Popular crypto analyst Xremlin, known on social platforms as @0x_gremlin, told his 104,000 followers that the altcoin season in 2024 could eclipse the monumental gains seen in 2021. Reflecting on the historical significance of major exchange listings, Xremlin emphasized, “Altseason 2024 > Altseason 2021. Your bags are headed to Valhalla.”

During the 2021 altseason, altcoins such as Polygon (MATIC) and Solana (SOL) saw a staggering 300x increase, largely attributed to listings on Tier-1 centralized exchanges (CEXs) like Binance and Coinbase, according to him. “MATIC and SOL’s 300x was fueled by Tier-1 CEX listings. Binance/Coinbase listings = Billions in retail liquidity,” the crypto analyst remarked.

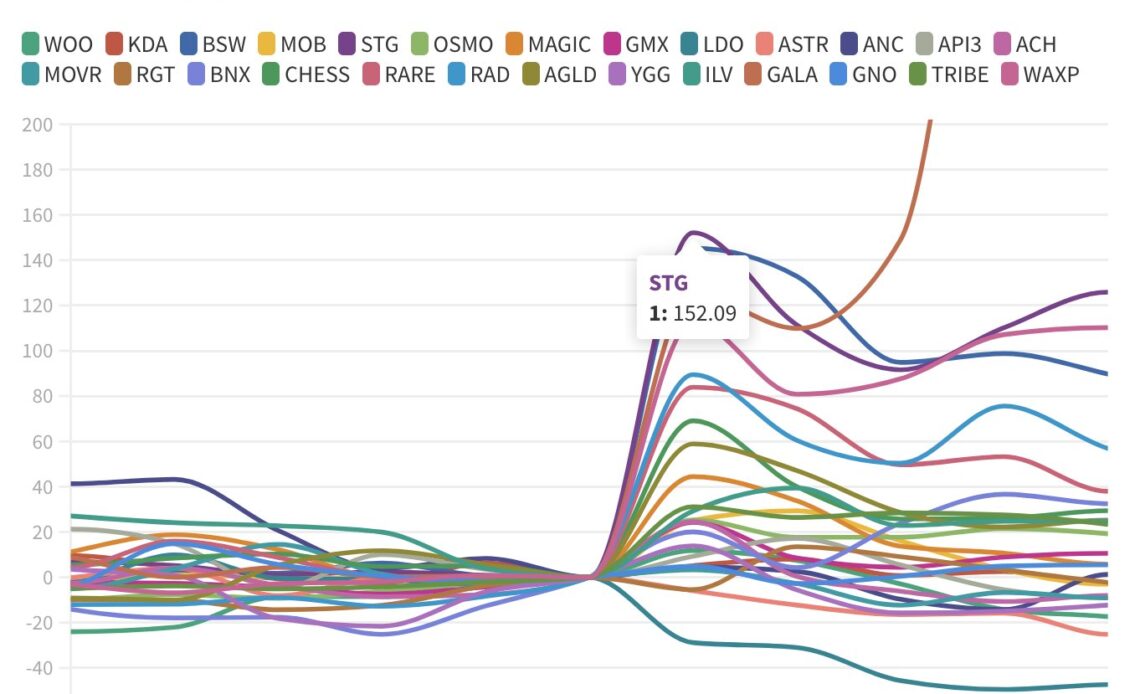

The core of Xremlin’s analysis hinges on the demonstrable impact that listings on premier exchanges such as Binance and Coinbase have on the valuation of cryptocurrencies. According to the analyst, “These 8 altcoins [are] likely to be tradable there next → Pump by 10-50x,” highlighting the potential for immediate and substantial price increases.

Listings often trigger price surges ranging from 3 to 10 times the pre-listing value, primarily due to the vast user bases of these platforms engaging with the newly available tokens. Xremlin further elucidated the critical role of liquidity for the long-term success of a cryptocurrency project, stating, “In the long run, having access to billions in liquidity is crucial for a project’s success.”

This perspective underlines the strategic advantage gained from being listed on Tier 1 centralized exchanges (CEXs). Xremlin has identified eight altcoins that not only show promise of being listed on such exchanges but also possess the potential for dramatic value appreciation. Here’s a detailed look at the altcoins spotlighted by Xremlin:

Top 8 Altcoins Not Listed On Tier-1 Crypto Exchanges

NGL (ENTANGLE): Operating as an omnichain infrastructure, Entanglefi aims to revolutionize data provision to smart contracts across any blockchain. With a current market cap of $232 million and trading at $1.96, its position as a Layer 1 (L1) protocol underscores its foundational potential in the blockchain ecosystem.

ALPH (ALEPHIUM): Priced at $2.75 with a market cap of $203 million, Alephium stands out as a Layer 1 blockchain solution tackling the critical issues of accessibility, scalability, and security faced by…

Click Here to Read the Full Original Article at NewsBTC…