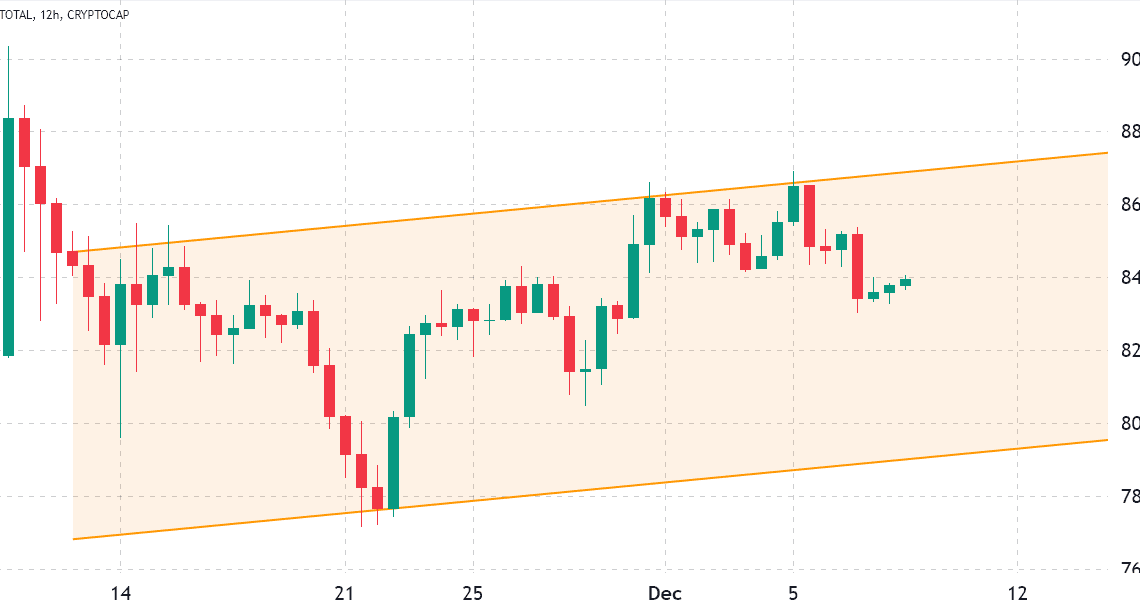

The total cryptocurrency market capitalization has dropped 1.5% in the past seven days to rest at $840 billion. The slightly negative movement did not break the ascending channel initiated on Nov. 12, although the overall sentiment remains bearish and year-to-date losses amount to 64%.

Bitcoin (BTC) price dropped 0.8% on the week, stabilizing near the $16,800 level at 10:00 UTC on Dec. 8 — even though it eventually broke above $17,200 later on the day. Discussions related to regulating crypto markets pressured markets and the FTX exchange collapse limited traders’ appetites, causing lawmakers to turn their attention to the potential impact on financial institutions and the retail investors’ lack of protection.

On Dec. 6, the Financial Crimes Enforcement Network (FinCEN) said it is “looking carefully” at decentralized finance (DeFi), with the agency’s acting director, Himamauli Das, saying that digital asset ecosystem and digital currencies are a “key priority area.” In particular, the regulator was concerned with DeFi’s “potential to reduce or eliminate the role of financial intermediaries” that are critical to its efforts against money laundering and terrorist financing.

Hong Kong’s legislative council approved a new licensing regime for virtual asset service providers. From June 2023, cryptocurrency exchanges will be subject to the same legislation followed by traditional financial institutions. The change will require stricter Anti-Money Laundering and investor protection measures before being guaranteed a license to operate.

Meanwhile, Australian financial regulators are actively working on methods for incorporating payment stablecoins into the regulatory framework for the financial sector. On Dec. 8, the Reserve Bank of Australia published a report on stablecoins that cited risks of disruptions to funding markets, such as bank exposure and liquidity. The analysis highlighted the particular fragility of algorithmic stablecoins, noting the Terra-Luna ecosystem collapse.

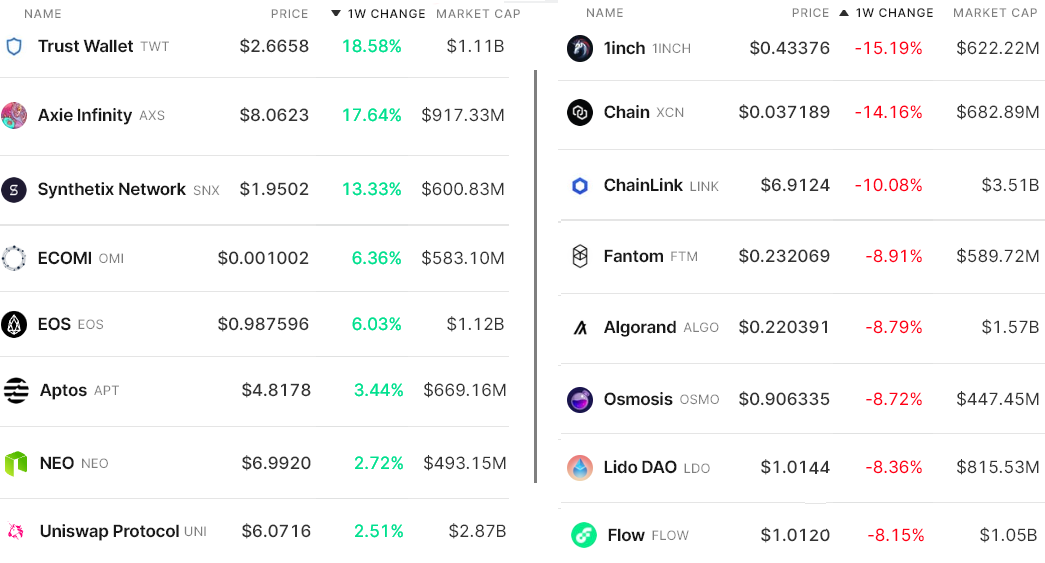

The 1.5% weekly drop in total market capitalization was impacted mainly by Ether’s (ETH) 3% negative price move and BNB (BNB), which traded down 2.5%. Still, the bearish sentiment significantly impacted altcoins, with 10 of the top 80 coins dropping 8% or more in the period.

Trust Wallet (TWT) gained 18.6% as the service provider gained market share from the browser…

Click Here to Read the Full Original Article at Cointelegraph.com News…