On-chain data shows an Ethereum metric is giving a bullish signal as the cryptocurrency’s price has broken past the $2,400 barrier during the past day.

Ethereum Has Continued To Leave Exchanges Recently

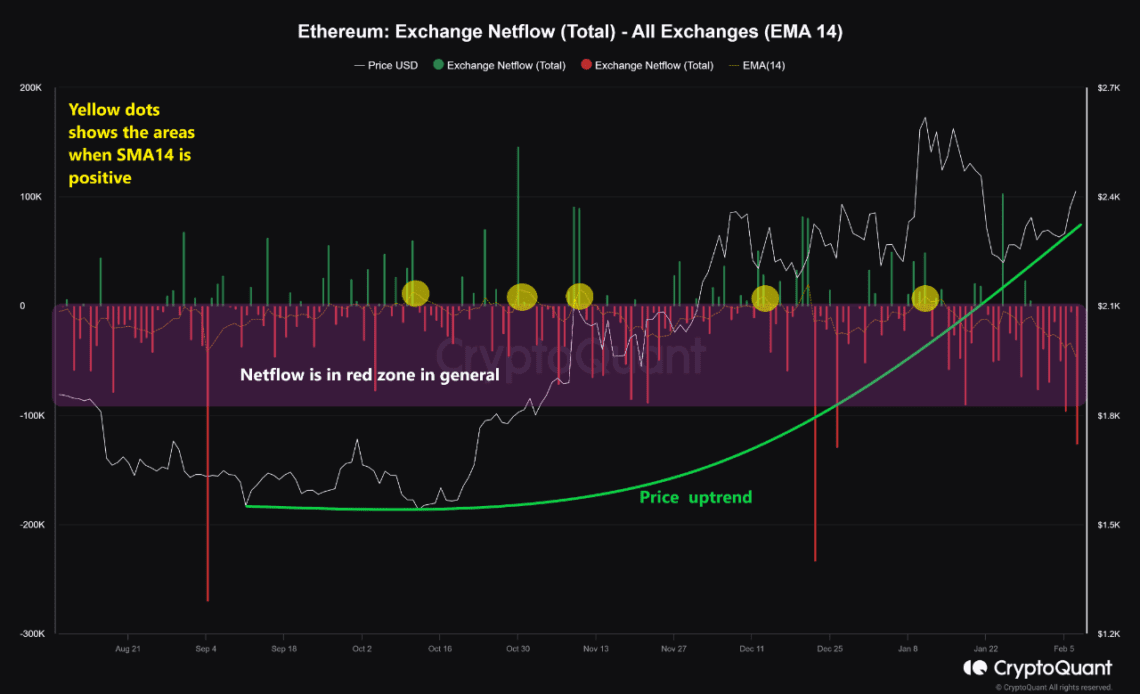

In a CryptoQuant Quicktake post, an analyst explained the recent relationship between the Ethereum price and data of the exchange netflow indicator.

The “exchange netflow” here refers to a metric that keeps track of the net amount of the asset entering or exiting out of the wallets of all centralized exchanges. The indicator’s value is calculated by subtracting the outflows from the inflows.

When the flow has a positive value, the inflows are overwhelming the outflows right now, and a net number of coins is moving into the custody of these platforms.

One of the main reasons investors might deposit their tokens on the exchanges is for selling-related purposes. This trend can potentially have bearish implications for the asset’s price.

On the other hand, the negative indicator implies the holders are making net withdrawals from these platforms. Such a trend suggests the investors may be accumulating for the long-term, which would naturally be bullish for the cryptocurrency’s value.

Now, here is a chart that shows the trend in the Ethereum exchange netflow, as well as its 14-day exponential moving average (EMA), over the last few months:

The value of the metric seems to have been quite red in recent days | Source: CryptoQuant

As highlighted by the quant in the above graph, the Ethereum price has observed an overall bullish trend in the last few months as the 14-day EMA exchange netflow has mostly been inside the negative territory.

There have been some spikes in the positive region. With these net deposits, the cryptocurrency has usually encountered some degree of resistance, implying that these transfers added to the selling pressure in the market.

Recently, the indicator has assumed red values for more than a week straight, suggesting that investors have been constantly making net withdrawals. The scale of the negative spikes has also been quite significant this time, meaning that some whales are involved.

Off the back of this potential accumulation from the investors, Ethereum has observed its recovery below the $2,400 level. Since the netflow has continued to be quite negative recently, it’s possible that this rally isn’t all the coin would see; there may still be potential for further upside.

Spikes back…

Click Here to Read the Full Original Article at NewsBTC…