Popular crypto analyst Michaël van de Poppe thinks that one decentralized finance (DeFi) altcoin that’s been showing strength this year is likely due for a big bounce.

Van de Poppe tells his 649,800 Twitter followers that GMX, the native asset of decentralized perpetual trading platform GMX, remains in an uptrend despite its recent corrective move from its all-time high of $85.07, which it hit on February 18th.

The trader believes that GMX will likely bounce once it hits support at around $69.

“This one is trending upwards and therefore, still in the ‘buy the dip’ approach. If it stays above $65-68, we most likely see another rally towards the all-time high and the range at $65-68 becomes a point of interest.”

At time of writing, GMX is worth $75.15.

Next up is smart contract protocol Fantom (FTM). Van de Poppe thinks that the Ethereum (ETH) rival could witness a deeper pullback if the crypto markets continue to flash weakness.

“I’ve marked this level as point of interest on Fantom. We got there, so it should be activated. However, if markets are continuing and the trend is now lower highs, lower lows, then I’m looking at $0.36 for the next long opportunity.”

At time of writing, FTM is trading for $0.469, just above Van de Poppe’s first area of interest.

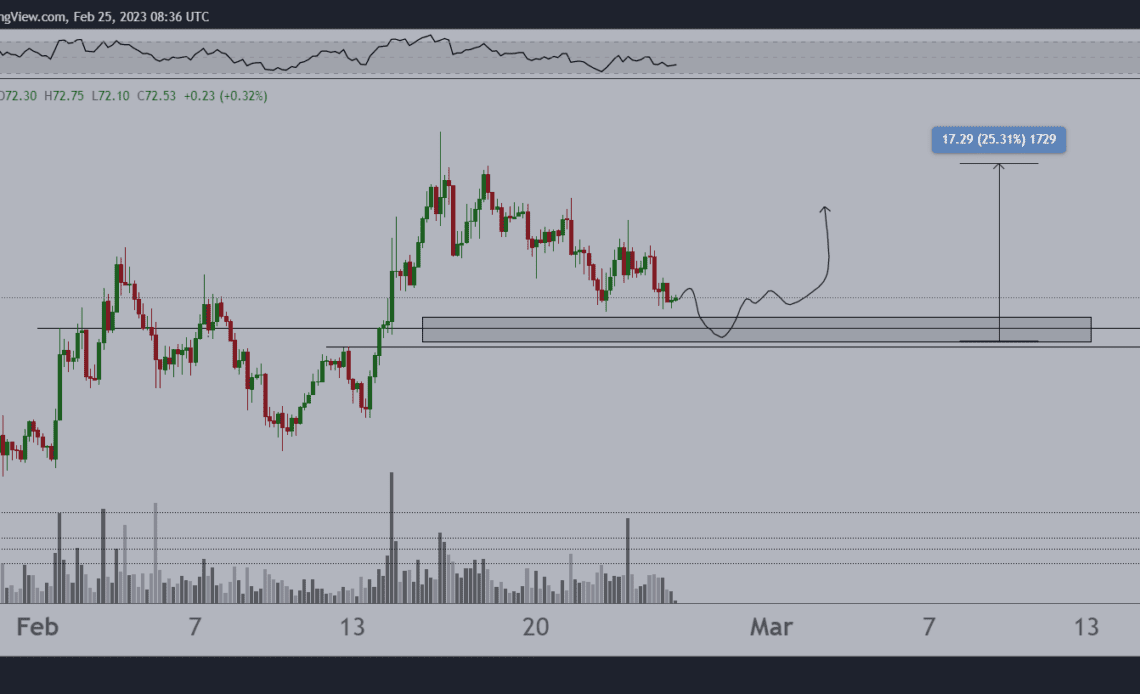

Van de Poppe is also keeping a close watch on Polygon (MATIC), which he says could be gearing up for a significant bounce.

“This one is at a point of interest and potential bounce regions. If that’s taking place, 20-25% can be established. If not, then I’ll be looking at $1 next.”

At time of writing, MATIC is worth $1.27.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Click Here to Read the Full Original Article at The Daily Hodl…