It’s weird to think that anyone could look forward to downturns in the crypto market, but that is precisely the position held by many developers and project creators who enjoy the low-pressure environment that exists during a bear market.

As the saying goes, bear markets are for building, and now is one of the best times to survey the landscape to see which sectors of the market are most active in designing the platforms that will soar to new heights in the next bull cycle.

Here’s a look at five sectors of the blockchain ecosystem that may present some of the best opportunities for accumulation while prices are low and demand is non-existent.

Layer-1 protocols

Layer-1 (L1) protocols like Bitcoin and Ethereum form the foundation that much of the cryptocurrency ecosystem is built upon and enable most of the other sectors of the market to exist.

That being said, there are currently not many options available for launching other protocols on the Bitcoin network and Ethereum has well-known limitations in terms of scalability that can lead to high transaction costs and slow processing times.

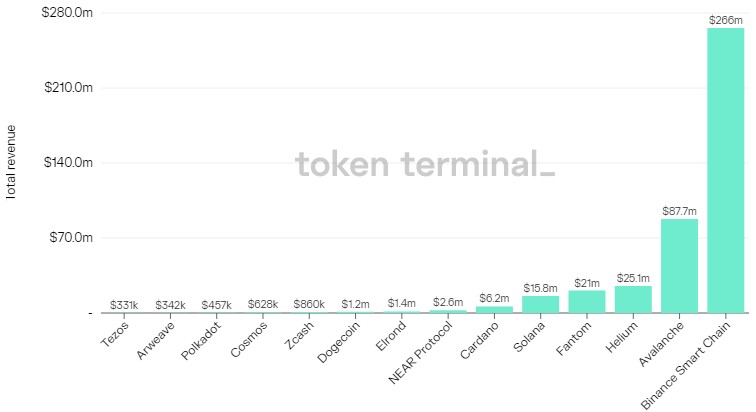

Due to these factors, there remains a significant opportunity for other L1 protocols to establish themselves and carve out a good slice of market share. The total revenue generated by a protocol is one metric that can be used to determine which networks see the most usage.

According to data from Token Terminal, the top five L1 protocols in terms of total revenue over the past 180 days, excluding Bitcoin and Ethereum, are BNB Smart Chain, Avalanche, Helium, Fantom and Solana.

Layer-2 protocols

As mentioned above, the Ethereum network has limitations in terms of scalability that won’t be solved during the upcoming Merge, leaving an opening for layer-2 protocols to fill the need by helping to reduce the activity that occurs directly on the Ethereum blockchain.

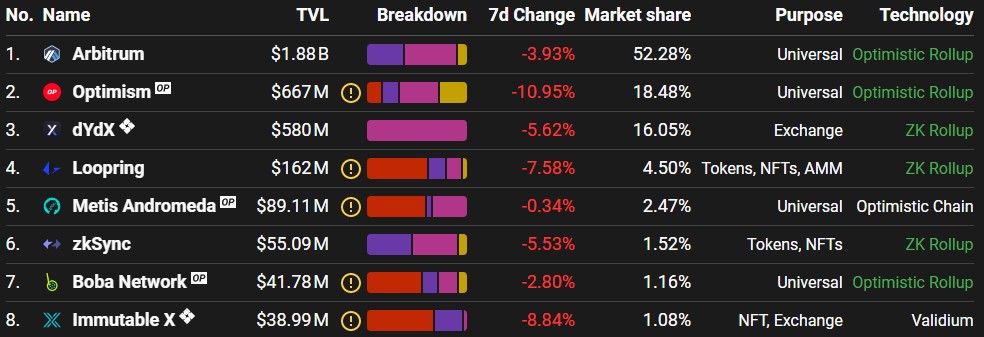

According to L2Beat, which tracks the stats on the top Ethereum L2s, Arbitrum is ranked number one in terms of total value locked (TVL), followed by Optimism and dYdX.

One network that was curiously left off the list provided by L2Beat, but remains the most highly adopted L2 in terms of active wallets and protocols launched is Polygon, which currently has a TVL of $1.59 billion, according to data from DefiLlama.

As for the Bitcoin network, the main L2 solution that is…

Click Here to Read the Full Original Article at Cointelegraph.com News…