The U.S. Treasury’s Office of Foreign Assets Control (OFAC) issued sanctions against Tornado Cash this month, marking its first action against a decentralized finance (DeFi) mixer in what may prove to be a watershed moment for DeFi regulation.

A lack of response and regulatory preparation from the industry is perhaps unsurprising of a mindset honed outside the rule of law. Yet, the potential of DeFi is threatened if its leaders do not face the reality that regulation in this space will only increase. Taking steps to work with regulators is now the only way forward.

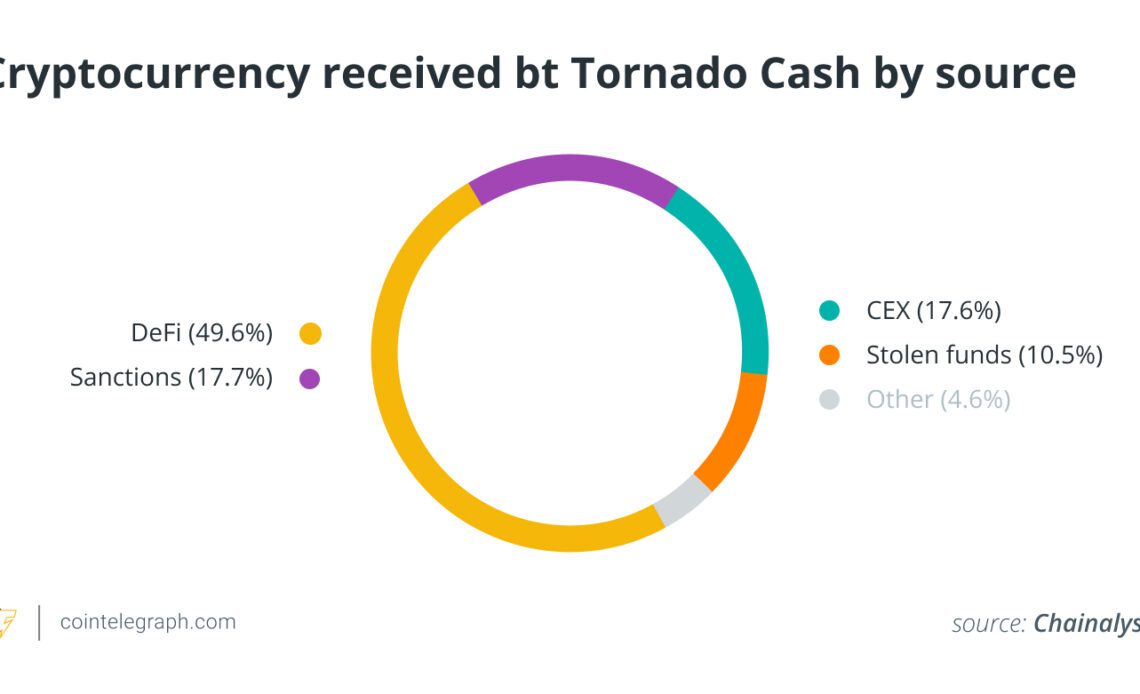

On Aug. 8, OFAC targeted Tornado Cash for processing transactions totaling more than $1.5 billion on behalf of illicit actors, including North Korean cybercriminals. The consequences of the action are severe: US individuals and companies, including crypto exchanges and financial institutions, are now prohibited from transacting with Tornado Cash addresses.

This will hinder criminals’ ability to launder funds through the service, which has become a prolific part of the cybercrime ecosystem. However, OFAC’s action against Tornado Cash sends a clear message to everyone in the space: DeFi is now firmly in regulators’ crosshairs and won’t escape regulation.

RELATED: Tornado Cash community fund multisignature wallet disbands amid sanctions

History tells us it is inevitable now that regulatory scrutiny will only accelerate. Prevailing “DeFi think” is a tendency to ignore or brush this fact under the carpet, but a rethink is needed. Regulators’ motives are not malevolent. They are simply toeing the very fine line of suppressing crime without neutering the positive potential of DeFi.

To evidence this, a Financial Action Task Force (FATF) report published earlier this year noted that cross-chain bridges are facilitating the growth of DeFi, but are also enabling criminals to swap funds more swiftly, generating money laundering risks. The negative focus is on the crime — not the technology or its potential.

DeFi developers and those participating in the ecosystem will seriously need to consider working with regulators on compliance issues if they want their projects to succeed.

Concerningly, the reaction of many DeFi developers and others in the ecosystem has been to shrug and argue that DeFi is, by nature, unregulatable. Because regulation involves imposing rules on centralized intermediaries, the argument runs, regulating DeFi is not possible. Consequently, many DeFi projects have not…

Click Here to Read the Full Original Article at Cointelegraph.com News…