On-chain data shows a Bitcoin indicator has continued to retest the bear-bull transition point recently, but is yet to obtain a break.

Bitcoin Short-Term Holder SOPR Is Retesting The Break-Even Level

As pointed out by an analyst in a CryptoQuant post, the short-term holders have continued to sell at a loss recently. The relevant indicator here is the “Spent Output Profit Ratio” (SOPR), which tells us whether the average investor in the Bitcoin market is selling at a profit or at a loss right now.

When the value of this metric is greater than 1, it means that the overall market is realizing more profits than losses with their selling currently. On the other hand, values under the threshold suggest the dominance of loss-taking in the sector.

The SOPR being exactly equal to 1 implies that the total amount of profits being realized by the investors are exactly canceling out the losses, and thus, the average holder can be thought to be just breaking even on their sales.

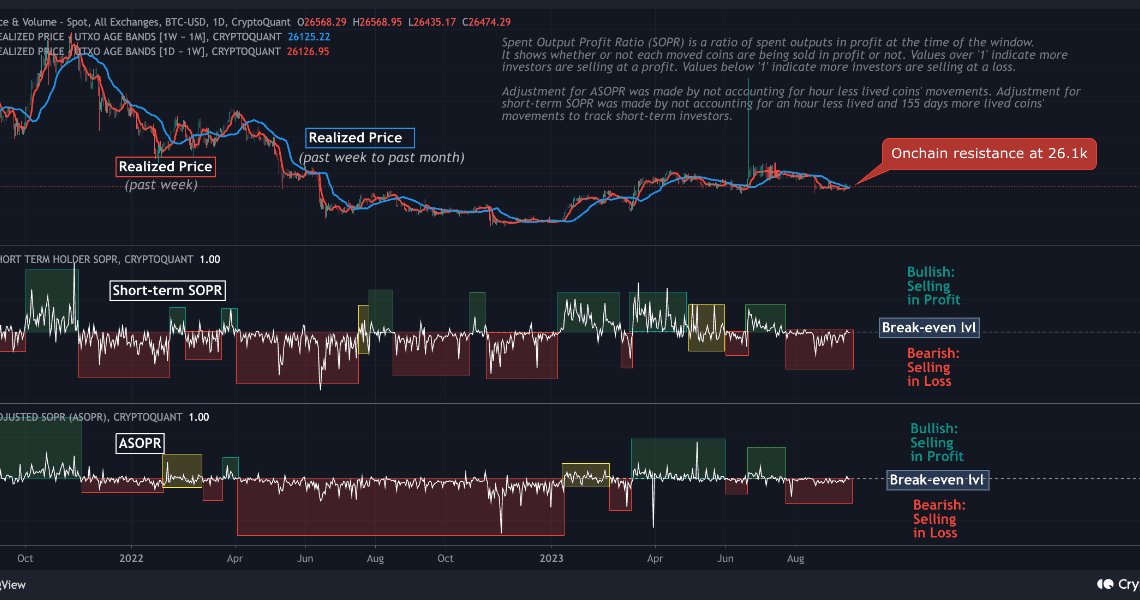

Now, here is a chart that shows the trend in the Bitcoin SOPR over the last couple of years:

Looks like the value of the metric has been near the break-even mark for both of these metrics | Source: CryptoQuant

As displayed in the bottom graph in the image, the Bitcoin ASOPR has been consolidating around the 1 mark recently. The ‘A’ in front of SOPR here refers to “Adjusted,” since the indicator has been adjusted to filter out the sales of coins that were sold within one hour of their previous sales.

From the graph, it’s visible that the Bitcoin ASOPR has constantly remained slightly inside the loss region recently as it has been retesting the break-even mark from below. This means that the average holder can be assumed to be selling at a slight loss right now.

The indicator has made many attempts to break into the profit territory, but it hasn’t found any success so far. Historically, the ASOPR has been inside the red zone during bearish periods, while it has been in the green region during bullish periods.

An indicator that displays this relationship even more closely is the short-term holder SOPR. The “short-term holders” (STHs) here refer to investors who have been holding their coins for less than 155 days.

As is visible in the graph, whenever the Bitcoin SOPR for these investors has entered inside the profit zone, the price has experienced some uptrend. Much like the metric’s value for the overall market, though, the STH SOPR has also…

Click Here to Read the Full Original Article at NewsBTC…