trading for $28,294.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image:…

Click Here to Read the Full Original Article at Bitcoin News – The Daily Hodl…