A trader who rode the crypto surge at the start of the year says that he’s staying away from Litecoin (LTC) even though the peer-to-peer payments network is just a couple of weeks away from its next halving event.

Pseudonymous analyst DonAlt tells his 496,000 Twitter followers that based on historical price action, Litecoin tends to witness deep corrective moves after the blockchain slashes miners’ rewards in half.

With LTC’s third halving set for August 2nd, DonAlt says the event will likely not push Litecoin to fresh 2023 highs.

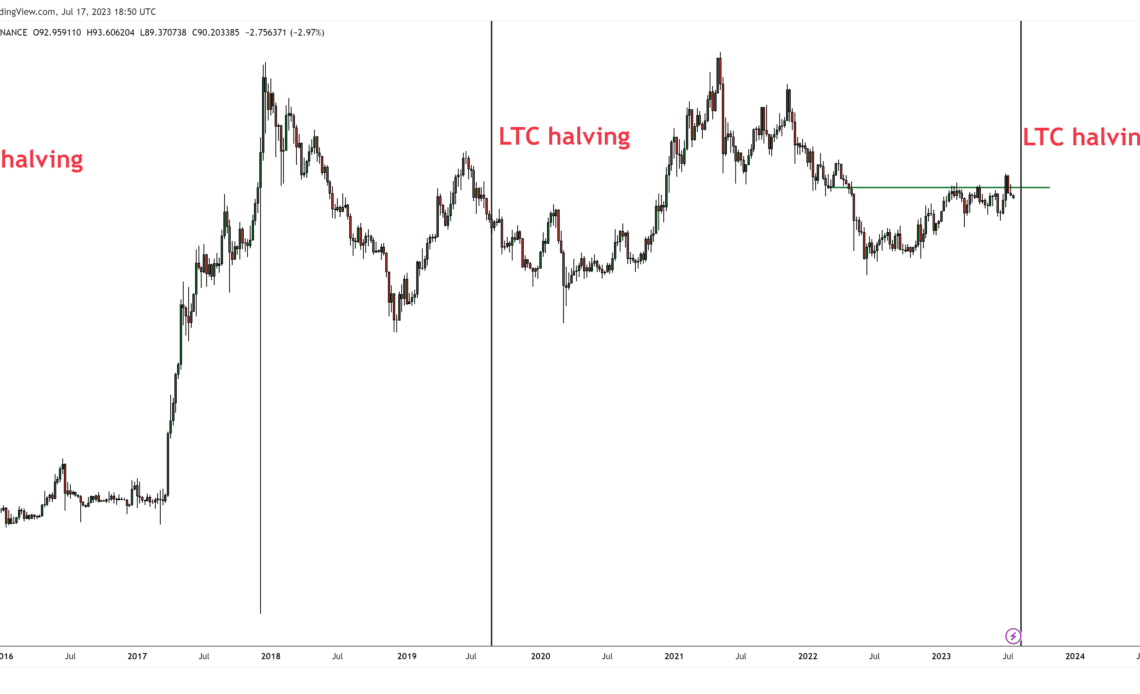

“LTC halvings on a chart.

This is why I shilled this more than half a year ago and stopped weeks ago.

The halving isn’t a bull catalyst anymore. It’s a drag given a bunch of people only bought it in anticipation.

But for some reason, people still shill this thing two weeks out.”

The crypto strategist says that he plans to accumulate Litecoin again in 2026 in anticipation of its fourth halving.

“I’ll consider buying LTC in three years again maybe.”

Looking at the Litecoin versus Bitcoin (LTC/BTC) ratio, DonAlt says the pair has a history of losing over 80% of its value after the halving.

“LTC vs. BTC after each recent halving.”

At time of writing, Litecoin is trading for $92.89.

As for Bitcoin itself, DonAlt says that the crypto king looks weak even amid the emergence of multiple bullish news stories such as the announcement of BlackRock’s bid for a spot-based BTC exchange-traded fund (ETF) and Ripple scoring a massive victory in its legal battle with the U.S. Securities and Exchange Commission (SEC).

“At daily support so hard to be too bearish but it’s impossible for me to be bullish given we’re hugging support while positive news are endless and traditional markets are doing well.

Interesting above $30,600 or around $27,000 to me for shorter-term plays.”

At time of writing, Bitcoin is worth $30,060.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur…

Click Here to Read the Full Original Article at Bitcoin News – The Daily Hodl…