HodlX Guest Post Submit Your Post

LRTs (liquid restaking tokens) and the emergence of layer two solution Blast are powering a new wave in DeFi staking.

In this article, we’ll look at the backdrop behind this development, what it means for DeFi staking and what the major trends are in the space.

Liquid restaking tokens he newest innovation in LSDs

Source: Bing Ventures

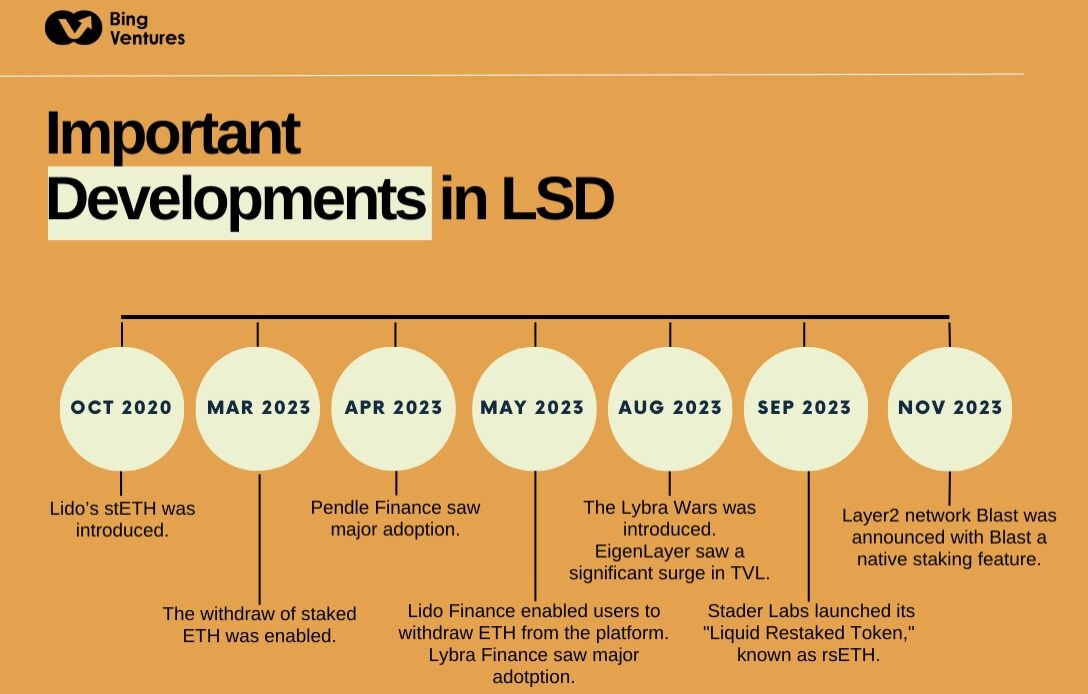

LSD (liquid staking derivatives) have been an area in the Ethereum ecosystem that has demonstrated exemplary innovation and adaptability, especially after the Shanghai upgrade.

Lido Finance, a platform that played a critical role in refining the Ethereum staking mechanism, was where it all started.

With its innovative solution, Lido unlocked the liquidity of staked assets in Ethereum, solving a major issue in the Ethereum staking mechanism.

Lido allows users to earn staking rewards on Ethereum without locking up assets, marking a major shift from the traditional rigid paradigm of staking.

Pendle Finance was the next to chart new territories in the LSD space. It pioneered yield tokenization on Ethereum, enabling users to trade yield and earn a fixed yield on their assets.

This new model opened up new approaches for yield optimization and risk management.

The quest for higher yields and fuller utilization of staked assets, however, has no end. Restaking protocol Eigenlayer emerged with a more complex model.

Eigenlayer allows stakers to reallocate their staked assets to secure additional decentralized services on the Ethereum network.

This not only increases stakers’ overall rewards but also enhances cryptoe-conomic security and resilience of the entire Ethereum network.

However, a major challenge emerged. Restaked assets became fragmented and illiquid, hampering the activity and composability in the DeFi space. This was where LRT came into play.

This innovation unlocks the liquidity of restaked assets and further increases stakers’ rewards by enabling them to participate in DeFi.

Users can deposit LRTs to liquid restaking protocols for additional earnings.

With these developments, the LSD space has evolved from a starting point of single-layer staking into a more complex and multifaceted ecosystem.

Some more recent happenings, such as the emergence of Blast, reflect this trend. Blast is an EVM-compatible Ethereum layer two networks that offers native yield staking of ETH and stablecoins on its chain.

This has further democratized staking rewards and elevated the…

Click Here to Read the Full Original Article at The Daily Hodl…