NFT trader’s $1.5M bot chess move

YouTuber and nonfungible token (NFT) trader Hanwe Chang said he scored 800 Ether (ETH), around $1.5 million, by tricking a rival trader’s bot into buying his own inflated NFTs.

In an Aug. 5 X (Twitter) post, Chang said he noticed a bot was copying his bids on the NFT marketplace Blur and decided to trick them.

An NFT-focused account A Raving Ape speculated that from a separate, anonymous wallet Chang purchased multiple Azuki NFTs sharing the same background color.

Context on how @HanweChang executed a plan to perfection and made 800e by selling “Off White A – Background color” azuki at 50e each and azuki elementals at 15e each.

This is an epic case of PvP in the current NFT trading market ⚔️

Hanwe has been coasting at the top spot of… pic.twitter.com/M8Ujm8CquJ

— A-Raving-Ape.eth (@a_raving_ape) August 5, 2023

Knowing bots were copying his trades, Chang placed an inflated bid on the NFTs held in his anonymous wallet from his publicly-known hanwe.eth wallet.

Once a bot automatically copied the inflated bid, Chang accepted it from his anonymous wallet and was able to palm off the NFTs at a significant markup.

Seemingly, the owner of the bot known as elizab.eth responded to Chang’s post claiming the funds were stolen and offered to discuss a 10% bounty if the funds were returned.

We would like to discuss a bounty with you. We are offering a 10% bounty of any funds stolen from our bot, which are yours to keep if you return the remaining 90%.

— elizab.ethᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠᅠ (@ThinkingETH) August 5, 2023

Chang’s on-chain move triggered discussion over its legality.

Lawyer Gabriel Shapiro said he thinks elizab.eth “might have good legal claims” to get their ETH back from Chang’s trick — but only if they hire a skilled litigation attorney.

NFT volumes nearly halves over July

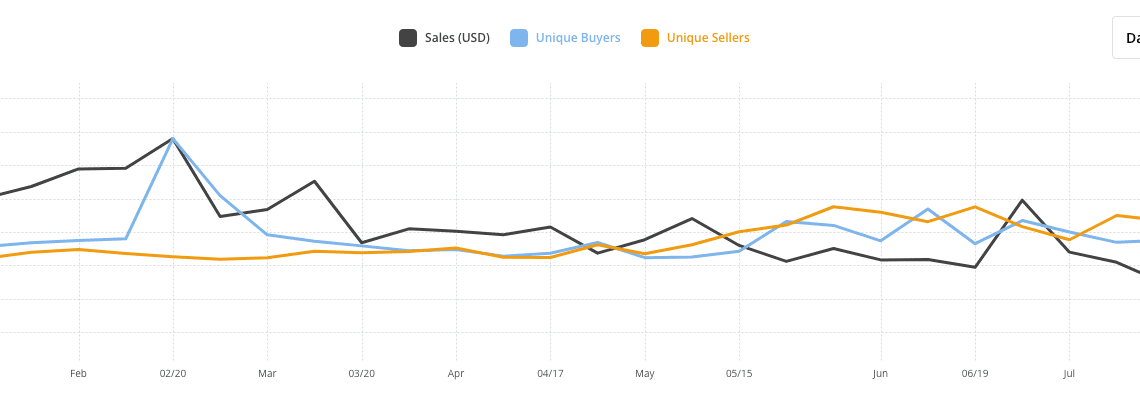

NFT volumes have continued to slide in the ongoing bear market, having sank by almost half over July.

Figures from NFT data aggregator CryptoSlam show U.S. dollar sales volume decreased nearly 42% over July with the month starting off with $22 million in daily volume before sinking to $12.8 million on July 31.

July’s drop comes after a significant rally in late June where daily sales volumes peaked at nearly $58.5 million on June 27, the largest trading…

Click Here to Read the Full Original Article at Cointelegraph.com News…