On-chain data shows two Bitcoin indicators are currently retesting levels that have historically been relevant for the market’s course.

Bitcoin NUPL For Both Short-Term & Mid-Term Holders Is Neutral Currently

As pointed out by an analyst in a CryptoQuant post, the BTC NUPL has been retesting crucial levels recently. The “Net Unrealized Profit/Loss” (NUPL) is a metric that keeps track of the net amount of profit or loss that investors are holding currently.

This indicator works by looking through the on-chain history of each coin in circulation to see what price it was last moved at. If this previous transfer price for any coin was less than the current spot price of Bitcoin, then that particular coin is holding a profit right now.

The NUPL counts this profit that the coin is holding in the unrealized profit. Similarly, the loss that underwater coins are holding gets included in the unrealized loss. The metric then takes the difference between these two numbers to find the net profit/loss status of the entire market.

In the context of the current discussion, the entire market isn’t of interest, however, only specific sections of it are. In particular, two BTC cohorts called the “short-term holders” (STHs) and the “mid-term holders” (MTHs) are of relevance.

The STHs include all investors who bought their coins within the last six months, while the MTHs are those who have been holding their coins since at least six months ago and at most 2 years ago.

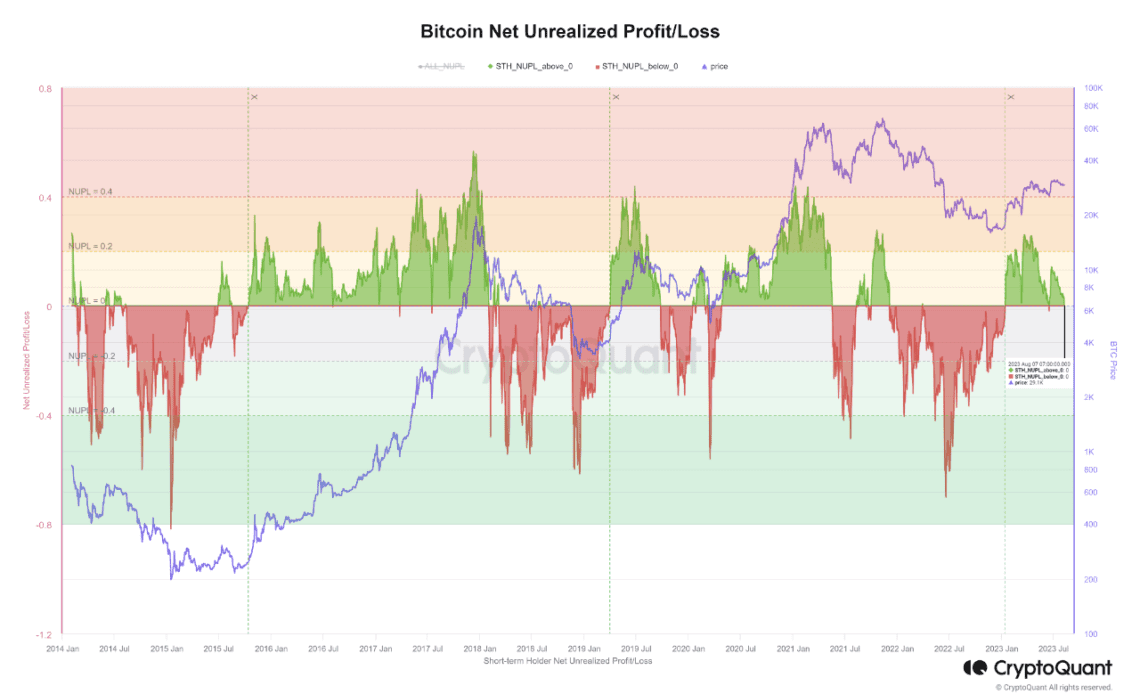

First, here is a chart that shows the trend in the Bitcoin NUPL specifically for the STHs:

Looks like the value of the metric has approached zero recently | Source: CryptoQuant

As displayed in the above graph, the Bitcoin STH NUPL has been positive throughout this rally that first started back in January of this year. Generally, this is the case in bullish trends, as the STHs are those who bought relatively recently, so any price rises immediately reflect on their profit/loss status.

What’s more significant, however, is the indicator’s relationship with the zero mark. At this line, the STHs as a whole are neutral, meaning that their unrealized losses equal their unrealized profits.

Usually, whenever the metric retests this line from above during bullish trends, it finds support and the price feels a bullish effect. This could be seen working in action during this rally alone, as the rebounds in March and June both occurred when the STH NUPL approached this…

Click Here to Read the Full Original Article at NewsBTC…